[ad_1]

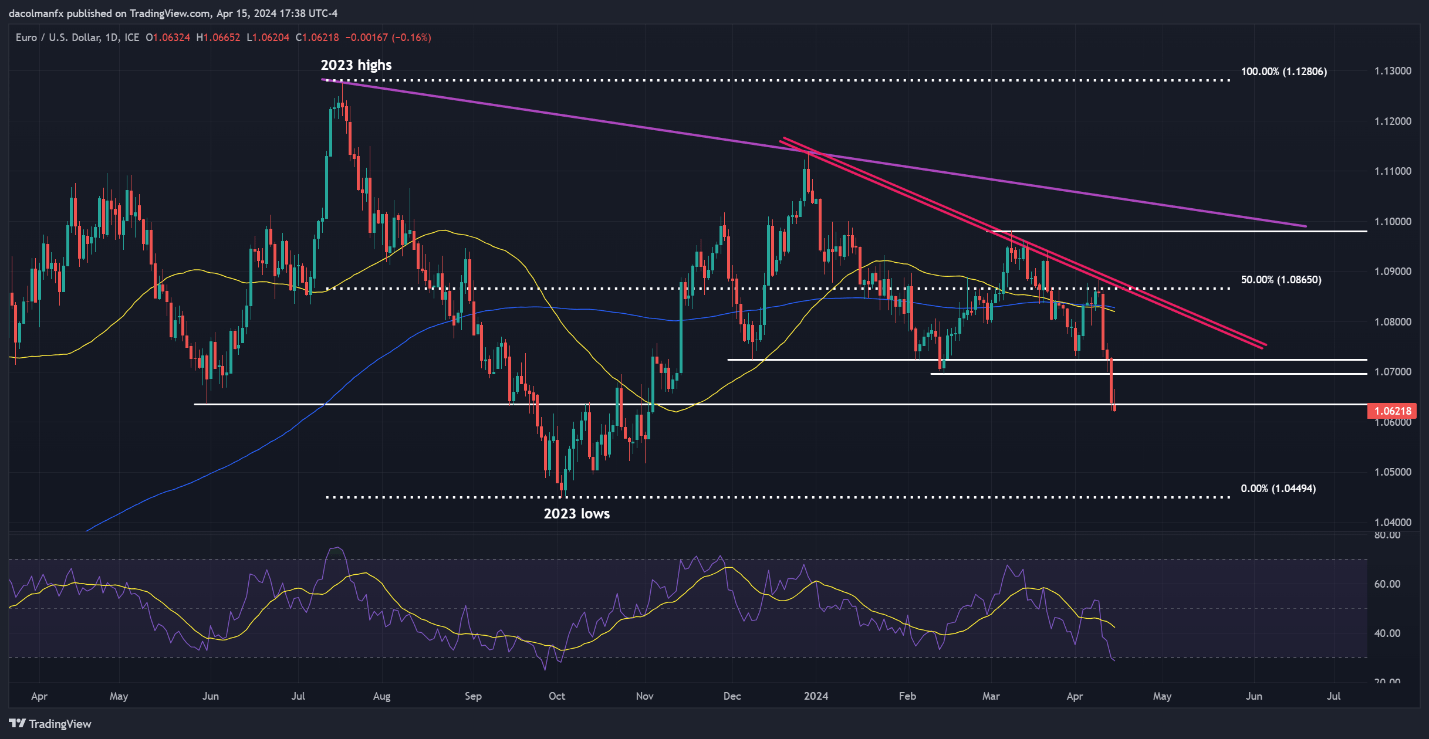

EUR/USD Undermined by Greenback Surge

EUR/USD started the week with losses, breaching key assist at 1.0635 to document lows not seen since November final yr, and down greater than 2.4% from April’s highs. A affirmation of this breakdown may spark extra promoting, with lows round 1.0450 on the horizon.

Regardless of potential rallies, resistance at 1.0635 and 1.0700 might restrict features. The euro’s decline coincides with a stronger US greenback, spurred by expectations of delayed price cuts and higher-than-expected inflation within the US.

With the European Central Financial institution (ECB) hinting at attainable price cuts, the EUR/USD outlook stays gloomy, with the pair at the moment buying and selling round 1.0620, down about 0.5% for the day.

