[ad_1]

Overview of Expectations

The expectation rises as merchants and traders anticipate the discharge of the nonfarm payrolls (NFP) report from the United States Bureau of Labor Statistics on Friday.

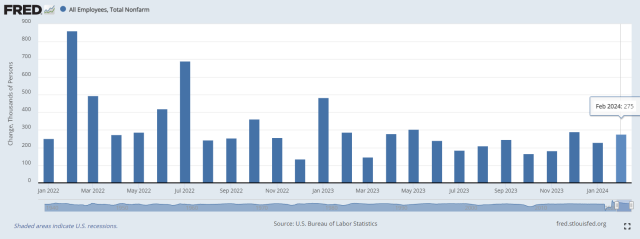

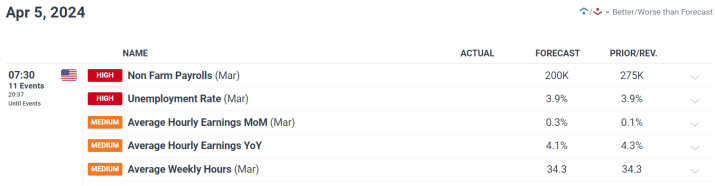

The report is a key measure of financial well being that influences the Federal Reserve’s financial coverage selections. Economists estimate that job progress will lower in March, with solely 200,000 new positions added in comparison with 275,000 in February.

The unemployment fee is predicted to stay secure at 3.9%, with common hourly earnings probably rising by 0.3% month on month.

Market Reactions to Anticipate

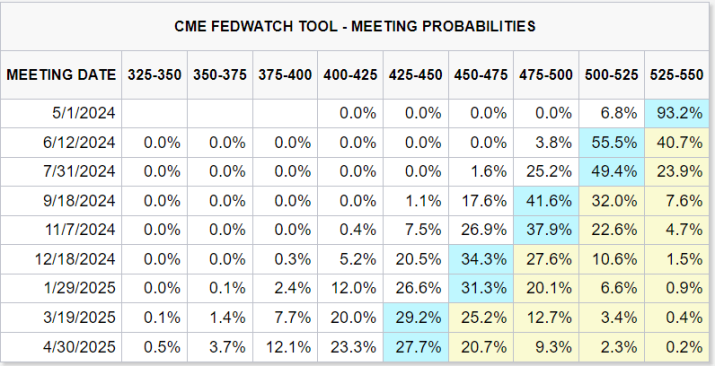

The influence of NFP knowledge on markets is basically decided by how far the information deviates from expectations. A constructive report might postpone the Fed’s rate of interest cuts, strengthening the US greenback and decreasing gold and silver costs.

A weak report, however, may speed up fee cuts, probably weakening the greenback and boosting treasured metallic costs.

The desk beneath exhibits FOMC assembly possibilities as of Thursday morning.

Merchants ought to look past the headline knowledge, making an allowance for the labor drive participation fee, earlier month changes, and underlying labor market tendencies.

USD/JPY and Gold Worth Forecasts

The USD/JPY’s efficiency stays vital, with technical evaluation indicating potential volatility close to the 152.00 barrier degree. If the Japanese authorities doesn’t intervene, a breach above may spark a bullish rally.

Gold costs, after spiking, might retrace, with $2,305 serving as a big resistance degree.

Deeper Insights into the Jobs Report

The March knowledge is anticipated to affirm ongoing employment progress however with indicators of a cooling labor market.

The unusually important job achieve in February, mixed with subsequent adverse revisions of earlier months’ knowledge, known as into query the reliability of the sooner figures.

This adverse revision sample, which deviates from historic norms, exhibits that preliminary job progress estimates needs to be interpreted with warning.

Areas of Focus

The report can be examined for indicators of inflationary pressures, modifications in employment sorts (full-time versus part-time), and the well being of key financial sectors. Common hourly earnings and their annual progress can be intently monitored for inflationary alerts.

Closing Ideas

The impending jobs knowledge represents a watershed second for monetary markets, with large ramifications for financial coverage and market sentiment.

Whereas a balanced report might depart the Fed’s present coverage trajectory unchanged, merchants ought to plan for volatility and use cautious threat administration measures.

The emphasis stays on evaluating the information within the context of a bigger financial image, making an allowance for anticipated changes and underlying labor market elements.

The submit March US Jobs Report Preview: Impression on USD/JPY, Gold; What to Anticipate appeared first on Dumb Little Man.

[ad_2]