[ad_1]

Overview: Gold’s Resilient Rise

Gold has remained on an upward development this week, albeit backtracking from its latest excessive of $2,430, set momentarily in the course of the New York session on Friday.

During the last 5 days, the valuable steel has proven power, aided by Center Jap geopolitical considerations and protracted market uncertainty.

Regardless of confronting obstacles reminiscent of a robust US greenback and hawkish US rate of interest predictions, gold has risen properly, rising seven of the final eight weeks and greater than 17% since mid-February.

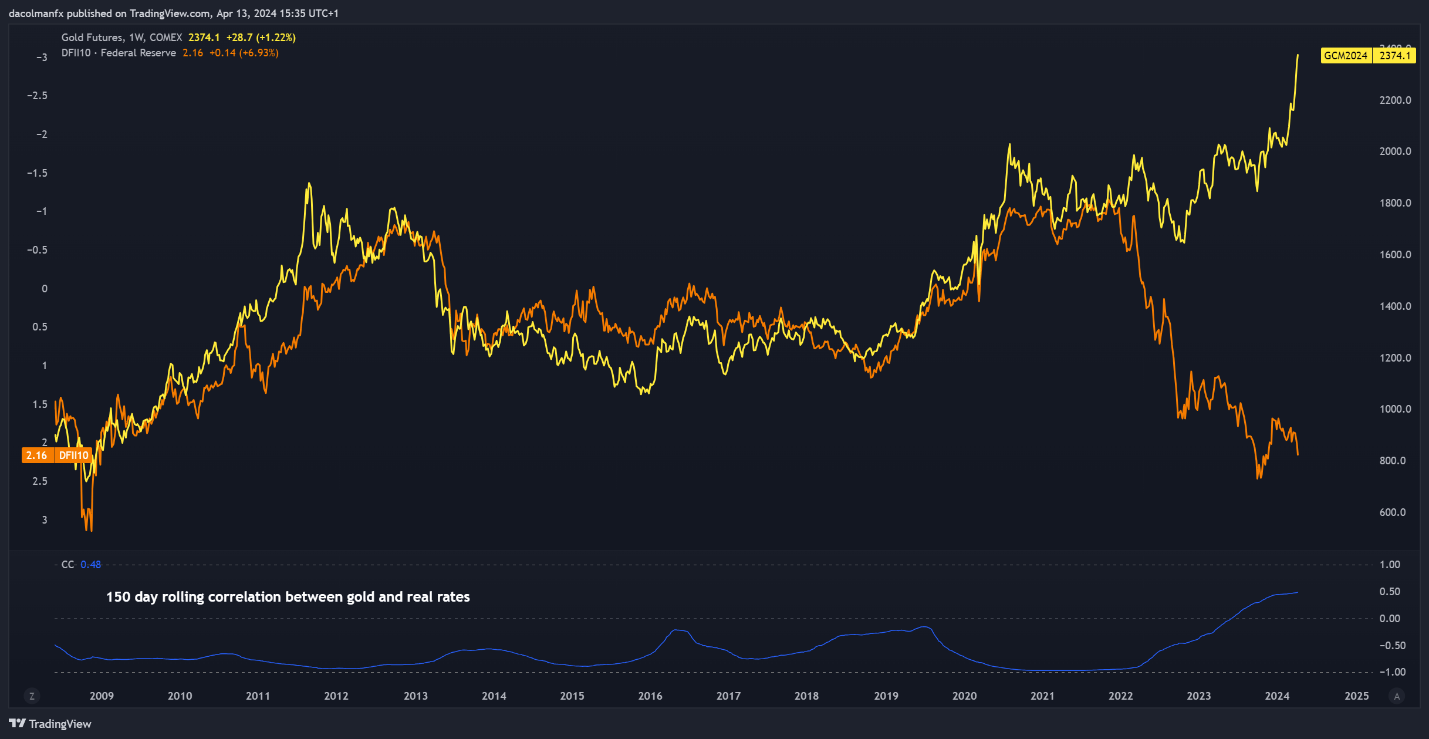

Many basic merchants have been perplexed by this superb efficiency, because the conventional detrimental hyperlink between bullion and US actual yields has dissolved, calling standard market dynamics into query.

Drivers Behind Gold’s Surge

A number of causes have contributed to gold’s robust efficiency this yr, with market dynamics reflecting a mix of hypothesis, financial hedging, and inflationary considerations.

The persistent climb in gold costs could also be propelled by a momentum lure, wherein speculative frenzy propels vertical rallies which will show unsustainable in the long term.

Moreover, market individuals could also be hedging in opposition to possible financial downturns attributable to aggressive financial coverage tightening and long-term high-interest charges.

Moreover, gold bulls could also be fastidiously positioning themselves for a future inflation comeback, relying on Federal Reserve price discount to mitigate financial dangers, which might spark a new wave of inflation that advantages treasured metals.

