[ad_1]

There may be affiliate hyperlinks on this web page, which implies we get a small fee of something you purchase. As an Amazon Affiliate we earn from qualifying purchases. Please do your personal analysis earlier than making any on-line buy.

Books on budgeting all appear the identical. For essentially the most half, these books cowl the budgeting fundamentals and past…

These books talk about the fundamentals of finance:

All of that is actually vital stuff. little doubt about that.

However individuals who wrestle to simply get by each single week could discover it tough to make the cash they’ve coming in meet their funds necessities.

That’s the place these books on saving cash and budgeting come into play.

The purpose of the books on this listing is to provide PRACTICAL ADVICE on saving cash.

Each one among these books is not going to provide the usual recommendation on the best way to make the funds. These cash saving and budgeting books will present you the best way to make your restricted money move stretch to succeed in your funds wants.

These are as a lot books on frugal residing as they’re private budgeting and debt aid books. They talk about specifics on “how to economize” not simply offer you platitudes on spending much less cash however to provide actionable recommendation on the best way to get by on a shoestring funds and nonetheless pay down any debt.

That’s what makes this assortment of books on saving cash a bit distinctive, and really sensible.

Even when you’ve got already learn among the finest introductory finance books accessible, these books nonetheless have so much to show you. If not in regards to the science of budgeting and saving not less than in regards to the artwork of creating your revenue meet your budgetary wants.

If you wish to learn to funds, debt proof residing, investing and the 7 cash guidelines for all times learn the whole cash makeover by Dave Ramsey. However if you wish to make your greenback stretch additional, then learn any of those books on frugal residing, budgeting, saving cash and climbing out of debt.

1. The Easy Greenback by Trent A. Hamm

Takeaways:

- The Easy Greenback gives sensible recommendation on private finance, offering methods for budgeting, saving, and reaching monetary freedom by way of easy and sustainable practices.

- Trent A. Hamm emphasizes the significance of conscious spending and long-term monetary planning, advocating for a balanced method to managing cash and assets.

- The guide offers insights into frugality and the worth of residing inside one’s means, providing actionable suggestions for decreasing bills and making knowledgeable monetary selections.

- The Easy Greenback encourages readers to prioritize monetary well-being and undertake a mindset of monetary accountability, selling the pursuit of a extra intentional and fulfilling relationship with cash.

- Hamm’s work serves as a precious useful resource for people searching for to enhance their monetary literacy and obtain larger monetary stability, providing sensible steering on managing cash and constructing a safe monetary future.

Trent Hamm makes use of The Easy Greenback: How One Man Wiped Out His Money owed and Achieved the Lifetime of His Goals as a platform to inform about his private expertise with liberating himself from debt slavery, and the way the method was in a position to present him with some long-lost happiness.

This account of how Hamm was profitable in doing this and the constructive modifications it dropped at his life helps readers use his concepts to realize his similar success.

This guide helps to unclutter individuals’s monetary conditions and leads to a extra rewarding life. Going from debt to wealth himself, Hamm is ready to put together the reader for each the anticipated and the surprising complexities of private budgeting in as we speak’s financial world.

This guide is filled with sensible suggestions and instruments that the reader can apply to their very own life. Its means to be motivating and empowering helps the reader to proactively create more healthy relationships with each cash and folks.

Utilizing private anecdotes, Hamm is ready to have interaction the reader all through the guide and maintain them centered. He additionally will get proper to the purpose with out including in a variety of fluff materials, so that you by no means really feel like you’re losing your time studying by way of issues that aren’t vital.

Whereas a variety of the factors on this guide are already made on his weblog, that is nonetheless an important place to place his message collectively to assist readers obtain the monetary success that he has.

2. 365 Methods to Stay Low cost by Trent Hamm

Takeaways:

- 365 Methods to Stay Low cost gives a wealth of sensible suggestions and techniques for saving cash and residing frugally, offering actionable recommendation for people searching for to cut back bills and obtain monetary safety.

- Trent Hamm shares insights on budgeting, good purchasing, and resourceful residing, presenting a various array of frugal residing strategies appropriate for varied existence and circumstances.

- The guide encourages readers to domesticate a mindset of conscious spending and resourcefulness, selling the worth of creating intentional selections to stretch one’s assets and dwell extra economically.

- 365 Methods to Stay Low cost serves as a complete information for people seeking to optimize their funds, providing inventive and sustainable approaches to minimizing prices and maximizing worth in each day life.

- Hamm’s work offers a precious useful resource for people searching for to reinforce their monetary well-being, providing a large number of sensible and actionable strategies for residing frugally and taking advantage of accessible assets.

365 Methods to Stay Low cost: Your On a regular basis Information to Saving Cash is actually a frugal residing guide. But it surely additionally discusses methods to avoid wasting long-term cash. For instance, utilizing chilly water whereas washing your garments can save virtually $65 a 12 months, whereas investing in a deep freezer and shopping for meals in bulk can save on groceries.

Hamm encourages his readers to check out their very own lives and to understand that there are lots of methods to dwell on much less. Providing a large number of the way to chop prices, this guide on saving cash nonetheless makes positive that you’re residing a way of life that’s satisfying for you.

Whereas among the suggestions on this guide have been round for a very long time, it is a great spot to brush up on some money-saving tips and see what new issues you may be taught that may provide help to save.

