[ad_1]

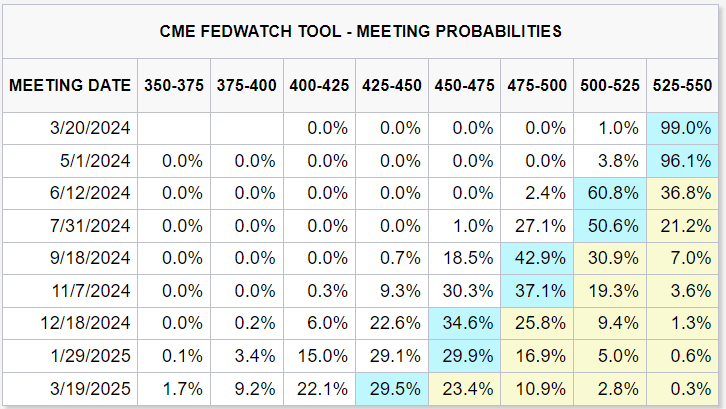

The Federal Reserve is ready to announce its financial coverage choice this Wednesday. For the fifth consecutive assembly, the benchmark price is anticipated to be stored at its present vary of 5.25% to five.50%.

With no changes deliberate to its quantitative tightening program, which goals to step by step scale back its bond holdings, this transfer signifies the central financial institution’s steady struggle in opposition to persistent inflation.

Market Anticipation and Financial Projections

Buyers are bracing themselves for the Fed’s ahead steerage, which will likely be vital in figuring out the trail of future financial coverage. In keeping with the consensus, the Fed ought to proceed cautiously and watch for extra proof of deflation earlier than decreasing borrowing costs.

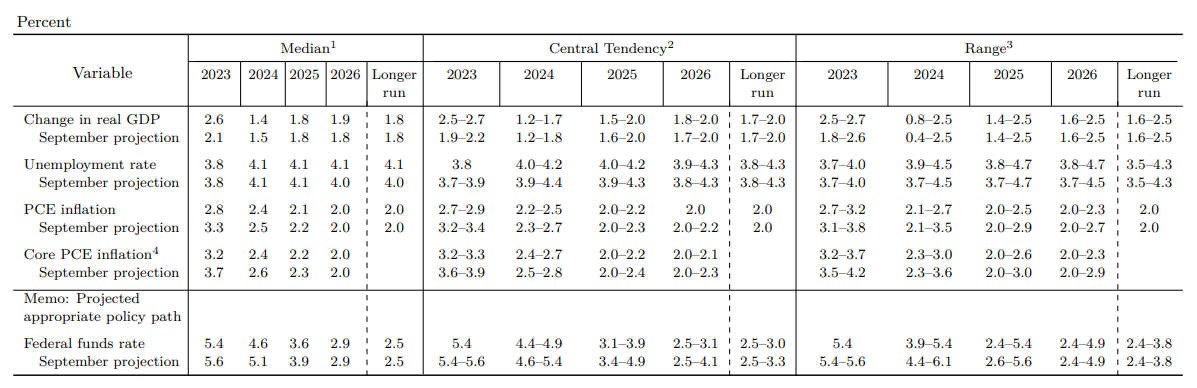

This technique recommends delaying any potential price cuts till the central financial institution is extra sure that inflation is steadily approaching its 2% goal. Resilient financial indicators have been noticed, with latest PPI and CPI information emphasizing sticky pricing pressures.

The prospect of fewer price cuts in 2024 than first anticipated is indicated by the chance that the Fed might elevate its macroeconomic projections for GDP and core PCE deflator forecasts.

Potential Market Influence

As markets acclimate to the opportunity of a extra affected person and cautious Fed, many predict that this stance might lead to a transient spike within the U.S. Treasury yields and the U.S. greenback.

This is able to unsettle gold and shares, which have loved rallies below the impression of an impending shift in coverage towards easing.

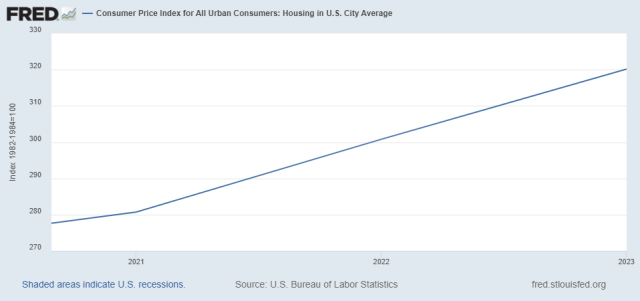

Inflation Challenges and Housing Prices

The Fed’s objectives are challenged by ongoing inflation, significantly in housing bills. Rising mortgage charges and an absence of accessible houses nationwide have made renting the preferred alternative for many Individuals, regardless of forecasts of a decline introduced on by constructing booms in some areas.

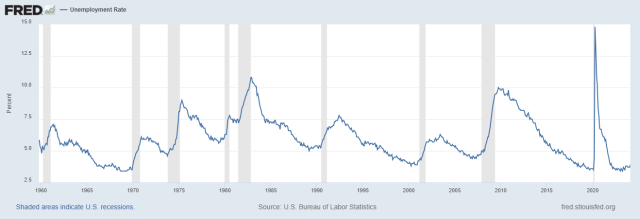

With the unemployment price remaining beneath 4% for the longest interval for the reason that Nineteen Sixties, employment stability has no less than considerably mitigated these results.

Financial Outlook and Inflation Dynamics

Bankrate analysts spotlight how entrenched inflation is, speculating that the Fed’s efforts to realize the 2% inflation goal could also be restricted to only two rate of interest cuts this yr.

The labor market has blended outcomes, with rising immigration and productiveness offering doable inflation hedges. These parts might current a doubtlessly secure financial future by enabling the financial system to accommodate increased wages with out inflicting extra inflation.

Political Concerns and Timing

Political sentiments in the direction of the financial system stay divided, influencing public notion and doubtlessly the timing of future Fed actions. To keep away from showing politically motivated, the Fed is making an attempt to carry off on making any adjustments to rates of interest till June on the newest. That is as a result of carefully approaching basic election.

Last Ideas

Because it units the tone for financial expectations sooner or later months, the Federal Reserve’s impending coverage announcement is pivotal for merchants and market observers.

In gentle of persistent inflation and a advanced financial panorama, the Fed’s cautious method signifies a delicate equilibrium between selling financial stability and managing obstacles to cost stability.

The market’s response to the central financial institution’s decision-making will depend upon its capability to information the financial system towards fulfilling its twin mandate of low inflation and full employment with out caving into exterior strain or jeopardizing its credibility in entrance of consequential political turning factors.

The put up Fed Anticipated to Preserve Present Curiosity Charges Amid Ongoing Inflation Considerations appeared first on Dumb Little Man.

[ad_2]