[ad_1]

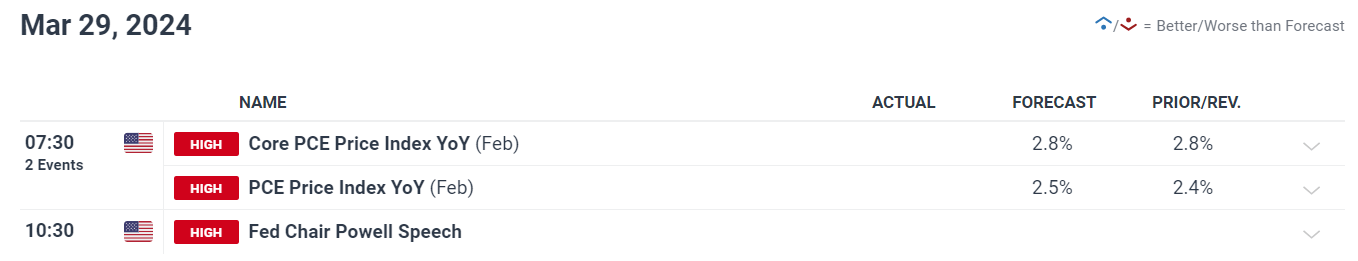

The US greenback skilled a minor decline on Monday, although the drop was minimal, probably restrained by an increase in U.S. Treasury yields. Buyers took income following the greenback’s sturdy efficiency the earlier week. Moreover, many selected to not take important positions forward of anticipated main occasions such because the core PCE knowledge launch and a speech by Powell on Friday.

Transitioning from basic to technical evaluation, this piece delves into the sentiment and value actions for 3 key greenback foreign money pairs: EUR/USD, GBP/USD, and USD/JPY. We are going to spotlight essential assist and resistance ranges essential for danger administration in place constructing.