This guide does an important job in mentioning among the pointless on a regular basis spending that folks are likely to do. It helps readers determine the additional bills in their very own lives that may be minimize for the long-term good.

3. Couponing for the Remainder of Us by Kasey Knight Trenum

Takeaways:

- Couponing for the Remainder of Us gives sensible insights and techniques for people fascinated with saving cash by way of couponing, offering suggestions tailor-made for a variety of existence and schedules.

- Kasey Knight Trenum shares recommendation on leveraging coupons successfully, emphasizing the significance of group, planning, and understanding retailer insurance policies to maximise financial savings.

- The guide encourages readers to undertake a strategic and conscious method to couponing, providing steering on discovering, organizing, and utilizing coupons to realize important reductions on on a regular basis purchases.

- Couponing for the Remainder of Us serves as a precious useful resource for these searching for to optimize their funds by way of couponing, providing sensible recommendation and real-world examples to assist readers navigate the world of coupon financial savings.

- Trenum’s work offers actionable methods and insights for people seeking to harness the facility of coupons to cut back bills and profit from their family funds.

Couponing for the Remainder of Us: The Not-So-Excessive Information to Saving Extra is a superb guide for individuals who like the thought of couponing, however don’t love the thought of spending their time doing it.

Trenum is nicely conscious of the truth that individuals don’t need to spend time clipping coupons, but additionally is aware of how a lot cash coupons can save households on this tight economic system.

This guide helps individuals discover coupons for what their household eats, methods to chop down on Web payments, the best way to decide sale cycles, and the best way to make purchasing much less irritating.

The writer reveals the reader how straightforward it’s to economize on on a regular basis issues in order that they’ll have a bit extra monetary freedom.

An empowering and sincere learn, Couponing for the Remainder of Us: The Not-So-Excessive Information to Saving Extra can also be humorous, so it’s relatable and straightforward to learn. With the writer being a spouse and mom, she is ready to deeply join with readers who’re additionally in those self same roles.

Among the best issues about this guide is that it isn’t about excessive couponing—it’s about manageable issues that folks can do whereas they’re purchasing to assist get monetary savings.

4. Cash Secrets and techniques of the Amish by Lorilee Craker

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Cash Secrets and techniques of the Amish gives precious monetary knowledge impressed by the frugal and community-oriented life-style of the Amish, offering insights into easy residing, thrift, and monetary stewardship.

- Lorilee Craker shares sensible recommendation on budgeting, saving, and conscious spending, drawing from the timeless ideas of Amish cash administration to supply actionable methods for contemporary readers.

- The guide emphasizes the significance of resourcefulness, contentment, and group assist in reaching monetary safety, highlighting the worth of residing inside one’s means and making intentional monetary selections.

- Cash Secrets and techniques of the Amish serves as a supply of inspiration for people searching for to reinforce their monetary well-being, providing a novel perspective on frugality, gratitude, and the pursuit of a extra significant and sustainable relationship with cash.

- Craker’s work offers actionable insights and real-life examples that showcase the enduring knowledge of Amish monetary practices, providing readers a roadmap for reaching larger monetary stability and contentment.

What’s it in regards to the Amish that has allowed them to not simply survive however really thrive throughout occasions of financial turmoil?

Cash Secrets and techniques of the Amish: Discovering True Abundance in Simplicity, Sharing, and Saving will get to the underside of that thriller and presents the reader with many tried and true Amish monetary habits that may be associated to anybody’s monetary actuality.

These habits have been used for generations and can assist make money last more and accumulate wealth.

This guide is enjoyable to learn within the sense that the writer offers catchy phrases to dwell by, corresponding to “use it up, put on it out, make do, or do with out” and “repurpose, recycle, and reuse.” The good money-saving concepts illustrated are sensible even for many who don’t dwell a life as wise because the Amish.

This guide on saving is each touching and humorous whereas offering an eye-opening account of how the Amish make ends meet. The tales speak about buying and selling for items and companies, bargaining, residing with much less, staying out of debt, and even stopping the behavior of attempting to impress others.

This guide is not a lot about earning money as it’s about self-discipline, household, and redefining what it means to be rich. It encourages the reader to see extra clearly what is basically precious in life, and helps to encourage individuals to alter their views on life.

That is a straightforward learn that may assist anybody reduce their consumerism. Whereas there may be not a variety of new recommendation in right here for individuals who already dwell frugally, it offers an important look into the lives of a distinct tradition that has been in a position to be financially profitable whereas others haven’t.

5. The Budgeting Behavior by SJ Scott and Rebecca Livermore

Verify eBook Worth | Verify Audiobook Worth

Budgeting is the important thing to success in private finance. Should you do not need a superb grasp of your funds by way of a funds it’s onerous to handle your cash.

The Budgeting Behavior: Tips on how to Make a Finances and Persist with It! provides step-by-step course of that may provide help to grasp budgeting.

Let’s face it. Budgets are boring. This isn’t a flashy matter, like earning money, investing or beginning a facet hustle. It’s drab and boring. Like brushing your enamel.

However what brushing your enamel is to private hygiene, budgeting is to finance. It might be boring however doing it proper is the lynchpin on prime of which all monetary success rests.

On this guide, we tried to make budgeting as fascinating because it probably may very well be. However extra importantly, we try to provide a sensible information to create a easy, however efficient funds. Extra importantly, this guide teaches you the best way to make a behavior out of following your funds, making a funds that rather more efficient.