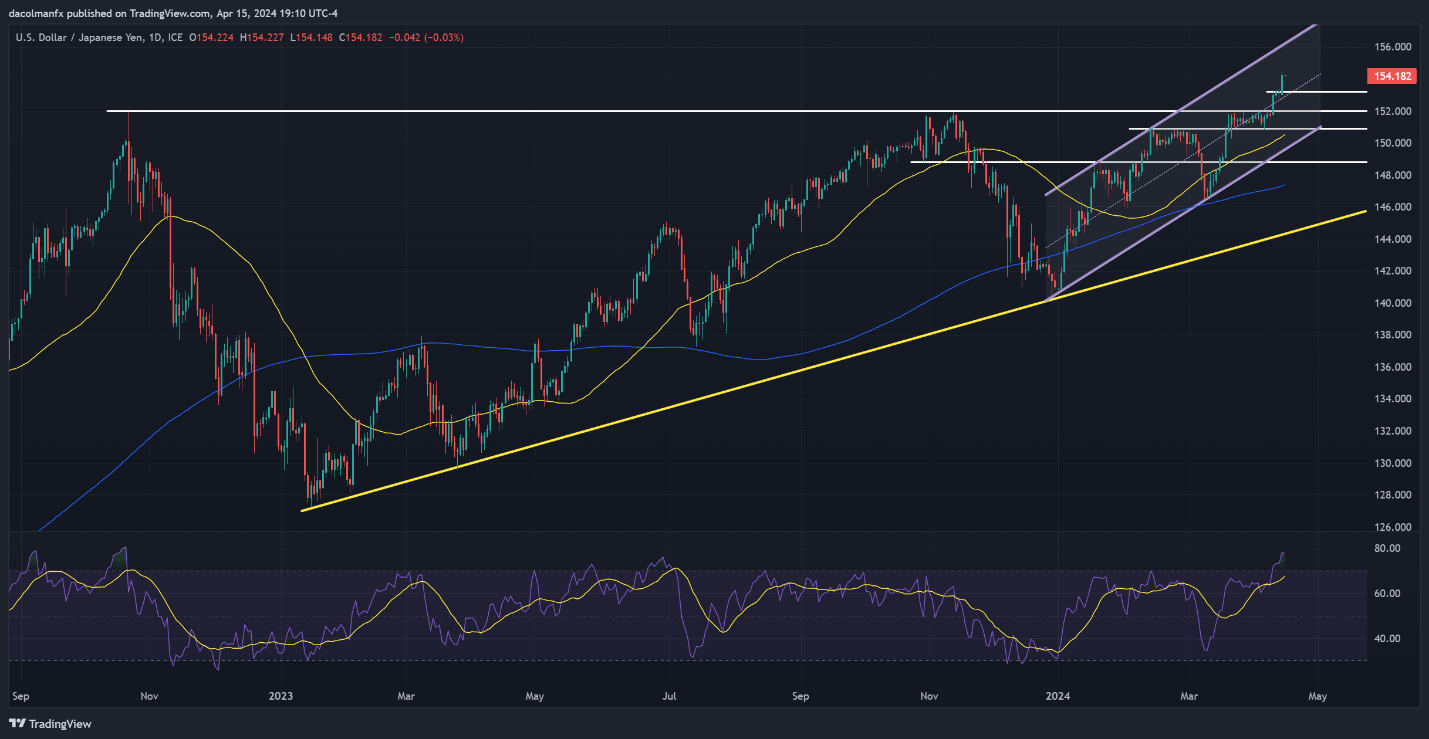

USD/JPY Hits 1990 Highs on Treasury Yield Surge

USD/JPY rose above 152.00, reaching ranges not seen since June 1990, propelled by rising US Treasury yields and good financial indicators.

The pair is aiming for extra rises into channel resistance round 155.80, whereas Japanese authorities intervention might restrict upside momentum.

Whereas overbought situations persist, current phrases from Fed Chairman Jerome Powell and future US financial information might affect the USD/JPY’s trajectory.

The upward slope of the 50-day SMA predicts that the market will proceed to admire, with a possible take a look at of the June 1990 excessive. At the moment, the USD/JPY is buying and selling at 154.45, up 0.6%.

