[ad_1]

Greenback down, Gold up

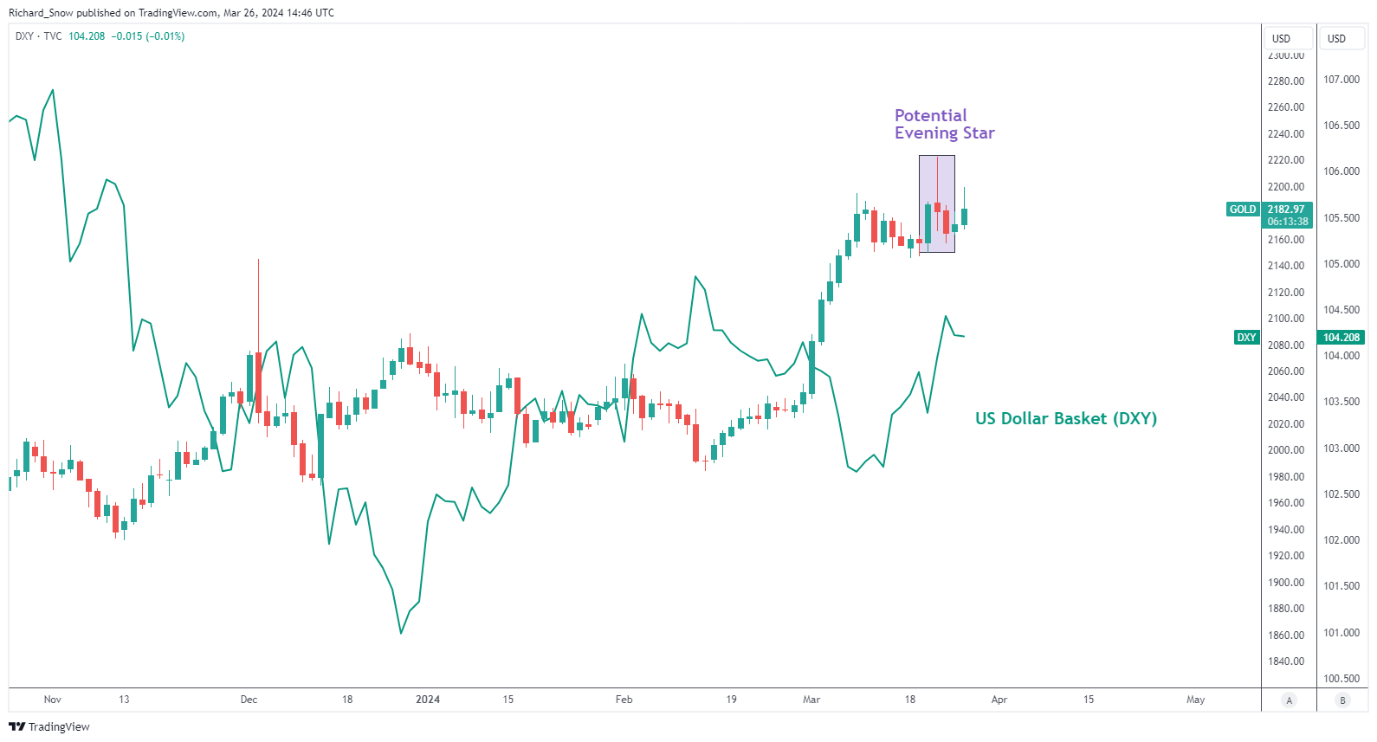

In current buying and selling dynamics, goutdated and silver have diverged on their very own programs in opposition to the backdrop of a weaker greenback. Gold costs have moved increased, monitoring the foreign money’s minor decline, and the holiday-shortened buying and selling week has begun with cautious optimism.

