[ad_1]

Combined Alerts from World Markets

In an surprising change of occasions, Asian markets have gained traction on the disclosure that US manufacturing rose for the first time in 18 months in March, with manufacturing and new orders rising considerably.

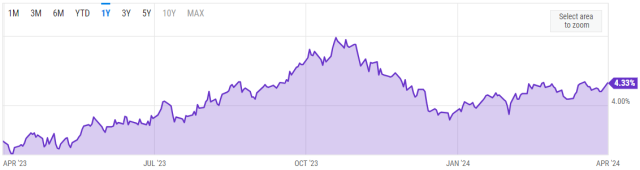

This robust financial indicator despatched US Treasury yields skyrocketing, with two-year yields peaking at 4.726% and ten-year yields reaching 4.337%, the highest degree in two weeks.

2-Yr Yields

10-Yr Yields

Consequently, the greenback firmed, placing strain on the yen, which stayed near a 34-year low of 151.76 per greenback.

Yen Beneath Stress

With the yen’s worth being keenly monitored, Japan’s historical past of foreign money market interventions in 2022 looms giant, notably because the foreign money approaches the important thing 152-per-dollar degree.

In the meantime, European markets are set for a modest begin, with futures indicating tiny will increase throughout main indices: Eurostoxx 50 futures are up 0.10%, DAX futures by 0.02%, and FTSE futures by 0.07%.

Regional Market Highlights

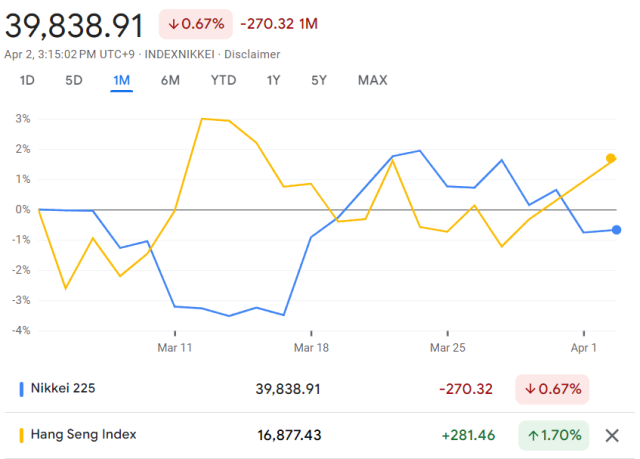

The Nikkei exhibited volatility, momentarily approaching 40,000 earlier than stabilizing. In distinction, the Cling Seng Index outperformed, rising greater than 2% as Hong Kong markets reopened after the vacation.

Regardless of a massive rise the day earlier than, Chinese language shares noticed a reasonable improve, owing to constructive manufacturing exercise knowledge indicating a sustained financial restoration.

World Outlook

European futures point out a cautious begin, with minor good points throughout main indices. Regardless of its finest first-quarter efficiency in 5 years, the US S&P 500 is underneath strain from larger Treasury yields, that are being pushed by manufacturing statistics.

Market analysts at the moment are adjusting the chance of a Fed price minimize in June primarily based on the interplay of robust financial indicators and Federal Reserve coverage expectations.

Commodities and Foreign money

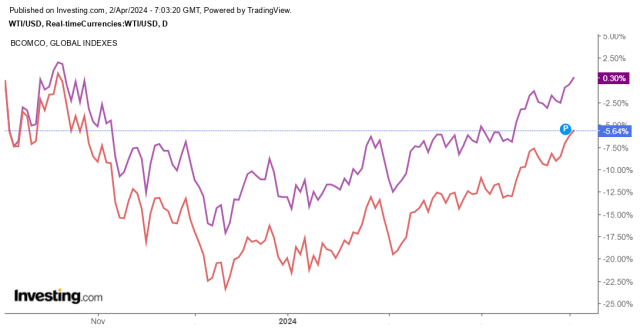

Oil costs have risen barely, with US crude at $84.14 per barrel and Brent crude at $87.85, boosted by demand optimism and geopolitical worries. Gold continues to rise, including to its good points after reaching an all-time excessive of $2,256.46 per ounce.

The greenback’s power, approaching a 4.5-month excessive of 105.5, is seen in opposition to a basket of currencies, pushing the euro and sterling decrease.

Ultimate Ideas

This time of financial resiliency in america, as evidenced by sturdy manufacturing figures, has added a brand new degree of complication for merchants and policymakers alike.

The Asian inventory market’s response, mixed with foreign money modifications and commodity worth actions, demonstrates the world interdependence of monetary markets.

As merchants navigate this altering panorama, strategic decision-making and danger administration turn out to be more and more necessary.

The recalibration of Fed price minimize expectations has an influence not solely on funding methods but additionally highlights the significance of intently watching financial indicators and geopolitical developments.

This unstable local weather presents each difficulties and potentialities, with necessary implications for world markets and funding portfolios.

[ad_2]