6. Lower Your Grocery Invoice in Half With America’s Most cost-effective Household by Steve Economides and Annette Economides

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Lower Your Grocery Invoice in Half With America’s Most cost-effective Household gives sensible methods and suggestions for decreasing grocery bills and maximizing financial savings, offering actionable recommendation for budget-conscious buyers.

- Steve and Annette Economides share insights on meal planning, good purchasing, and frugal cooking, presenting a complete method to economizing on meals prices with out sacrificing high quality or vitamin.

- The guide encourages readers to undertake a strategic and intentional method to grocery purchasing, providing steering on leveraging gross sales, coupons, and bulk shopping for to realize important reductions in meals bills.

- Lower Your Grocery Invoice in Half With America’s Most cost-effective Household serves as a precious useful resource for people searching for to optimize their grocery funds, offering sensible recommendation and real-life examples to assist readers profit from their meals {dollars}.

- The Economides’ work offers actionable methods and insights for people seeking to streamline their grocery spending and profit from their family funds, providing a roadmap for reaching substantial financial savings on meals bills.

Lower Your Grocery Invoice in Half With America’s Most cost-effective Household: Contains So Many Modern Methods You Will not Need to Lower Coupons is a superb guide for individuals who need to get monetary savings on their on a regular basis groceries with out spending the time that’s wanted to seek for coupons.

The authors supply suggestions that may minimize down in your purchasing journeys to once-a-week or much less whereas consuming more healthy and saving cash. Written by a husband and spouse who follow what they preach, it is a relatable guide with a variety of life like suggestions.

Generally known as “America’s Most cost-effective Household,” the authors current methods and tips to economize yearly by reducing down on grocery payments. Among the best issues about this guide is that the ideas offered are helpful whether or not you reside by your self or have a household of seven.

This frugal residing guide is a straightforward and lightweight learn that evokes individuals to make small modifications that may end up in massive pay-offs. Whereas it could be onerous to imagine {that a} household can minimize their grocery invoice in half, the authors present step-by-step directions to take action.

This page-turner has one thing to be taught in every chapter. The reader doesn’t have to complete the whole guide earlier than starting to economize. The cash-saving concepts begin immediately, and the guide is simple to leap round in if you wish to skip chapters or return to reread one thing.

A number of the suggestions on this guide are probably repeats for lots of people, however they’re stable items of recommendation which might be value revisiting. In contrast to another books, this one contains recipes and meal strategies which might be nice for individuals residing on a funds.

Among the best frugal residing books on the market. This guide has so some ways to avoid wasting, and offers a ton of actionable recommendation to assist households meet their funds wants.

7. You Are a Badass at Making Cash by Jen Sincero

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- You Are a Badass at Making Cash gives empowering insights and techniques for remodeling one’s mindset and relationship with cash, offering a contemporary perspective on wealth creation and monetary abundance.

- Jen Sincero shares sensible recommendation on overcoming limiting beliefs, embracing threat, and taking daring motion to realize monetary success, drawing from private experiences and anecdotes to encourage readers.

- The guide encourages readers to domesticate a constructive and proactive mindset in direction of cash, providing steering on harnessing the facility of intention, gratitude, and self-belief within the pursuit of monetary prosperity.

- You Are a Badass at Making Cash serves as a motivational and sensible information for people searching for to raise their monetary actuality, providing actionable steps and mindset shifts to unlock their incomes potential.

- Sincero’s work offers a mix of motivational insights and actionable methods, empowering readers to interrupt by way of self-imposed obstacles and step into their capability for creating wealth and monetary abundance.

Jen Sincero had a blockbuster hit together with her debut guide, You’re a Badass. This guide helped individuals to come back to phrases with the issues that had been holding them again in life and holding them from reaching their potential.

She does the identical factor with You Are a Badass at Making Cash: Grasp the Mindset of Wealth. Besides she does it for cash.

She helps individuals to know the issues which might be holding them again financially. She helps individuals attain their cash making potential, and reveals us the right mindset to realize monetary success. And she or he does all this with a novel fashion and sass that made individuals love the primary guide.

8. The Minimalist Finances by Simeon Lindstrom

Takeaways:

- The Minimalist Finances gives sensible steering on simplifying funds and prioritizing spending based mostly on private values, offering a minimalist method to reaching monetary freedom and contentment.

- Simeon Lindstrom shares insights on decluttering bills, conscious consumption, and intentional residing, presenting a holistic perspective on budgeting that aligns with minimalist ideas.

- The guide encourages readers to reassess their relationship with cash and possessions, providing methods for decreasing monetary litter and aligning spending with long-term objectives and success.

- The Minimalist Finances serves as a precious useful resource for people searching for to streamline their funds, offering actionable recommendation and mindset shifts to domesticate an easier and extra intentional method to cash administration.

- Lindstrom’s work offers sensible methods and thought-provoking insights for people seeking to embrace minimalism as a way of reaching monetary readability, decreasing stress, and fostering a extra significant and intentional life-style.

I like easy issues. Far too usually books on finance are overly advanced. It’s extra environment friendly to have brief, fast however sensible recommendation. That’s what I really feel this assortment of three budgeting books provides.

Every “guide” is pretty brief, however they’re all fast and straightforward reads totally overlaying completely different features of correct budgeting.

Nevertheless, though I favored them as a result of they’re straightforward to observe and logical, I might even have favored extra sensible examples.

