[ad_1]

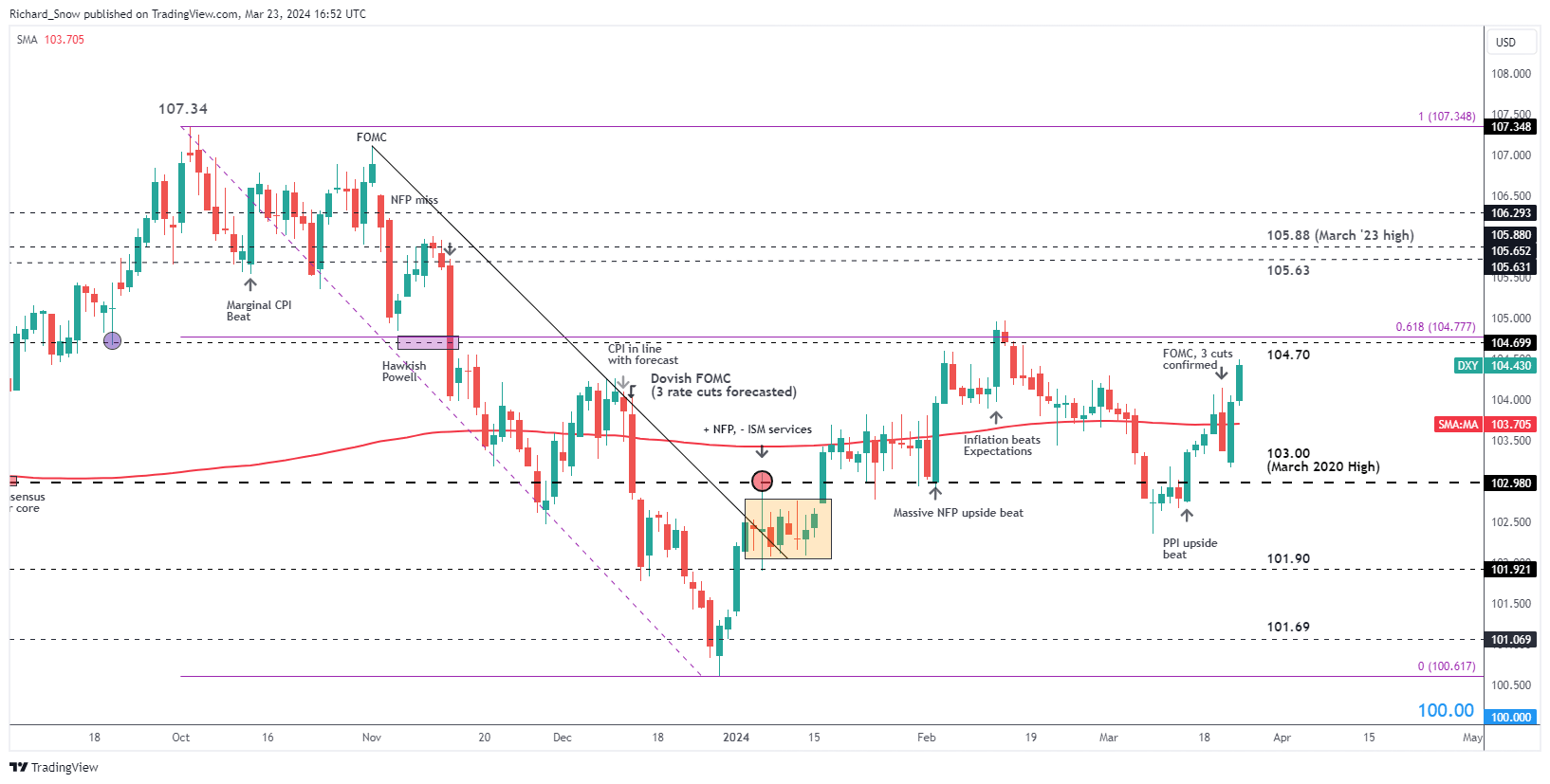

US Greenback Index (DXY) Overview

The US Greenback Index (DXY), a key indicator of the US greenback’s efficiency, has demonstrated a powerful begin to the yr. This rise in energy is attributed to strong financial information that led to a revision of beforehand anticipated aggressive price cuts. Even with the Federal Reserve conveying a extra cautious tone and sticking to its forecast of three price cuts in 2024, the index skilled a surge in March.

Presently, the index is buying and selling above its 200-day easy transferring common, reaching in the direction of 104.70, and can also be navigating close to the 61.8% Fibonacci retracement degree of its late 2023 downturn.

