[ad_1]

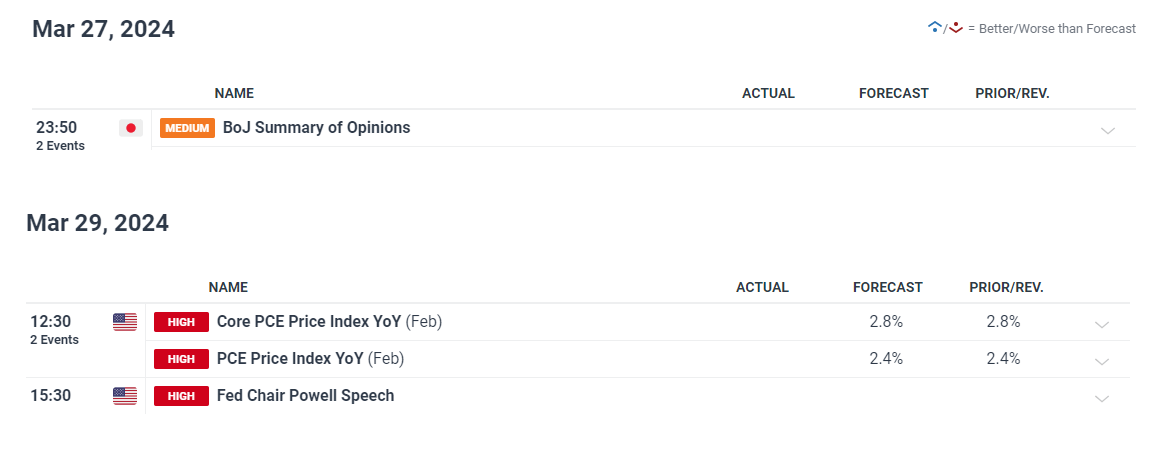

BOJ Minutes Present Scarce New Data

Following the Financial institution of Japan‘s (BoJ) pivotal resolution to conclude its unfavorable rate of interest coverage, the yen skilled a noticeable decline, reaching a four-month trough. This transfer, which ended eight years of unorthodox financial stimulus, didn’t introduce new insights as per the BoJ minutes, largely due to the Financial institution’s proactive communication technique earlier than and after the March meeting.

Regardless of the historic nature of this coverage shift, the yen depreciated by over 1% in opposition to the greenback, signaling the market had already adjusted its expectations.

The BoJ’s minutes confirmed that Japan’s 2% inflation goal stays unmet, and the anticipated tempo of price hikes will diverge from tendencies noticed in Western nations.

This method suggests a continued disparity in rate of interest differentials favoring carry trades, probably holding the yen underneath stress. Moreover, upcoming BoJ reviews and the ultimate This fall GDP knowledge from the US might heighten market volatility, particularly with lowered liquidity anticipated round Good Friday.