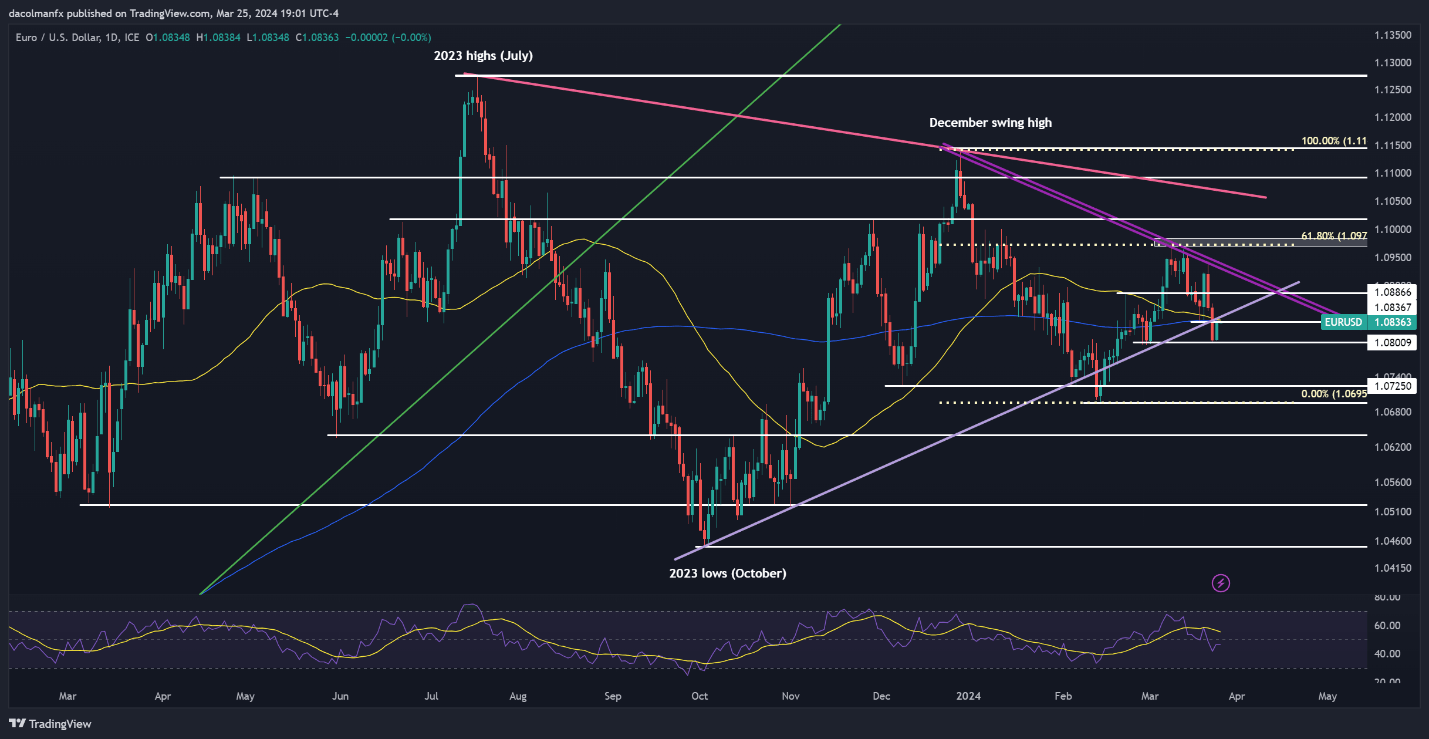

EUR/USD Technical Evaluation

EUR/USD noticed an uptick on Monday, bouncing again from assist close to the 1.0800 mark, with the value nearing a resistance confluence at 1.0835-1.0850. Bulls should steadfastly defend this zone to keep away from a possible push in the direction of 1.0890 after which 1.0925.

Ought to sellers take over, inflicting a downturn, assist is once more discovered at 1.0800. Holding this stage is important to avert a drop within the euro, with a possible decline extending in the direction of 1.0725 if breached.

For these eager on predicting the pound’s subsequent important motion, entry our quarterly forecast for detailed market insights. Safe your free information right this moment for complete market pattern evaluation!

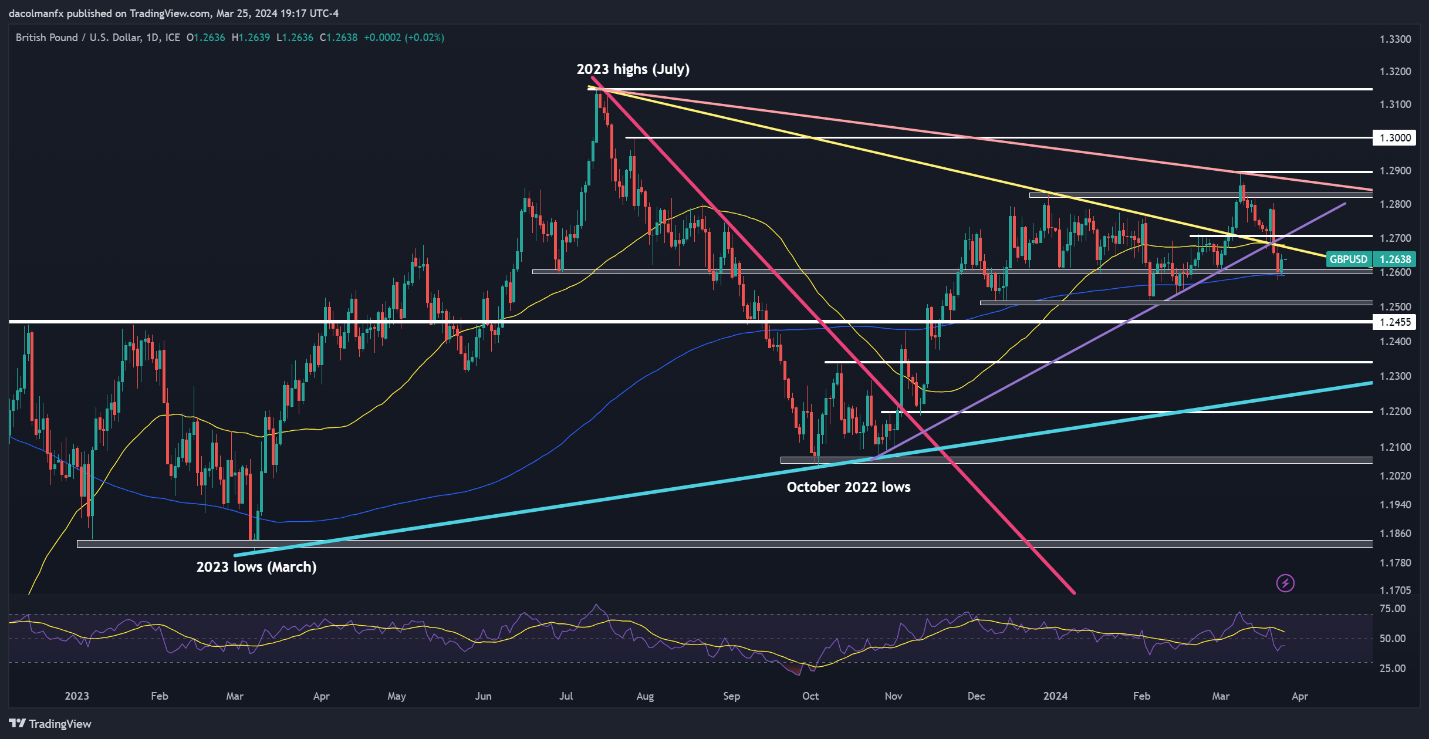

GBP/USD Technical Evaluation

GBP/USD stabilized on Monday after a pointy decline the earlier week, with the pair recovering floor after hitting assist on the 200-day SMA close to 1.2600. If the rebound strengthens, it faces resistance at 1.2675, 1.2700, and eventually 1.2830.