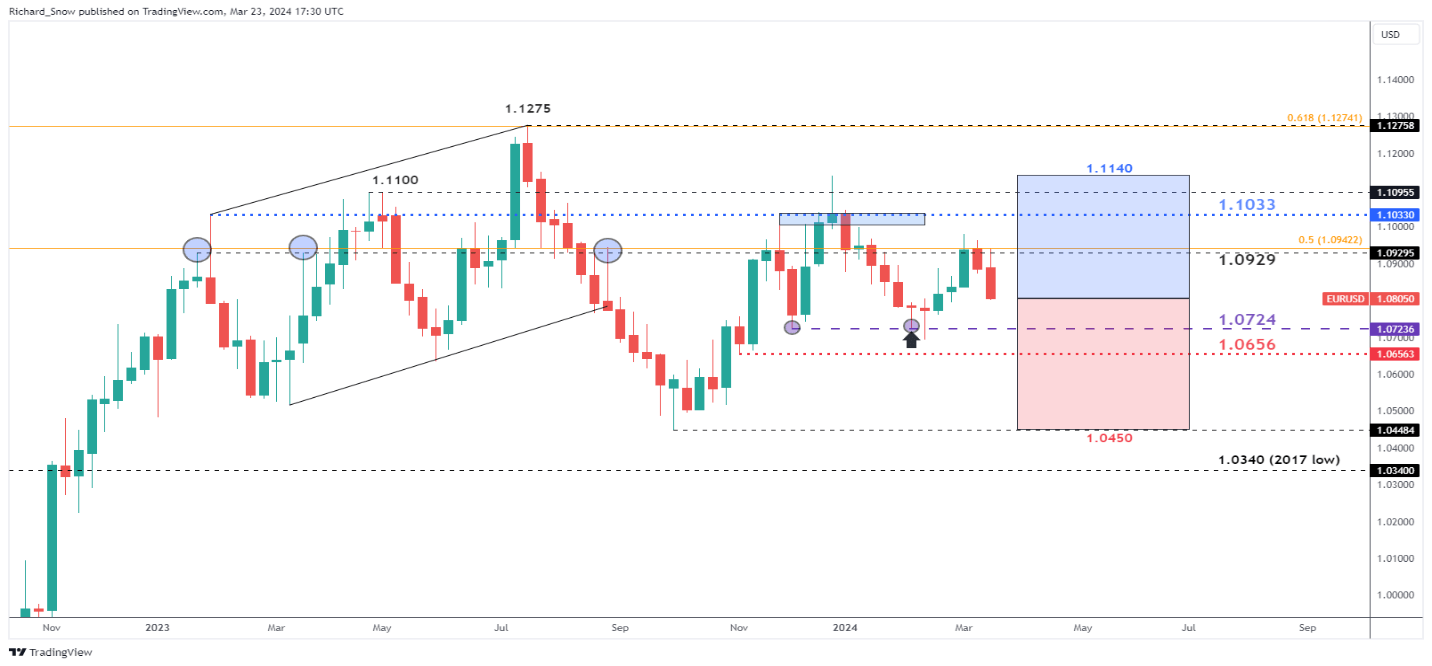

EUR/USD Evaluation

In Q1, EUR/USD noticed a decline, additional highlighting the diverging financial trajectories between the EU and the US. The US greenback’s advantageous rate of interest differential has made it extra interesting, particularly in occasions of low market volatility, as buyers favor investing in currencies with greater yields. Though this pattern is extra pronounced within the USD/JPY pair, it equally impacts the Euro’s attractiveness.

The pair confronted resistance at 1.1033 and 1.1140, ultimately dropping to seek out help at 1.0724. Regardless of a quick rally try by the Euro, it did not problem the yearly highs, trending decrease because the quarter concluded.

For Q2, the 1.0724 mark is essential for EUR/USD because it might set off additional declines. The depicted crimson and blue squares illustrate a possible buying and selling vary, contemplating the previous quarter’s common actions. With a downward bias for the Euro and a bullish outlook for the greenback, the preliminary goal is ready at 1.0656, with 1.0450 marking a big downturn degree.

The unsure central financial institution price minimize timeline means that foreign exchange actions is perhaps nonlinear. Due to this fact, potential upward targets are recognized at 1.0929 and 1.1033, with actions past 1.1100 in the direction of 1.1140 doubtlessly altering the bearish view for the quarter.