In some ways The Minimalist Finances BOXED SET – A Sensible Information On How To Spend Much less and Stay Extra had been as a lot about forming the right budgeting mindset as they had been in regards to the features of the best way to really make a funds.

Of all three “books”, the third part has essentially the most sensible recommendation for the best way to really make that funds. So stick round till the top.

9. 31 Days of Dwelling Properly and Spending Zero by Ruth Soukup

Takeaways:

- 31 Days of Dwelling Properly and Spending Zero gives a sensible and actionable information to a month-long spending freeze, offering methods for saving cash, decluttering, and reevaluating consumption habits.

- Ruth Soukup shares insights on frugal residing, intentional consumption, and artistic methods to repurpose assets, providing a complete method to resetting spending patterns and reaching monetary mindfulness.

- The guide encourages readers to embrace a minimalist and resourceful mindset, offering a step-by-step plan to cut back bills, make do with what’s readily available, and discover contentment in simplicity.

- 31 Days of Dwelling Properly and Spending Zero serves as a precious useful resource for people searching for to reset their relationship with cash and possessions, providing actionable steps and sensible suggestions for a transformative spending freeze expertise.

- Soukup’s work offers a roadmap for people seeking to recalibrate their spending habits, declutter their lives, and domesticate a extra intentional and conscious method to residing nicely inside their means.

This step-by-step guide could also be useful for you when you really feel like your funds has gone off observe and you’ll’t make it to the top of the month with out counting your pennies. The writer offers recommendation on the best way to do a month of no spending to reset your spending habits and get you again in your toes.

31 Days of Dwelling Properly and Spending Zero: Freeze Your Spending. Change Your Life gives a month of each day challenges for spending much less cash, and, in some circumstances, no cash.

There are revolutionary recommendations on the best way to achieve confidence in planning meals, organizing the house, and changing into extra inventive with out spending cash.

With the moment modifications that the writer offers, readers are motivated to dwell a month of zero spending whereas nonetheless discovering pleasure in it. There are new concepts on what to do with outdated meals, and even some budget-friendly methods to repurpose issues you have already got.

With anecdotes from individuals who have efficiently accomplished this problem, this guide gives encouragement and inspiration to its readers. It contains straightforward tips for promoting belongings you personal and reducing down in your grocery invoice.

It helps change the reader’s angle in regards to the issues that matter essentially the most in life, and that may convey a brand new degree of pleasure and togetherness to the family.

This guide might not be for you when you dwell alone and are searching for methods to chop prices, however it’s nice for households with homes and youngsters who need to get monetary savings however do not assume they’ll.

10. Dwelling Properly, Spending Much less! by Ruth Soukup

Takeaways:

- Dwelling Properly, Spending Much less! gives sensible recommendation on simplifying life, managing funds, and discovering contentment, offering a holistic method to residing a extra intentional and fulfilling life.

- Ruth Soukup shares insights on decluttering, budgeting, and prioritizing values, providing a blueprint for reaching a balanced and purposeful life-style whereas managing assets correctly.

- The guide encourages readers to reassess their spending habits and embrace simplicity, offering actionable methods for decreasing extra, minimizing waste, and aligning spending with private objectives and values.

- Dwelling Properly, Spending Much less! serves as a precious useful resource for people searching for to streamline their lives and funds, providing sensible steering and mindset shifts to domesticate a extra intentional and contented way of life.

- Soukup’s work offers a mix of actionable methods and inspirational insights, empowering readers to make conscious selections, declutter their lives, and pursue a path to residing nicely inside their means.

Dwelling Properly, Spending Much less!: 12 Secrets and techniques of the Good Life is all about discovering steadiness in a chaotic life and funds. Ruth Soukup is aware of firsthand how irritating an unorganized life and funds may be.

By means of her account, the writer tells private tales and offers sensible motion plans to encourage the reader to make lasting modifications to private funds and objectives.

This can be an important financial savings guide for you in case you are searching for encouragement throughout an amazing or irritating time attempting to satisfy tight funds necessities. It’s aimed in direction of moms who’re attempting to juggle life’s calls for with society’s stress to maintain up with everybody else.

It’s a sensible and relatable information for ladies who need to get their lives organized however do not know the place to start out. It offers an inspiring and sensible lesson on the best way to spend cash correctly with out compromising an important life.

Whereas this guide does have a largely autobiographic really feel to it, some could discover this beneficial as a result of the writer’s private tales relate to her total message.

11. The 12 months With out a Buy by Scott Dannemiller

Takeaways:

- The 12 months With out a Buy chronicles the writer’s transformative journey of residing a minimalist life-style by abstaining from non-essential purchases for a whole 12 months, providing profound insights into consumerism, contentment, and intentional residing.

- Scott Dannemiller shares reflections on simplifying life, reevaluating priorities, and discovering success past materials possessions, offering a compelling narrative that challenges typical notions of consumption and happiness.

- The guide encourages readers to rethink their relationship with materialism and consumption, providing a thought-provoking exploration of the impression of conscious spending and the pursuit of a extra purposeful and contented existence.

- The 12 months With out a Buy serves as a supply of inspiration for people searching for to interrupt free from the cycle of consumerism, providing a compelling narrative and actionable insights on embracing simplicity and discovering pleasure past materials accumulation.

- Dannemiller’s work offers a heartfelt and introspective account of the transformative energy of intentional residing, inspiring readers to reassess their priorities, declutter their lives, and pursue a path to larger success and contentment.