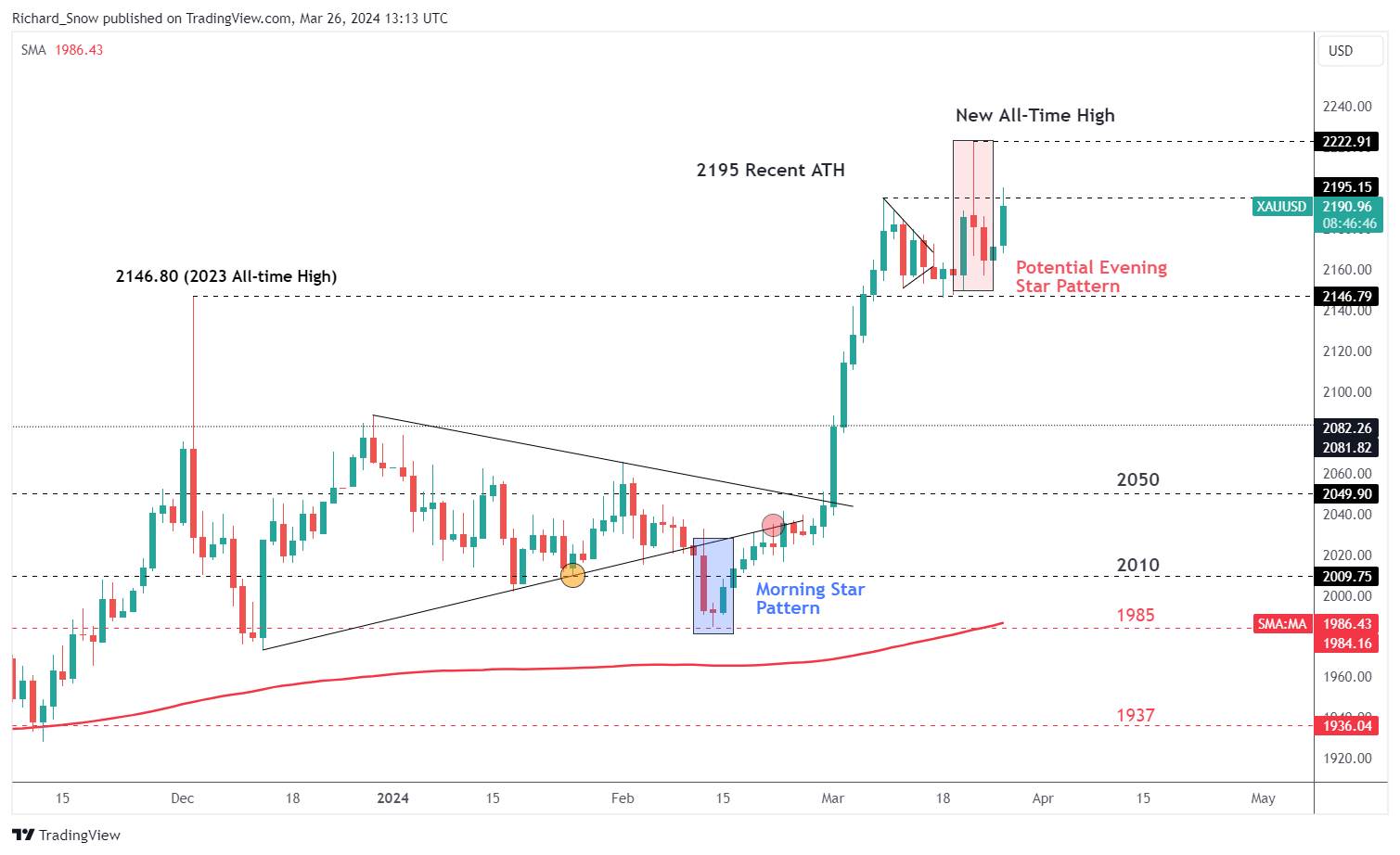

Final week’s buying and selling revealed an odd night star sample in gold value actions, a usually unfavorable indication that appeared on the uptrend’s peak. Regardless of its rarity, this sample, which is distinguished by a a lot increased wick within the center ‘doji’ candle, stays in step with technical standards.

The fluctuation within the greenback’s energy seems as a cooldown from the earlier week’s volatility, which noticed a drop publish the Federal Open Market Committee (FOMC) assembly, adopted by a pointy rebound.

The anticipation for incoming inflation knowledge on Friday positions it because the week’s pivotal occasion, doubtlessly stirring vital market actions amidst the anticipated decrease liquidity resulting from financial institution holidays within the UK and the US.

Every day Gold Chart In contrast with the US Greenback Basket (DXY)

Gold Retest Previous to 2024 All-Time Excessive

Gold’s value endurance is seen because it strives to attain its earlier all-time excessive in 2024, testing the current prime of roughly $2222 following a shut above $2195. This check of bullish momentum could point out the necessity for additional catalysts to keep up the upper development, with $2146 recognized as a major help stage for the week.

Merchants are cautioned to anticipate heightened volatility on Friday, relying on the end result of the inflation report.