Conversely, if sellers regain the higher hand, pushing the speed down, the 1.2600 stage serves as essential assist. Falling beneath this might rapidly result in additional declines, concentrating on 1.2510.

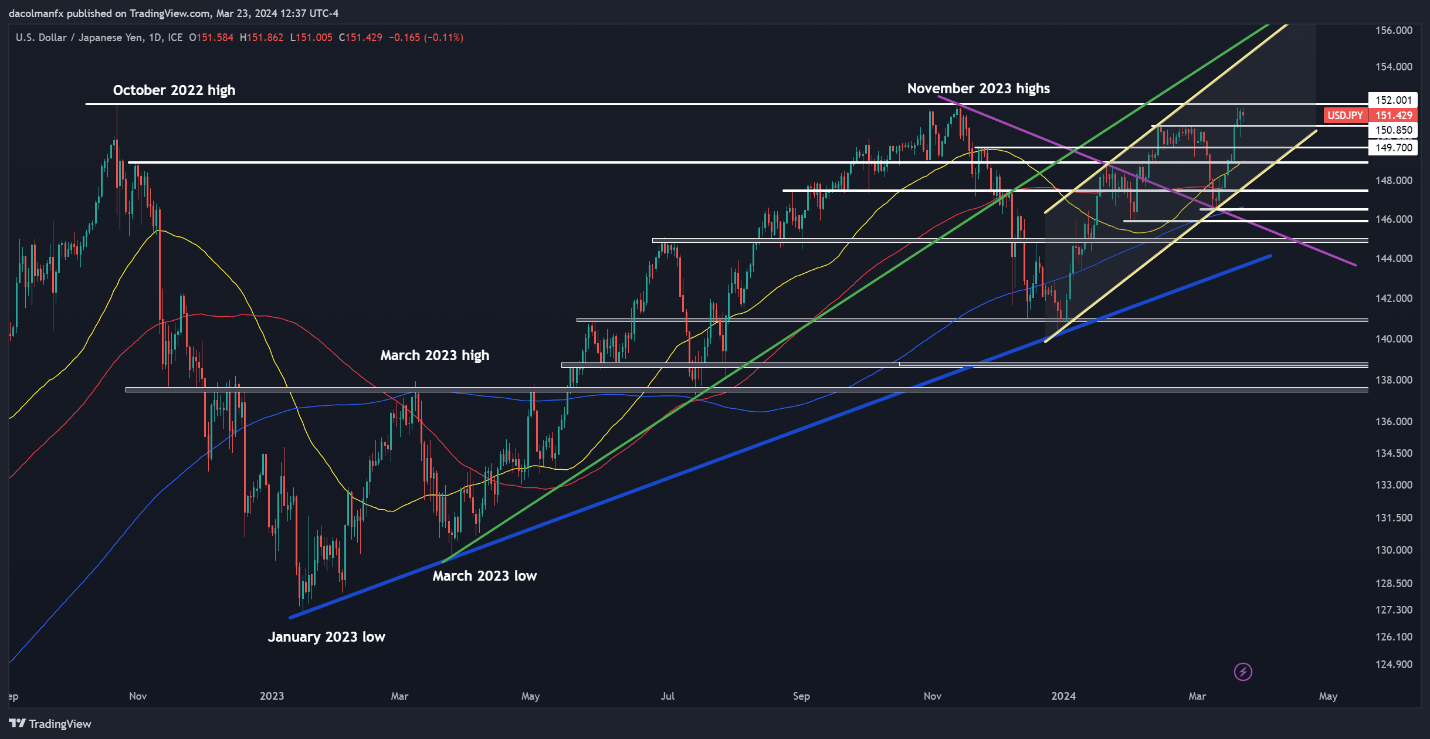

USD/JPY Technical Evaluation

USD/JPY remained directionless on Monday, stabilizing slightly below the height of the earlier 12 months at 152.00. Surpassing this stage would possibly set off interventions by Japanese authorities to assist the yen, doubtlessly capping the rally. Within the absence of intervention, shifting past 152.00 might result in a climb in the direction of 154.40.

If the momentum shifts to bears, resulting in a downturn, assist is discovered at 150.90 and 149.75. A retreat to those ranges might precede stability, whereas an extra drop would possibly head in the direction of the 50-day easy shifting common at 148.90.

The submit US Greenback Market Evaluation: Insights on EUR/USD and GBP/USD Restoration, USD/JPY Stability appeared first on Dumb Little Man.

[ad_2]