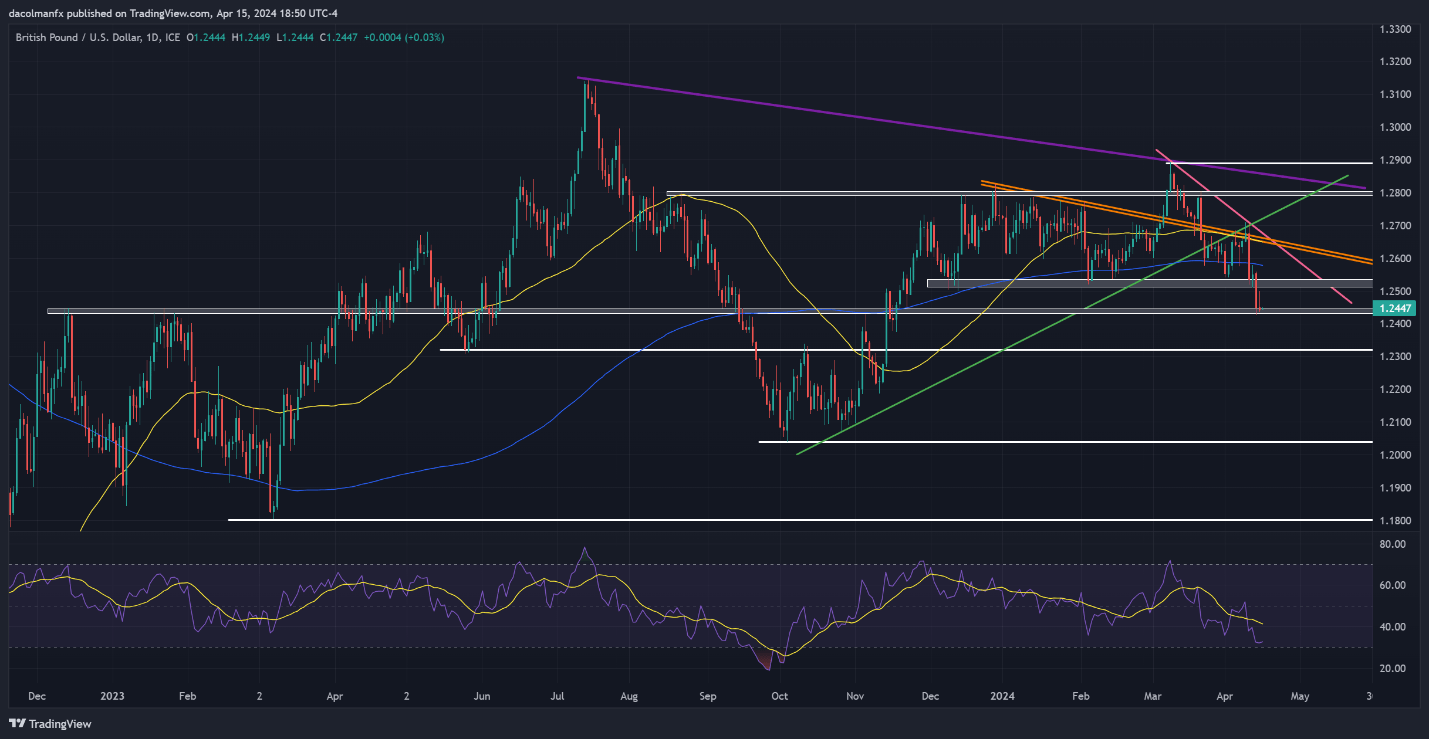

GBP/USD Maintains Help Amid Geopolitical Tensions

Regardless of worldwide tensions, the GBP/USD maintained above assist round 1.2435, recovering from November’s lows. Nonetheless, the pair is beneath bearish stress, with resistance round 1.2525 and 1.2580.

Geopolitical considerations, particularly information of Iran’s strike on Israel, elevated safe-haven demand for the US greenback, impacting the GBP/USD. Nevertheless, a potential de-escalation of hostilities might assist the pair recuperate.

Technical indicators level to a corrective rally, however the total view is detrimental, with static assist between 1.2450 and 1.2400. GBP/USD is now at 1.2450, up 0.2%.

Last Ideas

The present rise of the US greenback towards key currencies displays shifting market sentiment, which is pushed by expectations of delayed price cuts and sturdy financial statistics.

Whereas EUR/USD, USD/JPY, and GBP/USD are beneath stress, geopolitical tensions and central financial institution insurance policies proceed to have an effect on market dynamics.

Merchants ought to control key ranges and forthcoming occasions to search for new buying and selling alternatives in an ever-changing market.

The put up USD Strengthens Throughout Main Forex Pairs appeared first on Dumb Little Man.

[ad_2]