The 12 months With out a Buy: One Household’s Quest to Cease Purchasing and Begin Connecting on saving cash is an account of 1 household’s quest to alter their outlook on life by stopping purchasing and beginning to join with one another.

It was written by a former missionary who served in Guatemala, and whose household discovered itself deep in a lifetime of consumption with a unending cycle of wanting extra however by no means being glad. The household made the drastic change of deciding to not buy any nonessential gadgets for an entire 12 months.

Readers could start this guide doubting that they may go a whole 12 months with out shopping for garments or books, however by way of the humorous wit and poignant conclusions from the writer, this guide helps readers see their spending in a brand new gentle.

Stuffed with fascinating analysis, the guide appears to be like at fashionable America’s spending habits, together with the authors’ personal expertise of highs and lows whereas dropping out of the buyer tradition.

The guide does an important job of showing what is really vital in life—which has nothing to do with gift-giving or maintaining with the neighbors. The household discovers and shares truths about human nature and what the key is to discovering pleasure.

This can be a precious guide for anybody who has ever wished to cut back the stress of their life by focusing much less on materials gadgets and residing extra.

12. The One Week Finances by “The Budgetnista” Tiffany Aliche

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- The One Week Finances gives a sensible and accessible information to monetary planning, offering a step-by-step method to creating and implementing a funds inside per week.

- Tiffany Aliche, often known as “The Budgetnista,” shares insights on budgeting, saving, and debt administration, providing actionable methods and instruments to empower readers to take management of their funds.

- The guide encourages readers to undertake a proactive and arranged method to cash administration, offering steering on setting monetary objectives, monitoring bills, and constructing a sustainable budgeting system.

- The One Week Finances serves as a precious useful resource for people searching for to enhance their monetary literacy and obtain larger monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the method of budgeting.

- Aliche’s work offers an accessible and empowering roadmap for people seeking to achieve management over their funds, providing a complete plan to create and implement a personalised funds in a brief timeframe.

The One Week Finances: Study to Create Your Cash Administration System in 7 Days or Much less! is a workbook for anybody who needs to handle their on a regular basis cash with out the effort of determining how it’s best spent. A enjoyable and empowering learn, it reveals readers the best way to make frugal selections whereas nonetheless residing a superb life by doing extra with much less.

This guide helps to debunk some widespread misconceptions about issues, corresponding to consolidating bank cards and paying off debt. It presents a transparent and easy system for reducing bills and maximizing financial savings to satisfy monetary objectives.

The strategies used on this budgeting guide are for individuals of any age, however the guide is geared extra in direction of younger adults who’re climbing out of debt attempting to get on their toes.

13. Tips on how to Cease Dwelling Paycheck to Paycheck (2nd Version) by Avery Breyer

Takeaways:

- Tips on how to Cease Dwelling Paycheck to Paycheck gives sensible methods for breaking the cycle of monetary shortage and reaching larger stability, offering actionable steps to construct financial savings, scale back debt, and create a safer monetary future.

- Avery Breyer shares insights on budgeting, saving, and investing, providing a complete method to managing cash and gaining management over one’s monetary scenario.

- The guide encourages readers to undertake a proactive and disciplined method to cash administration, offering steering on constructing emergency funds, growing revenue, and making knowledgeable monetary selections.

- Tips on how to Cease Dwelling Paycheck to Paycheck serves as a precious useful resource for people searching for to reinforce their monetary well-being, providing sensible recommendation and real-life examples to assist readers navigate the trail to monetary safety.

- Breyer’s work offers actionable methods and empowering insights for people seeking to break away from the paycheck-to-paycheck cycle, providing a roadmap for reaching larger monetary freedom and peace of thoughts.

This timeless bestseller gives the motivation and data that’s wanted so as to construct up a safety web of emergency money, get out of debt, and keep away from the 11 most typical however worst funds traps.

Breyer gives her readers among the most vital issues that must be finished to take management of funds and repay debt. In contrast to among the different books on saving cash that you simply discover on this submit.

Avery’s saving moneyThis guide teaches a whole funds system that’s even applicable for younger adults who’re simply getting began—and the strategies solely take quarter-hour every week to take care of.

This simple budget-planning instrument helps rework funds to get rid of monetary stress. To enhance upon the primary bestselling guide, this version provides a chapter on cash and happiness, which is among the most vital elements in relation to pointless spending.

Tips on how to Cease Dwelling Paycheck to Paycheck (2nd Version): A confirmed path to cash mastery in solely quarter-hour per week! (Sensible Cash Blueprint) may be top-of-the-line budgeting and financial savings books for you when you discover that your feelings are sometimes tied to your checking account and you’ve got began to lose management of your funds.

14. Tips on how to Handle Your Cash When You Do not Have Any (Second Version) by Erik Wecks

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Tips on how to Handle Your Cash When You Do not Have Any gives sensible and empathetic recommendation for people going through monetary hardship, offering actionable methods and instruments for taking advantage of restricted assets.

- Erik Wecks shares insights on budgeting, frugal residing, and resourcefulness, providing a compassionate and life like method to managing cash throughout difficult circumstances.

- The guide encourages readers to undertake a proactive and resilient mindset in direction of monetary administration, offering steering on prioritizing wants, discovering inventive options, and constructing a basis for future monetary stability.