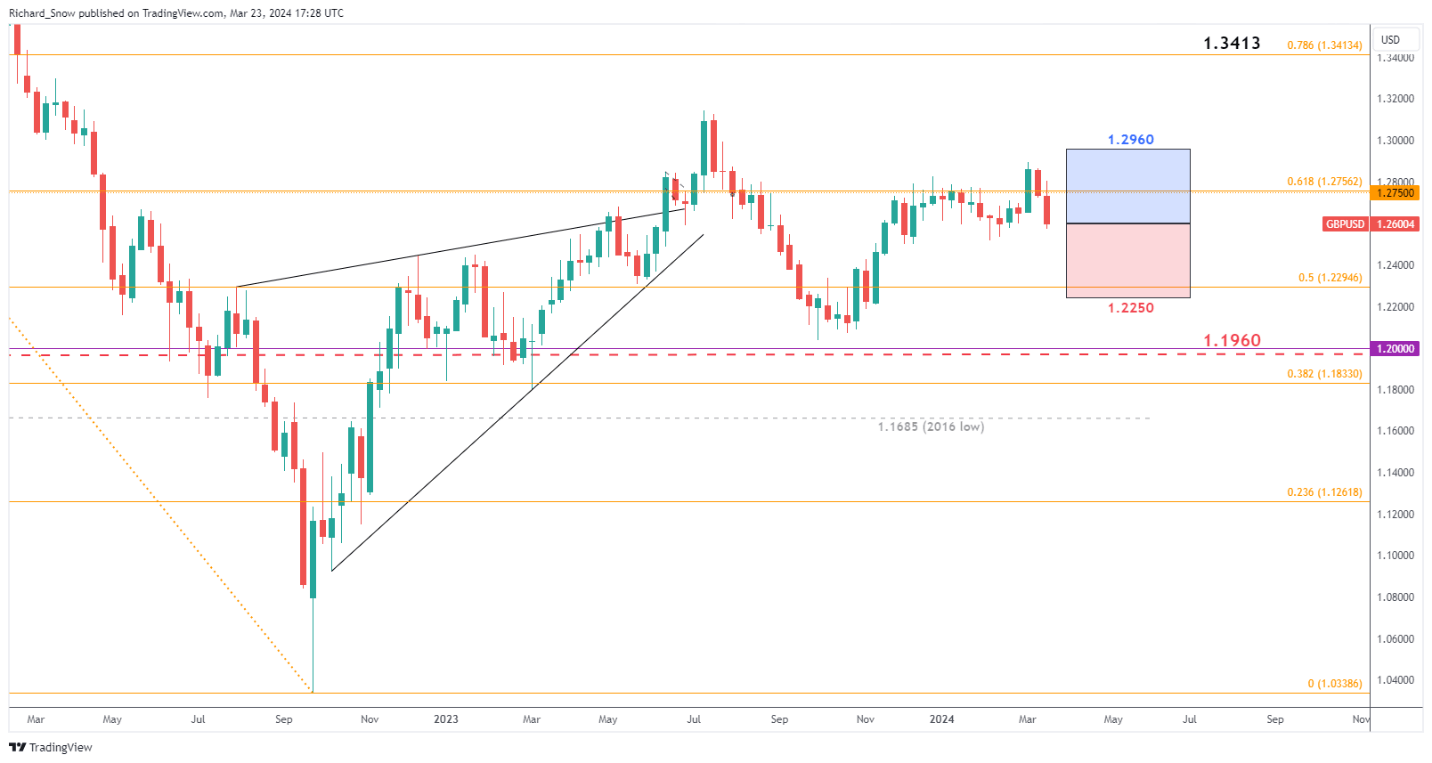

GBP/USD Insights

GBP/USD stands out for its resilience towards the US greenback, with minimal losses in Q1, regardless of market fluctuations. The Financial institution of England’s cautious strategy to rate of interest reductions, amidst excessive inflation, has lent help to the Sterling. Nonetheless, with inflation expectations to normalize mid-year, the foreign money’s outlook might align extra intently with broader market developments.

The foreign money pair has maintained its energy towards the sturdy greenback, with the BoE’s price mirroring the decrease spectrum of the Fed’s vary. The depicted chart outlines potential motion instructions primarily based on latest developments.

On the draw back, the preliminary problem is on the 1.2520 mark, with additional declines doubtlessly resulting in 1.2250. Forward of this, the 1.2295 degree represents a big midpoint of previous actions.

Conversely, an increase above the 61.8% Fibonacci retracement at 1.2756 after which 1.2960 might problem the bearish GBP/USD outlook.

