[ad_1]

Inflation Knowledge Surprises, Greenback Strengthens

The US greenback rallied considerably, reaching its highest stage towards the Japanese yen since 1990, fueled by shock inflation knowledge.

The March Shopper Worth Index (CPI) confirmed a extended inflationary pattern in the US, propelling the USD/JPY pair to recent 2024 highs. This improvement casts doubt on the Federal Reserve’s deliberate fee lower in June.

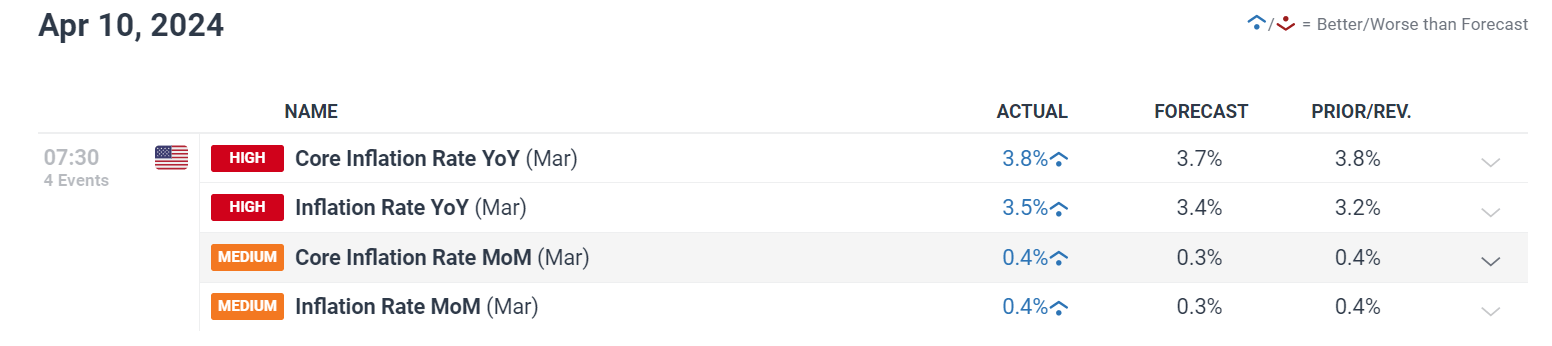

Headline CPI grew 3.5% yr on yr, exceeding estimates and the prior month’s 3.2%. The core CPI, which excludes risky items reminiscent of meals and power, additionally topped expectations at 3.8%, implying a rebound in pricing pressures.

Market Response and Federal Reserve’s Stance

The market responded shortly, with US Treasury yields rising throughout the board. This means elevated hypothesis that the Federal Reserve will hold financial coverage tighter for longer than anticipated.

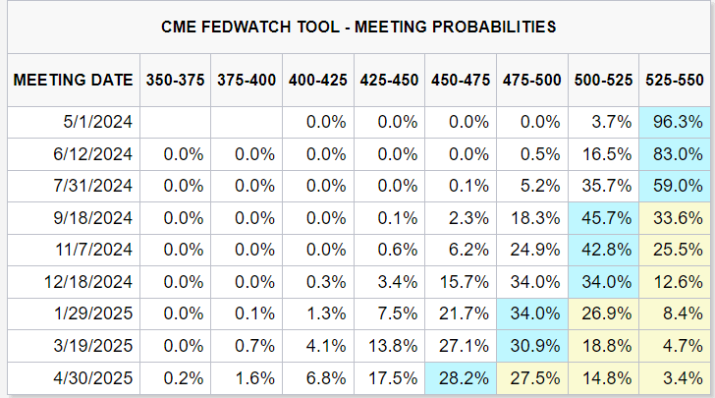

Moreover, the timetable and extent of future fee cuts have been delayed as merchants modified their FOMC expectations. Nevertheless, futures contracts have relaxed by lower than 40 foundation factors for a yr, with the primary decline coming in September.

The desk beneath exhibits assembly prospects.

Because of this, futures contracts count on much less easing this yr, with the first-rate lower doable in September.

Fed Chairman Powell had beforehand performed down inflation considerations. Nevertheless, the latest spate of higher-than-expected CPI statistics could lead to a extra hawkish Federal Reserve shortly, maybe strengthening the greenback much more.

USD/JPY Technical Outlook

The USD/JPY pair broke previous the 152.00 barrier stage, indicating extra advances. Nevertheless, the prospect of Japanese intervention to assist the yen lurks, significantly because the foreign money approaches historic lows.

Technical evaluation implies that if the yen’s drop will not be addressed, speculators could goal 155.70 subsequent.

In distinction, a decline beneath 152.00 would possibly discover assist at 150.90, with an additional drop probably resulting in a retest of the 50-day easy shifting common at 150.00.

The greenback’s surge was felt throughout all main currencies, with notable swings within the greenback index and versus the euro.

The market is on the lookout for any indicators of intervention from Japanese officers, which have engaged within the foreign money market a number of instances lately to strengthen the yen.

With US rates of interest rising and Japan’s holding round zero, the yen has been persistently beneath strain, prompting buyers to hunt higher returns within the greenback.

Given the yen’s quick decline, hypothesis a couple of doable Japanese intervention has grown.

Closing Ideas

The shock surge in US inflation has had a massive affect on foreign money markets, pushing the US greenback to a 34-year excessive towards the yen. Whereas this illustrates widespread greenback energy, it additionally raises considerations about sustained inflationary pressures within the US.

Market buyers will carefully watch the Federal Reserve’s response to those occasions, in addition to the opportunity of Japanese intervention in assist of the yen.

As merchants negotiate this risky panorama, the stability between US financial coverage and Japanese financial insurance policies might be important in predicting future foreign money strikes.

[ad_2]