- Tips on how to Handle Your Cash When You Do not Have Any serves as a precious useful resource for people searching for to navigate monetary adversity, providing sensible recommendation and real-world examples to assist readers make knowledgeable and empowering monetary selections.

- Wecks’ work offers actionable methods and compassionate insights for people seeking to handle their funds successfully regardless of restricted means, providing a roadmap for reaching larger monetary resilience and hope for the longer term.

In contrast to different cash books, Tips on how to Handle Your Cash When You Do not Have Any (Second Version) is written particularly for individuals who wrestle every month paying their payments.

It talks the reader by way of a no-nonsense have a look at the realities of as we speak’s economic system and offers a straightforward path to observe towards monetary stability.

Additionally, not like different monetary authors, Wecks hasn’t struck it wealthy. He is ready to supply a first-hand account of residing on the cash you will have throughout tough occasions. As a substitute of instructing individuals the best way to create wealth, this guide urges readers to do the most effective they’ll with the revenue they have already got, regardless of its dimension.

With jargon-free writing, this guide saving and budgeting is simple for anybody to choose up, it doesn’t matter what the monetary background. It’s opinionated, which can not resonate with all readers, but it surely additionally has its moments of humor.

It is a fast learn that’s related to readers, because it is filled with present, on a regular basis references. This is a perfect guide for the typical reader who’s simply attempting to make ends meet.

15. Dwelling a Stunning Life on Much less by Danielle Wagasky

Takeaways:

- Dwelling a Stunning Life on Much less gives sensible steering on simplifying life, managing funds, and discovering contentment, offering a holistic method to residing a extra intentional and fulfilling life.

- Danielle Wagasky shares insights on frugal residing, intentional consumption, and artistic methods to repurpose assets, providing a complete perspective on minimalist and purposeful residing.

- The guide encourages readers to reassess their spending habits and embrace simplicity, offering actionable methods for decreasing extra, minimizing waste, and aligning spending with private objectives and values.

- Dwelling a Stunning Life on Much less serves as a precious useful resource for people searching for to streamline their lives and funds, providing sensible steering and mindset shifts to domesticate a extra intentional and contented way of life.

- Wagasky’s work offers a mix of actionable methods and inspirational insights, empowering readers to make conscious selections, declutter their lives, and pursue a path to residing nicely inside their means.

Written by somebody with first-hand expertise, Dwelling a Stunning Life on Much less: The Blissful and Home Information to Meals, Enjoyable, and Funds reveals individuals the best way to dwell fortunately on a really small sum of money.

It contains life like suggestions and real-life examples to assist the reader relate to what the writer has been by way of, and be taught from her experiences.

This guide on budgeting is simple to learn, as it’s written in an informal and conversational tone. It’s a humorous guide whereas additionally being encouraging for anybody who wants assist navigating their funds and sustaining their funds.

This guide is clearly geared extra in direction of girls and moms who’re managing the budgets for his or her households. It could possibly present hope to lots of people who’re simply beginning out on their monetary journey.

16. The All the pieces Budgeting E book by Tere Stouffer

Takeaways:

- The All the pieces Budgeting E book gives a complete information to budgeting, offering sensible methods and instruments for creating and sustaining a personalised funds that aligns with particular person monetary objectives.

- Tere Stouffer shares insights on cash administration, saving, and decreasing debt, providing a step-by-step method to budgeting that empowers readers to take management of their funds.

- The guide encourages readers to undertake a proactive and arranged method to monetary planning, offering steering on monitoring bills, setting priorities, and making knowledgeable spending selections.

- The All the pieces Budgeting E book serves as a precious useful resource for people searching for to enhance their monetary literacy and obtain larger monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the method of budgeting.

- Stouffer’s work offers an accessible and empowering roadmap for people seeking to achieve management over their funds, providing a complete plan to create and keep a funds that helps long-term monetary well-being.

The All the pieces Budgeting E book: Sensible Recommendation For Saving And Managing Your Cash – From Each day Budgets To Lengthy-Time period Objectives provides a variety of sensible budgeting do’s and don’ts. It does dwell as much as its promise of overlaying every part about budgeting from cradle to grave.

Nevertheless, the guide was written over 5 years in the past and the age has begun to indicate a little bit bit. There’s nonetheless a ton of excellent data right here, just a few that’s dated. If you already know little about budgeting this may very well be an important guide for you.

This guide provides step-by-step directions on the best way to deal with an important features of private finance. Akin to: Tips on how to spend much less cash. Methods to lower your widespread bills.

Tips on how to maintain you funds so as. The significance of planning for the surprising. Setting monetary objectives. And naturally making a funds.

17. The Latte Issue by David Bach and John David Mann

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- The Latte Issue emphasizes the facility of small each day selections in reaching monetary freedom, providing a compelling narrative that explores the impression of incremental modifications on long-term wealth-building.

- David Bach and John David Mann share insights on budgeting, saving, and investing, presenting a relatable and actionable method to monetary administration that resonates with readers at any revenue degree.

- The guide encourages readers to reassess their spending habits and embrace the idea of paying oneself first, offering steering on prioritizing monetary objectives and making intentional selections to construct wealth over time.

- The Latte Issue serves as a precious useful resource for people searching for to remodel their relationship with cash, providing sensible recommendation and mindset shifts to domesticate a extra intentional and affluent monetary future.

