[ad_1]

Many buyers comply with the pattern, investing in belongings on the rise and retreating on the first signal of a downturn. Opposite to this widespread technique, indicators like IG consumer sentiment suggest a special strategy, highlighting that contrarian alternatives usually current the most effective returns. These indicators gauge the market’s temper—be it overly constructive or destructive—to sign potential market shifts.

Leveraging contrarian indicators must be one facet of a complete buying and selling technique. They don’t seem to be for use in isolation for making funding choices. By integrating contrarian alerts with elementary and technical analyses, buyers can achieve a deeper understanding of market dynamics, presumably uncovering missed alternatives. Let’s discover the insights offered by IG consumer sentiment on the Japanese yen.

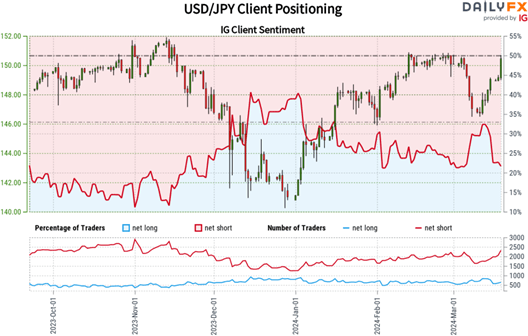

USD/JPY Market Sentiment

IG consumer sentiment information showcases a big bearish outlook on USD/JPY, with 70.65% of buyers betting in opposition to the U.S. greenback, mirrored in a short-to-long ratio of three.91 to 1. This bearish sentiment has grown, evidenced by a 9.34% enhance in merchants holding internet brief positions since yesterday and a 35.63% enhance from the earlier week.

This sturdy contrarian sign suggests a possible for reversal, indicating USD/JPY may rise. Contrarian buying and selling thrives on the premise that the bulk could be unsuitable, particularly below excessive emotional reactions. Though not assured, this extreme destructive sentiment amongst retail merchants may signify an overreaction, setting the stage for potential features within the U.S. greenback.

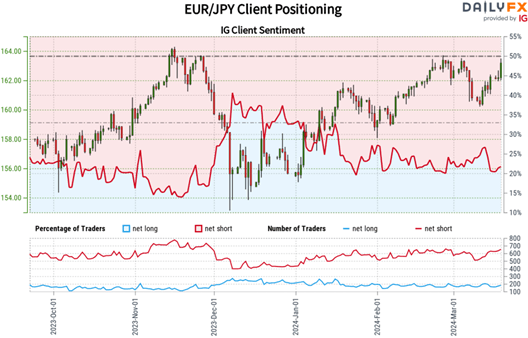

EUR/JPY Market Sentiment

IG consumer sentiment information signifies that 81.19% of retail buyers anticipate a decline in EUR/JPY, with a 4.32 to 1 ratio of bearish to bullish positions. The online-short positions have seen a slight enhance of 0.16% since yesterday and a big 13.72% rise from final week. In the meantime, net-long positions have decreased by 25.51% because the earlier session and 26.63% from the final week.

Sometimes, a contrarian perspective to crowd sentiment means that EUR/JPY costs may ascend. The pronounced net-short positioning on EUR/JPY, compounded by a rise in bearish sentiment from yesterday and final week, strengthens this bullish contrarian outlook. This might indicate that the market sentiment is overly pessimistic, doubtlessly providing a conducive state of affairs for EUR/JPY to advance.

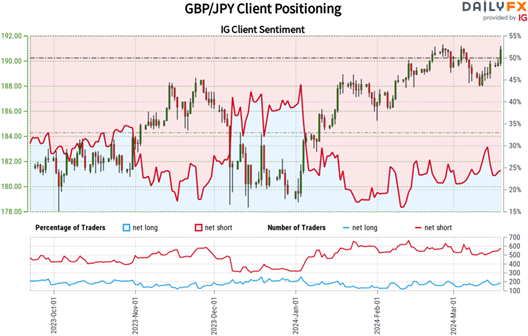

GBP/JPY Market Sentiment

In keeping with IG sentiment information, a dominant portion of retail purchasers are bearish on GBP/JPY. As of the most recent information, 79.01% of merchants are briefly positions, resulting in a short-to-long ratio of three.76 to 1. This destructive sentiment has intensified, with net-short positions rising by 4.79% since yesterday and 13.65% since final week.

Adopting a contrarian view, the substantial net-short positioning signifies potential upward motion for GBP/JPY within the brief time period. The rising pessimism, each on a each day and weekly foundation, underscores a contrarian bullish perspective, suggesting that the market could also be overly destructive, thereby opening up alternatives for additional GBP/JPY features.

[ad_2]