Technical Evaluation and Market Outlook

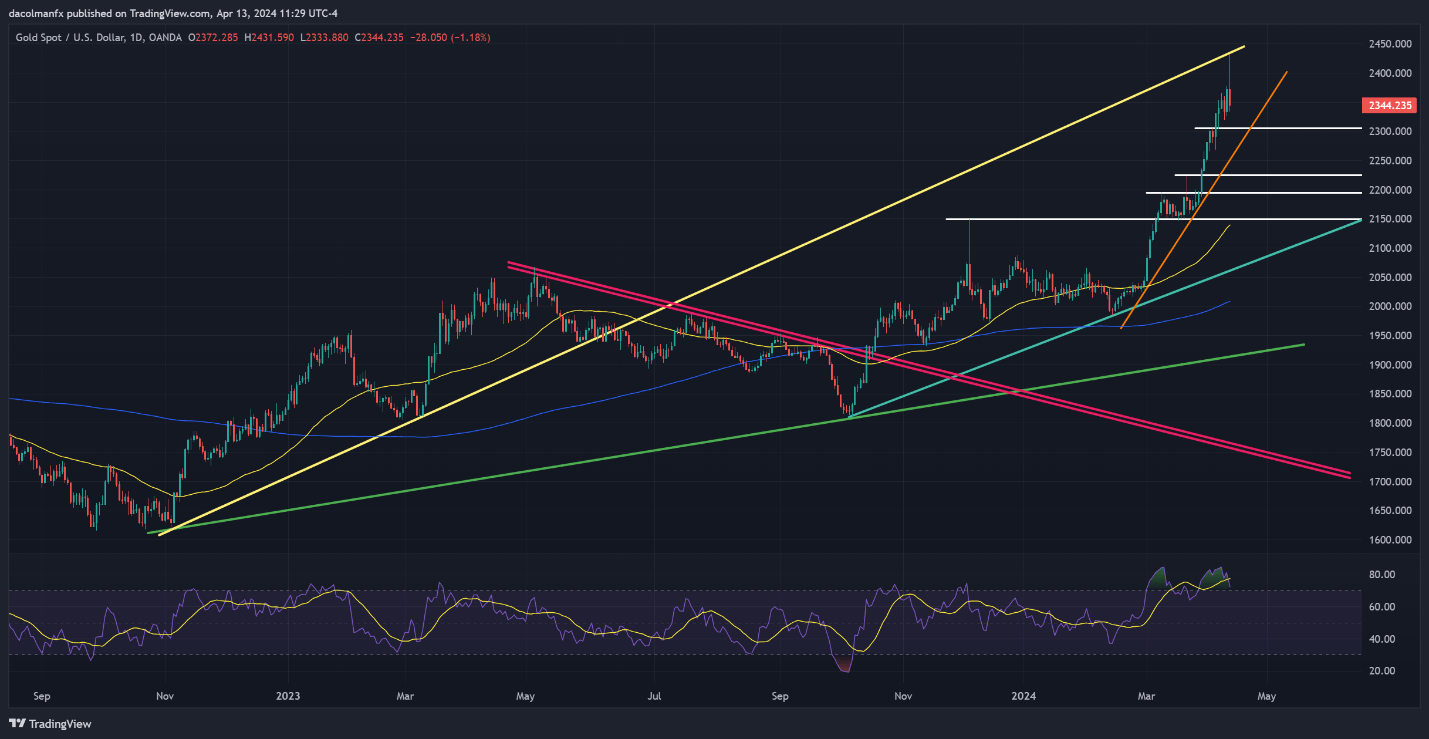

Technical evaluation means that gold will rise to a new all-time excessive at $2,430 this week, earlier than falling to $2,344 by Friday’s shut. If the market falls additional, assist ranges of $2,305, $2,260, and $2,225 have been highlighted.

A comeback in gold costs, then again, could face resistance above the $2,430 document excessive, with a attainable breach signifying a transfer to $2,500.

Regardless of the present rally above $2,350, gold faces headwinds from stretched market circumstances and overbought territory, which could stifle future positive aspects.

Current Developments and Market Response

The deepening of the strain between Iran and Israel over the weekend has boosted gold costs, as buyers search sanctuary within the conventional safe-haven forex.

Nevertheless, statements from world leaders criticizing Iran’s conduct and demanding warning have quelled market anxieties, including to extra bullish threat sentiment.

This sentiment is mirrored within the 0.30% improve in S&P 500 futures, which has restricted additional positive aspects in gold costs. Shifting ahead, the trajectory of gold costs will most actually be influenced by occasions within the Center East battle and modifications in market sentiment.

Moreover, the discharge of high-impact U.S. Retail Gross sales knowledge afterward Monday could present further insights into market dynamics, significantly when it comes to greenback demand and expectations for Federal Reserve coverage.

Closing Ideas

Gold stays in a complicated terrain marked by geopolitical tensions, shifting market dynamics, and unsure financial prospects.

Regardless of difficulties reminiscent of a powerful US forex and hawkish rate of interest predictions, the valuable steel has proven stunning resilience, gaining vital floor in latest weeks.

Nevertheless, the long-term viability of gold’s surge stays unsure, with considerations about underlying elements and potential market weaknesses.

As buyers control developments within the Center East battle and key financial indicators reminiscent of US retail gross sales knowledge, the way forward for gold costs stays unsure.

Within the face of uncertainty, merchants ought to present warning and be watchful in monitoring market circumstances to make knowledgeable funding choices.

[ad_2]