- Bach and Mann’s work offers a mix of relatable anecdotes and actionable methods, empowering readers to make knowledgeable monetary selections and harness the potential of small modifications to create a safer and fulfilling monetary life.

In The Latte Issue: Why You Do not Need to Be Wealthy to Stay Wealthy, Bach and his co-author cowl the three secrets and techniques to monetary freedom.

They do that by telling a parable of a younger barista struggling to make ends meet as she is drowning in a sea of debt. Because the story evolves she discovers the secrets and techniques of wealth and learns the few modifications she will make to safe her monetary future and dwell a greater life.

I like books like this that mix leisure and sensible data into an pleasant guide. Primarily based on Bach’s different books I’m positive that this shall be an entertaining and academic guide. Discover out extra within the hyperlink(s) under.

18. Your Cash or Your Life by Vicki Robin and Joe Dominguez

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Your Cash or Your Life: 9 Steps to Reworking Your Relationship with Cash and Attaining Monetary Independence (Totally Revised and Up to date) presents a transformative method to private finance, providing a complete information to reaching monetary independence and redefining the connection with cash.

- Vicki Robin and Joe Dominguez share insights on frugality, conscious consumption, and the idea of “sufficient,” offering a roadmap for aligning spending with private values and long-term success.

- The guide encourages readers to reassess their monetary priorities and embrace the idea of time as a precious useful resource, providing actionable steps to realize larger monetary autonomy and a extra significant life.

- Your Cash or Your Life serves as a precious useful resource for people searching for to realize management over their funds, providing sensible recommendation and mindset shifts to domesticate a extra intentional and purposeful method to cash administration.

- Robin and Dominguez’s work offers a mix of thought-provoking philosophy and actionable methods, empowering readers to make acutely aware selections, obtain monetary independence, and dwell a extra fulfilling and sustainable life.

19. Broke Millennial by Erin Lowry

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Broke Millennial: Cease Scraping By and Get Your Monetary Life Collectively gives sensible monetary recommendation tailor-made to the millennial technology, offering actionable methods for budgeting, saving, and investing in a relatable and accessible method.

- Erin Lowry shares insights on managing debt, navigating monetary independence, and constructing a robust monetary basis, providing a complete information to empower younger adults to take management of their cash.

- The guide encourages readers to confront monetary challenges head-on, offering steering on speaking about cash, setting life like objectives, and making knowledgeable monetary selections.

- Broke Millennial serves as a precious useful resource for younger adults searching for to reinforce their monetary literacy and obtain larger monetary stability, providing relatable recommendation and real-world examples to assist readers navigate the complexities of private finance.

- Lowry’s work offers a mix of sensible methods and empathetic insights, empowering readers to beat monetary obstacles, construct confidence, and lay the groundwork for a safe monetary future.

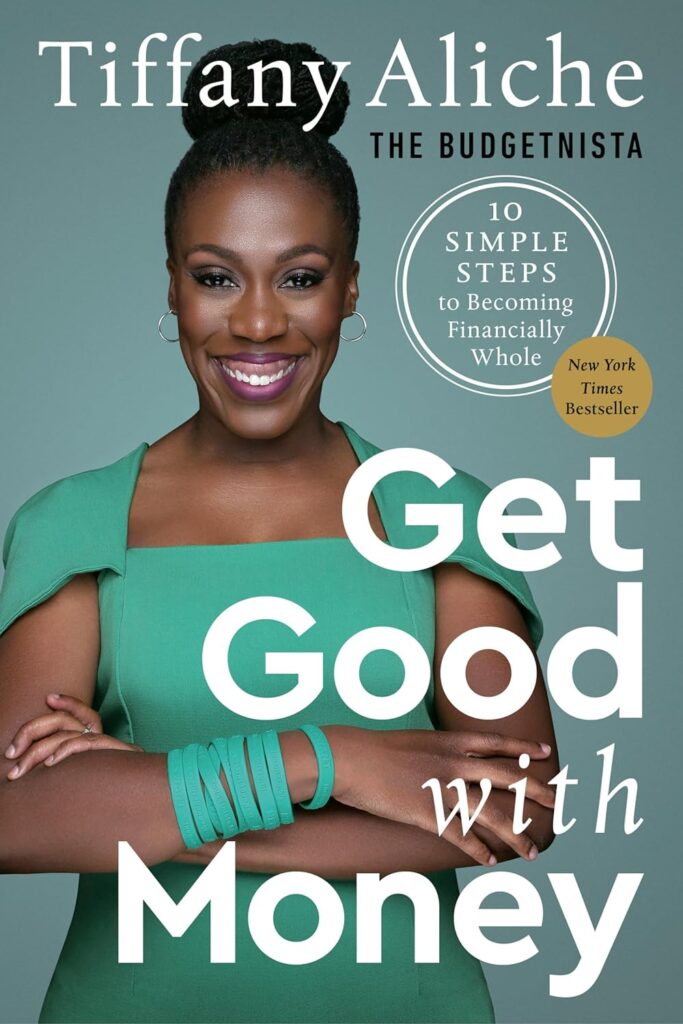

20. Get Good with Cash by “The Budgetnista” Tiffany Aliche

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- Get Good with Cash: Ten Easy Steps to Turning into Financially offers sensible and empowering monetary recommendation, providing actionable methods for budgeting, saving, and constructing wealth in a relatable and accessible method.