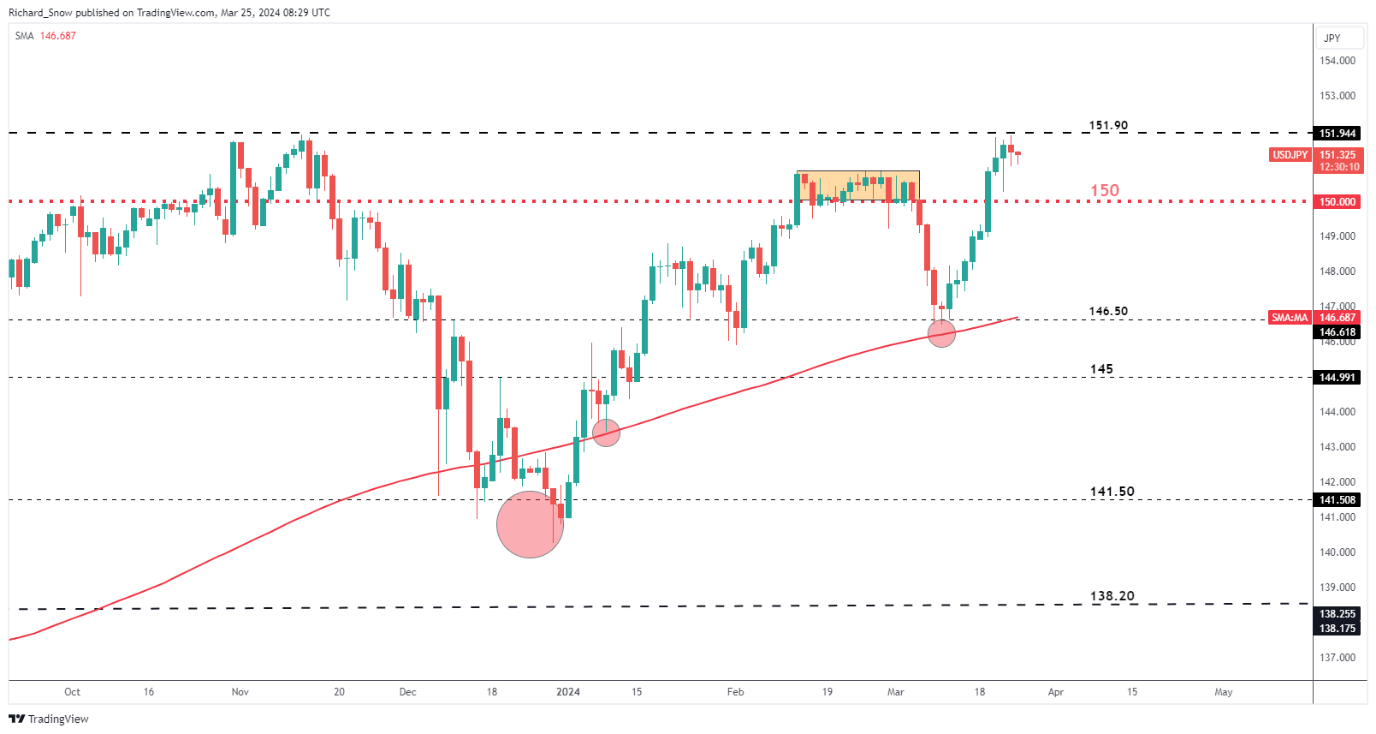

USD/JPY Edges Down From Resistance

By way of buying and selling, the USD/JPY pair has proven resistance across the 151.90 degree, hinting at a difficult path again to the 150.00 mark with out important influences from BoJ forecasts or US PCE knowledge.

Japan’s potential for one more price hike later this yr, spurred by inflation and progress prospects, contrasts with the eager market watch on the US PCE knowledge for potential seasonal impacts. The information’s end result reinforces the greenback’s power or contributes to a downward adjustment within the USD/JPY pair.

USD/JPY Each day Chart

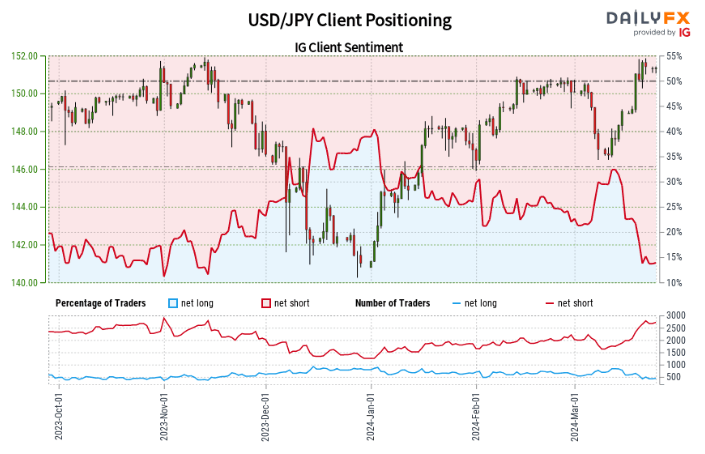

The sentiment amongst retail merchants stays combined, with a considerable quick positioning on USD/JPY, though latest shifts recommend an extra advanced buying and selling outlook. This sentiment evaluation, coupled with the yen’s efficiency post-BoJ’s announcement and forward of the Federal Reserve’s coverage outlook, underscores the intricate dynamics influencing the USD/JPY alternate price.

IG Consumer Sentiment ‘Blended’ Regardless of Huge Brief Positioning

We usually undertake a contrarian method to crowd temper and the truth that merchants are net-short indicators that USD/JPY costs might proceed to climb.

The variety of merchants net-long is 12.74% greater than yesterday and 27.58% decrease than the earlier week, whereas the variety of merchants net-short is 4.19% greater than yesterday and 34.04% greater than final week.

Positioning is much less net-short than yesterday, however extra net-short than the earlier week. The mixture of present feelings and latest changes creates a extra combined USD/JPY buying and selling inclination.

The worldwide foreign money market is now focusing closely on central financial institution choices, with the Federal Reserve’s subsequent coverage outlook anticipated to dominate. The greenback’s power is bolstered by strong US financial indicators, which level to continued inflation, maybe limiting any swift Fed price decreases.

This state of affairs has far-reaching penalties, influencing currencies worldwide, from the Australian greenback to the euro and sterling, and even affecting cryptocurrency valuations. infrastructure might spark retaliation and lift world oil costs, complicating the geopolitical surroundings and the worldwide power market’s stability.

Remaining Ideas

Because the market navigates these occasions, merchants pay explicit consideration to the results of financial coverage shifts in key economies. The BoJ’s plan to normalize financial situations is a big step ahead.

The fast influence on the yen highlights the intricate interaction between world monetary circumstances and market temper. With Fed choices on the horizon, the foreign money market is about for main adjustments in buying and selling conduct.

[ad_2]