If bears wish to regain management this week, $2146 is the suitable stage of help. To summarize, Friday could carry elevated volatility if we see a shock within the report resulting from lesser liquidity.

Gold (XAU/USD) Every day Chart

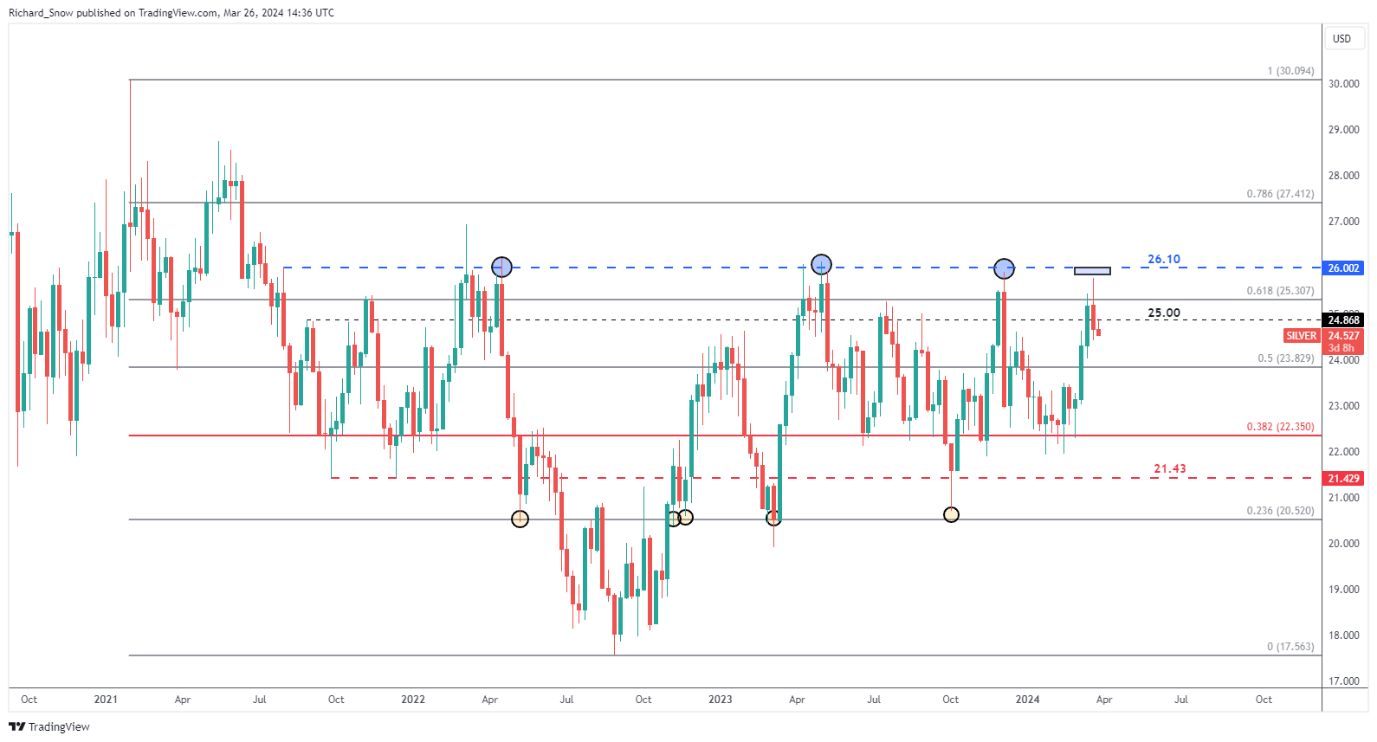

Silver discovered a barrier and continued to drip decrease

Conversely, silver encounters resistance, persistently trailing decrease after failing to breach the $26.10 threshold, a sturdy cap since mid-2023. The slide beneath key Fibonacci retracement ranges underscores the steel’s battle, with instant draw back pursuits doubtlessly resulting in $22.35.