- Tiffany Aliche, often known as “The Budgetnista,” shares insights on overcoming monetary obstacles, cultivating a constructive cash mindset, and reaching monetary wellness, offering a complete information to empower readers to take management of their funds.

- The guide encourages readers to confront their monetary fears and misconceptions, providing steering on setting achievable monetary objectives, managing debt, and making a sustainable monetary plan.

- Get Good with Cash serves as a precious useful resource for people searching for to reinforce their monetary literacy and obtain larger monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the complexities of private finance.

- Aliche’s work offers a mix of sensible methods and motivational insights, empowering readers to remodel their relationship with cash, construct long-term wealth, and attain monetary freedom.

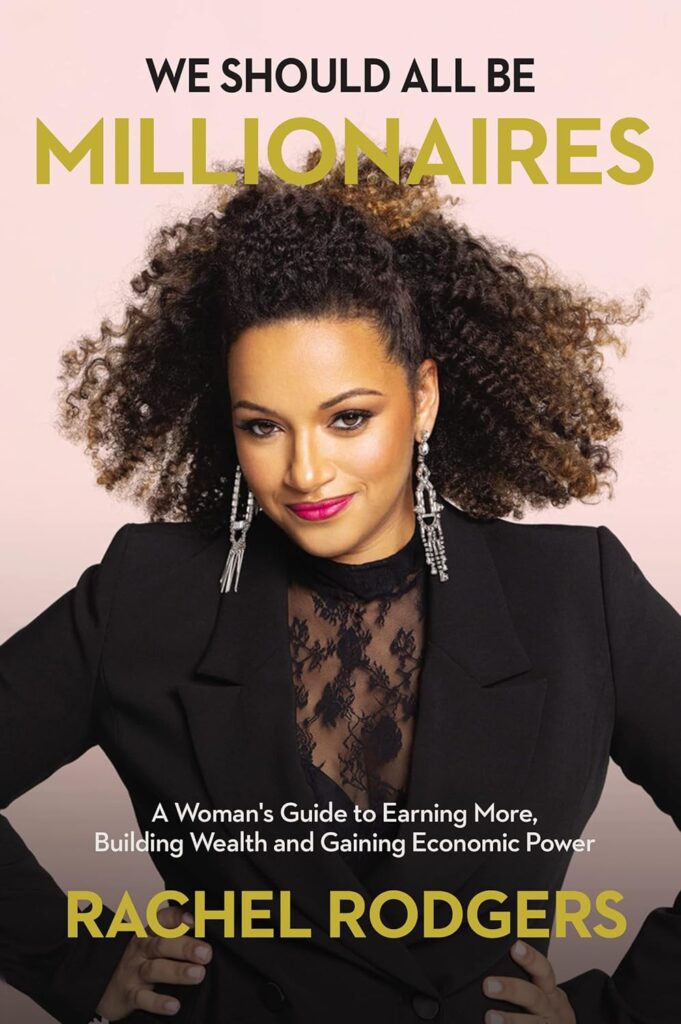

21. We Ought to All Be Millionaires by Rachel Rodgers

Verify eBook Worth | Verify Audiobook Worth

Takeaways:

- We Ought to All Be Millionaires: A Girl’s Information to Incomes Extra, Constructing Wealth, and Gaining Financial Energy challenges conventional monetary narratives and gives a contemporary perspective on wealth-building, notably for ladies and marginalized communities, emphasizing the significance of monetary empowerment and abundance.

- Rachel Rodgers shares insights on entrepreneurship, wealth creation, and overcoming societal obstacles, offering a roadmap for people to redefine their relationship with cash and obtain monetary success on their very own phrases.

- The guide encourages readers to embrace their value and worth, providing steering on wealth mindset, strategic incomes, and leveraging assets to create a lifetime of abundance and impression.

- We Ought to All Be Millionaires serves as a name to motion for people to step into their monetary energy, providing sensible recommendation and actionable steps to interrupt by way of limiting beliefs and construct sustainable wealth.

- Rodgers’ work offers a mix of motivational steering and actionable methods, empowering readers to problem the established order, construct wealth, and create a extra equitable and affluent future for themselves and their communities.

Ultimate Ideas on Books on Budgeting

I hope you loved this listing of the 21 finest books on budgeting, saving cash, frugal residing. Hopefully, these books will provide help to cease residing paycheck to paycheck and provide help to climb out of debt.

I see these books as a sensible means that can assist you heed the recommendation from lots of the finest monetary books for newcomers. You could even discover one among these books to be full sufficient that it’s the solely budgeting guide you will ever want.

Should you loved this listing, why not take a look at some extra nice associated lists of nice books. We’ve the principle “web page” of OVER 250 self assist/private improvement books. This principal web page has hyperlinks to many smaller guide lists (similar to this one)

In case you are generally investing, chances are you’ll have an interest within the finest investing books of all time. It is a assortment 16 books “must-read” books, funding books that ought to, frankly, be required studying for any aspiring investor earlier than they make any strikes with investing their very own cash.

In case you are struggling to satisfy your everyday residing bills. Actual property funding could look like a dream out of your far, far future. But it surely might not be so far as you assume.

A number of the 16 books under inform you the best way to begin creating an revenue from actual property funding with little upfront cash of your personal. Books on budgeting, financial savings and getting debt free ought to be first, however actual property funding books could also be subsequent on you listing.

And when you’re searching for extra assets on books to learn, make sure you take a look at these weblog posts:

[ad_2]