[ad_1]

The Elusive American Dream: A Dwelling of One’s Personal

For a lot of, the American dream of homeownership appears more and more out of attain, thwarted by skyrocketing dwelling costs, rising rates of interest, and ongoing inflation. Proudly owning a house has lengthy been a key to constructing wealth within the U.S., with main residences constituting over 1 / 4 of U.S. family belongings in 2022.

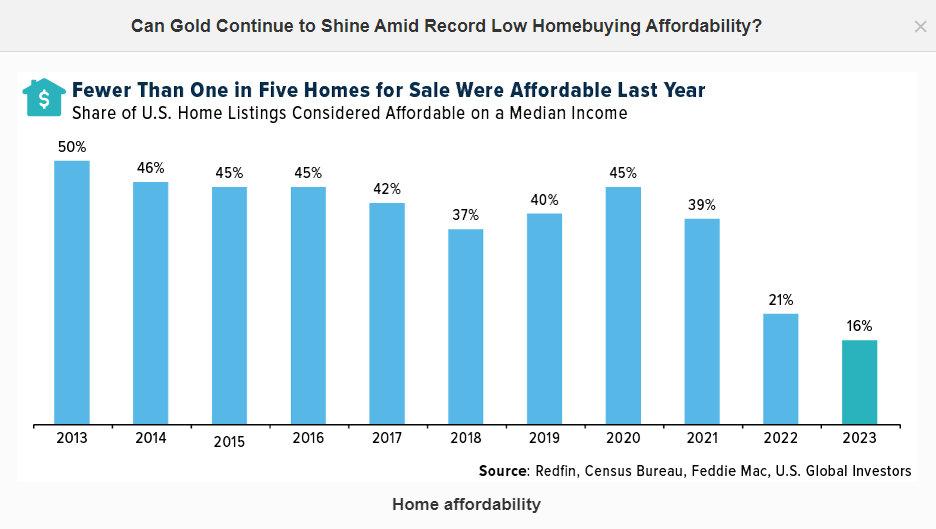

Nonetheless, a Redfin evaluation reveals a regarding pattern: solely 16% of properties available on the market in 2023 had been reasonably priced to the common American family, a document low. It is a sharp decline from 21% in 2022 and a dramatic fall from the pre-pandemic period.

Challenges to Homeownership

A big majority of renters, 81%, harbor aspirations of homeownership, but 61% worry this dream could by no means materialize, per a Harris Ballot survey. Amongst them, 57% declare the American dream of homeownership as successfully extinct, a sentiment much less generally shared by present householders.

Rising Mortgage Charges and the Housing Provide Dilemma

Mortgage charges, although barely off their peak, stay excessive, including roughly $250 to month-to-month dwelling funds in comparison with final 12 months. This hike has discouraged many from promoting, fearing lack of low-rate advantages, thus exacerbating the housing provide scarcity.

Financial Uncertainties and the Prospect of Fee Cuts

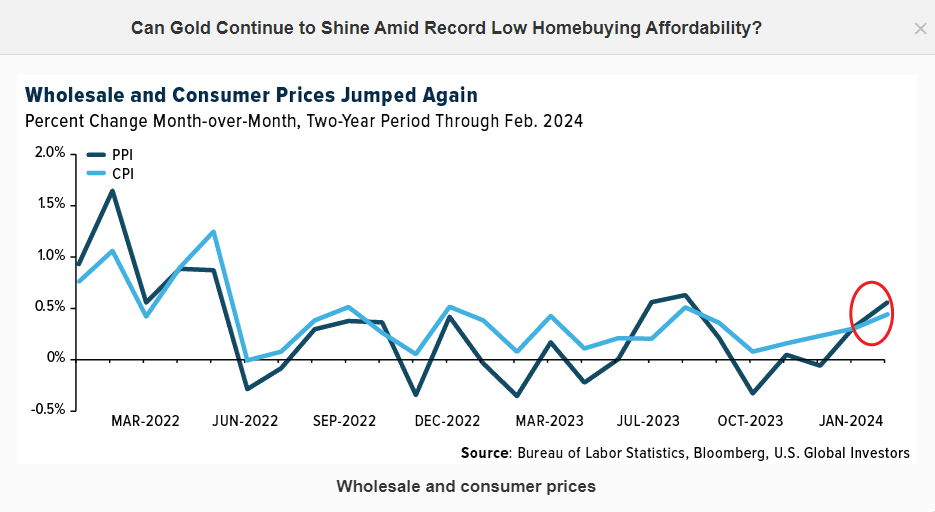

Current financial knowledge, together with a stunning uptick within the producer value index (PPI) and shopper value index (CPI), complicates the Federal Reserve’s path, probably delaying hoped-for price cuts. Regardless of these challenges, monetary analysts from UBS and RBC anticipate price reductions presumably beginning in June, although Janet Yellen warns in opposition to anticipating pre-pandemic price ranges.

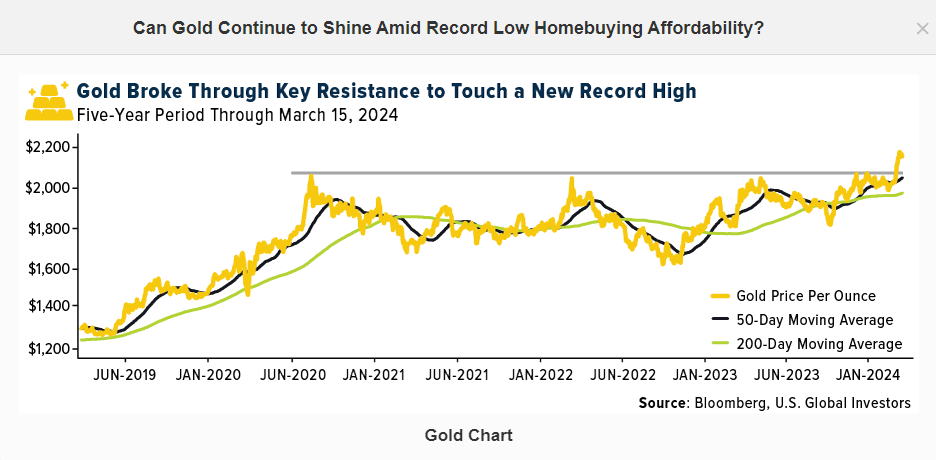

Gold’s Rally Amid Financial Flux

Amidst financial and financial uncertainties, gold has surged to a document excessive of $2,195 per ounce, buoyed by investor optimism for price cuts and a declining U.S. greenback. The valuable metallic’s efficiency, supported by central financial institution demand and ETF curiosity, questions the enchantment of conventional interest-bearing belongings.

Regardless of the strong efficiency of the U.S. inventory market and prevailing rates of interest, gold’s attract stays, probably poised for additional positive aspects amidst geopolitical tensions and financial challenges.

Remaining Ideas

Whereas previous efficiency is just not indicative of future outcomes, gold’s resilience within the face of financial headwinds and its potential for additional appreciation provide traders a hopeful prospect amidst the challenges of immediately’s monetary panorama.

Disclaimer: The views and knowledge shared are topic to alter and will not go well with all traders. The hyperlinks offered result in third-party websites; U.S. International Buyers doesn’t endorse their content material.

The submit Will Gold’s Luster Persist Amid Homebuying Affordability Disaster? appeared first on Dumb Little Man.

[ad_2]