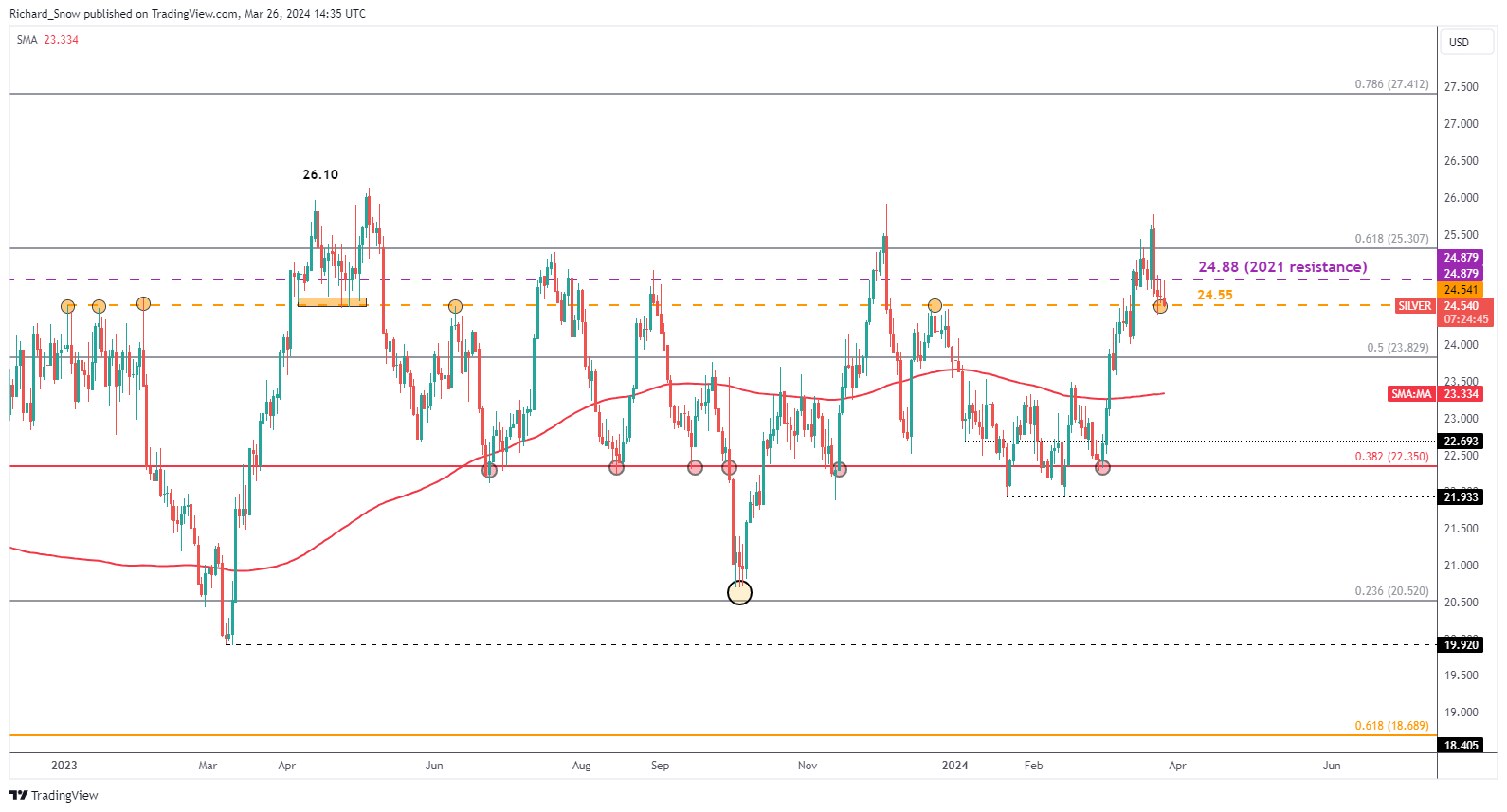

The bearish momentum faces a check at $24.55, a stage that beforehand capped its ascent, indicating a important juncture for silver’s value trajectory.

Silver Weekly Chart

The each day chart reveals an instantaneous check for bearish momentum at $24.55, which has beforehand acted to restrict rising potential.

Silver Every day Chart

Ultimate Ideas

For merchants, the worth distinction between gold and silver gives an advanced surroundings, accentuated by the greenback’s actions and future financial knowledge releases. The expectation of Friday’s inflation report has the potential to trigger appreciable swings, particularly given the menace of restricted market liquidity.

Consequently, navigating the valuable metals market requires a strategic technique that takes into consideration help and resistance ranges, in addition to macroeconomic knowledge.

The publish Gold and Silver Costs Replace: XAU/USD Rises on a Softer Greenback, Silver Withers appeared first on Dumb Little Man.

[ad_2]