[ad_1]

The Japanese inventory market rose to a 52-week excessive on Thursday, boosted by the US Federal Reserve’s reaffirmation of its dovish stance, with three charge cuts anticipated this yr. The Nikkei 225 index rose 2%, closing at 40,815.66, and briefly peaked at 40,823.32.

Financial and Company Highlights

The Ministry of Finance reported a appreciable discount in Japan’s commerce deficit in February, citing a 7.8% year-over-year progress in exports.

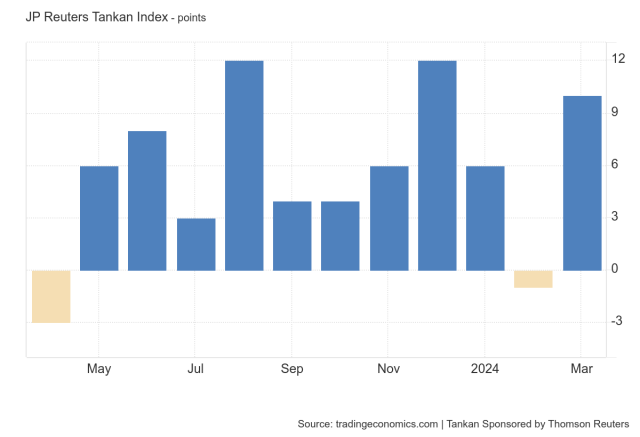

Concurrently, the Reuters Tankan survey reported a rise in enterprise sentiment amongst giant producers to +10 in March, up from -1 in February, boosted by the automotive, oil refining, and chemical industries.

On the company entrance, Nippon Sign, and Takamatsu Development had their shares rise by greater than 2%, whereas JCR Prescription drugs noticed a virtually 1% enhance after Nippon Sign introduced the next dividend prediction.

Diverging Paths of the Fed and BOJ

The Federal Reserve’s dedication to easing contrasts with the Financial institution of Japan’s (BOJ) latest coverage change, which included its first charge hike since 2007 and the conclusion of eight years of outstanding stimulus.

Nonetheless, BOJ Governor Kazuo Ueda maintained that coverage would stay considerably accommodative, hinting at one other charge hike later this yr. This hole has spurred investor confidence, prompting a comeback to the inventory market.

Nomura’s chief fairness strategist, Yunosuke Ikeda, cited steady favorable components resembling improved company governance, the finish of deflation, and shifting fears about China as all supporting Japanese shares.

Forex and Bond Market Actions

The yen rebounded in opposition to the greenback, dropping to 150.94 after reaching a four-month excessive. Market hypothesis revolves round possible BOJ actions, with forecasts pointing to a gradual tightening strategy.

In the meantime, Japanese Finance Minister Shunichi Suzuki expressed concern over forex swings however stayed silent on involvement. Japanese authorities bond charges rose little throughout maturities, reflecting market response to the BOJ’s latest coverage assembly and uncertainty about future strikes.

Ultimate Ideas

As Japan’s inventory market soars and the yen recovers, buyers and merchants navigate a panorama formed by the US Federal Reserve and the Financial institution of Japan’s opposing financial insurance policies.

Whereas the fast future appears promising for Japanese equities, the altering state of affairs necessitates shut monitoring of financial indicators, firm efficiency, and world market traits.

Because the BOJ considers extra coverage adjustments, the interaction of those components will proceed to impression investor sentiment and market traits.

The publish Japanese Shares Soar to New 52-Week Excessive Amid US Fed Fee Outlook; Yen Makes a Sturdy Comeback appeared first on Dumb Little Man.

[ad_2]