[ad_1]

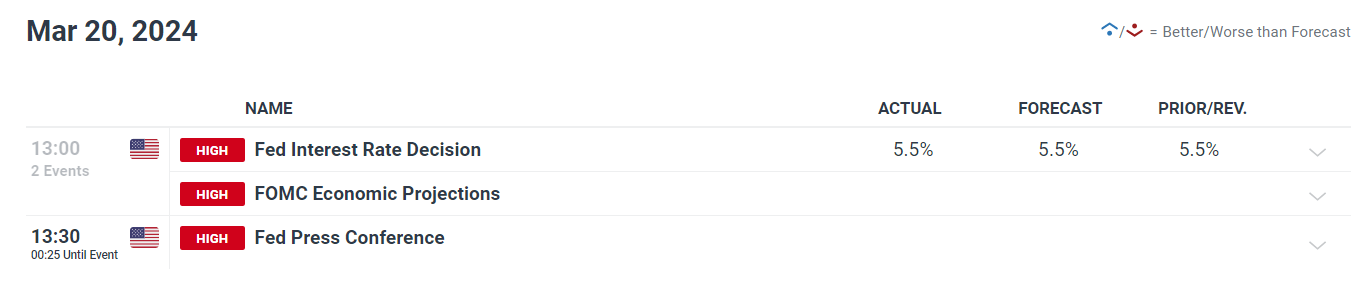

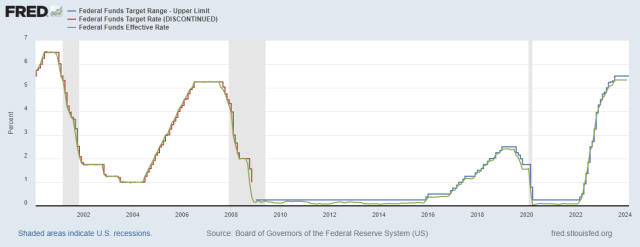

The Federal Reserve determined to keep up its benchmark rate of interest at a degree that might stay between 5.25% and 5.50% following its March coverage assembly on Wednesday, a choice anticipated by analysts and buyers.

The Federal Reserve has demonstrated its dedication to financial coverage stability by not adjusting borrowing prices for the fifth straight assembly. As well as, in response to market expectations, officers determined to keep up their present quantitative tightening program with out making any adjustments.

Financial Evaluation and Ahead Steerage

In its accompanying assertion, the Federal Open Market Committee (FOMC) reaffirmed its bullish evaluation of the financial system, declaring that macroeconomic indicators are nonetheless in step with robust beneficial properties.

The declaration made clear that though the unemployment charge remains to be at traditionally low ranges, financial exercise has been rising steadily. Regardless of its continued issues about pricing pressures, the Fed acknowledged that inflation has eased over the previous 12 months however stays elevated.

Concerning ahead steerage, the FOMC reiterated its place that till it’s extra sure that inflation is steadily approaching its 2.0% goal, it won’t ponder lifting coverage restraint.

In accordance with this assertion and former discussions, officers are holding off on taking a extra accommodative financial coverage stance till they’ve extra proof of a persistent decrease pattern in inflation.

Insights from Financial Projections

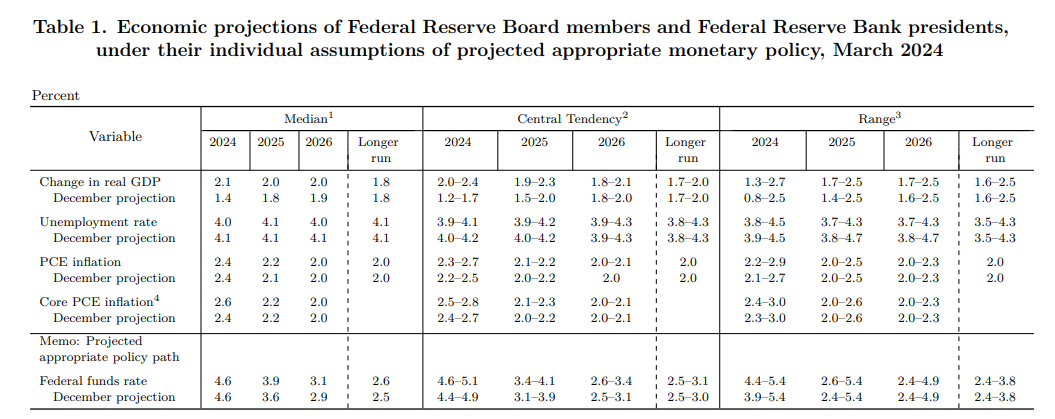

The discharge of the March Abstract of Financial Projections offered extra insights into the Fed’s outlook for key financial indicators.

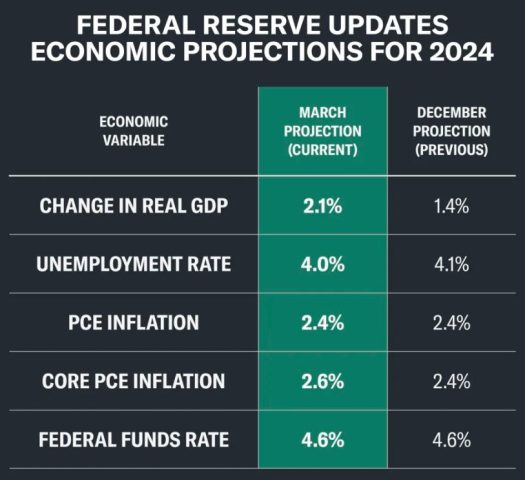

Notably, the financial system’s capability to climate challenges and preserve rising momentum was seen within the revision of GDP progress estimates for 2024, which went from 1.4% to 2.1%.