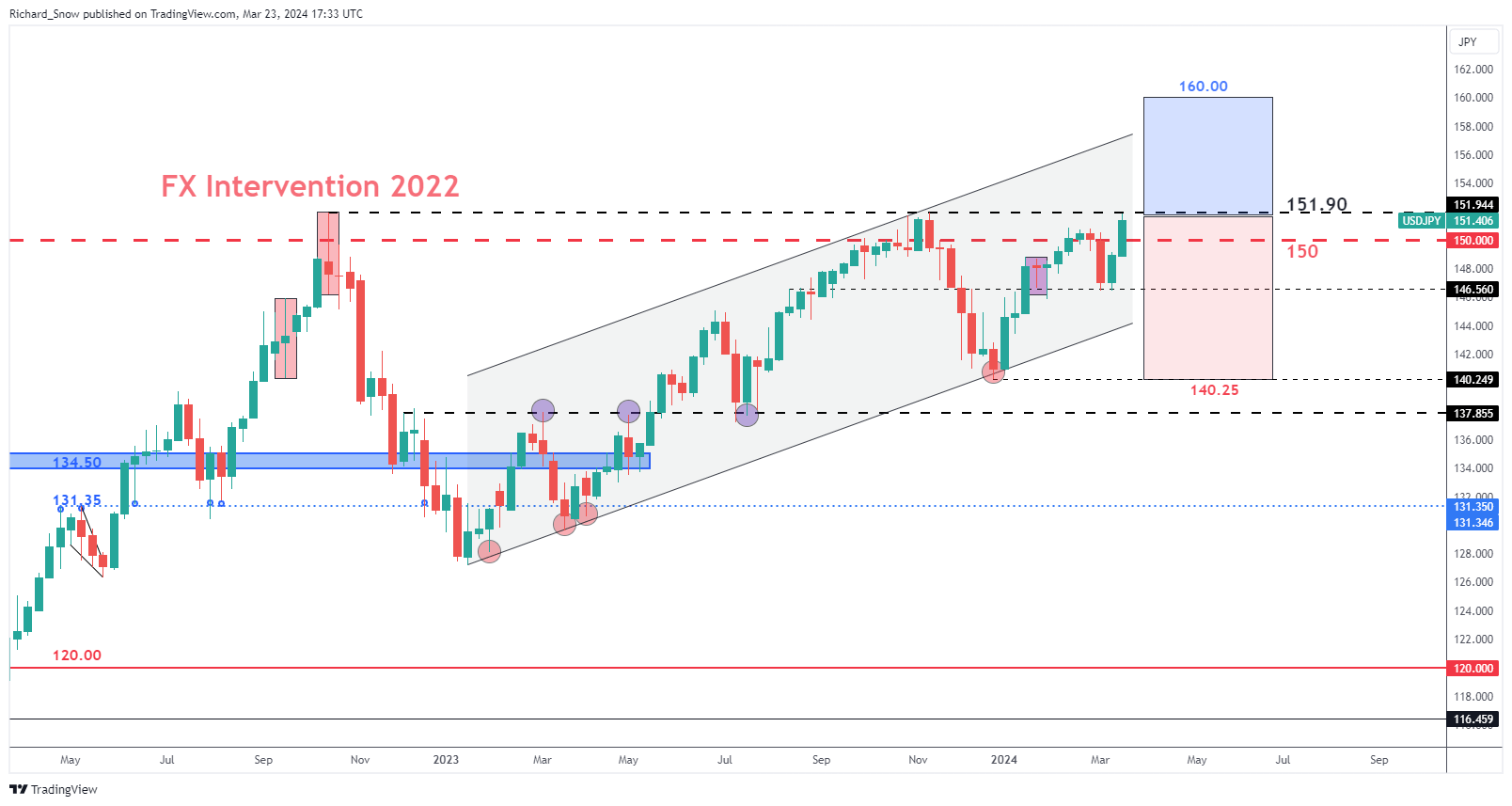

USD/JPY Overview

USD/JPY captured consideration in Q1, primarily because of the Financial institution of Japan’s pivotal shift away from damaging rates of interest in response to inflation and wage development. This determination, nonetheless, didn’t favor the yen, contributing to its continued devaluation.

With challenges each domestically and internationally, additional price hikes by the Financial institution are constrained, making a reversal within the carry commerce pattern much less possible.

The USD/JPY pair is very unstable across the 150.00 mark, the place governmental disapproval might mood bullish momentum. Therefore, buying and selling above this degree is deemed extremely speculative. Based mostly on previous quarter developments, whereas a climb to 160.00 is theoretically attainable, every increment above 150.00 turns into more and more unsure.

In Q2, with out intervention from Japan, the USD/JPY is prone to oscillate between 146.56 and 152.00. Hypothesis about extra Financial institution of Japan price hikes later within the yr stays speculative and past the scope of this evaluation.

[ad_2]