An additional indication of the persistence of an optimistic evaluation of the labor market’s resiliency was the revision of the unemployment charge outlook downward to 4.0%.

Inflation expectations additionally noticed upward revisions, with the Fed now forecasting a core PCE deflator of 2.6% for 2024, up from the earlier estimate of two.4%.

The Fed has made this adjustment to higher replicate its dedication to intently monitoring inflation dynamics and its recognition of ongoing worth pressures.

Dot Plot Insights and Market Response

The dot plot, which reveals the trajectory of rates of interest as anticipated by Federal Reserve officers, didn’t considerably range from earlier projections.

Policymakers proceed to anticipate three quarter-point charge cuts in 2024, with charges anticipated to finish the 12 months at 4.6%. By 2025, charges ought to have step by step decreased to three.9%, in response to the estimate.

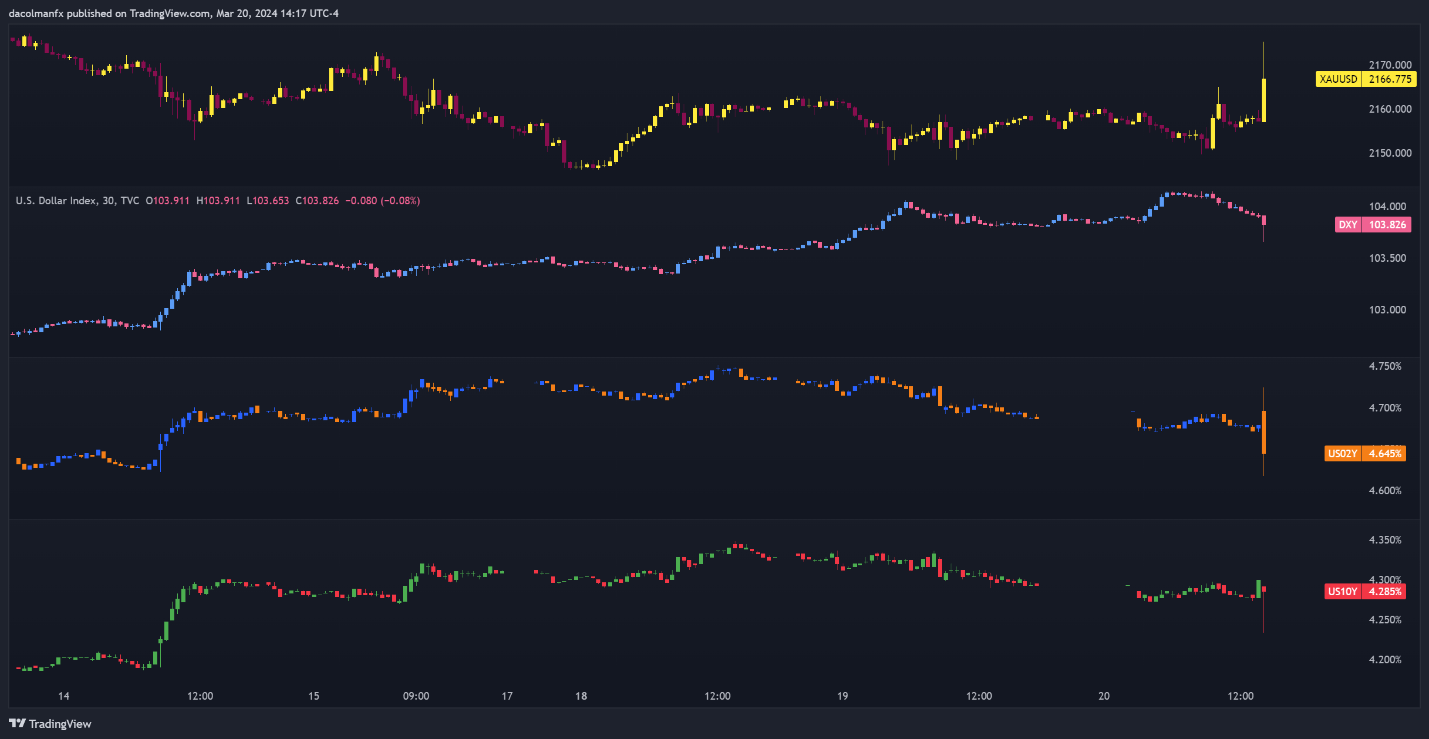

Following the Fed’s assertion, monetary markets reacted accordingly, the U.S. greenback and bond yields dropped, and gold costs step by step elevated.

An indication that charge cuts will proceed till 2024 put bearish stress on the greenback and demonstrated how delicate the market is to alerts from the financial coverage.

Last Ideas

A cautious strategy to managing financial dangers is mirrored within the Federal Reserve’s determination to preserve rates of interest and coverage outlook. Prioritizing sustainable financial progress, the central financial institution stays vigilant about inflationary pressures.

With the market pricing consistent with the Fed’s estimates, buyers will most likely be maintaining a detailed eye on incoming information and the remarks made by policymakers for any indications relating to the path of future financial coverage.

A significant component influencing market sentiment and asset worth fluctuations will proceed to be the Fed’s dedication to creating data-driven selections, at the same time as international financial circumstances change.

[ad_2]