[ad_1]

Market Outlook

Silver’s newest rally, which culminated in a bullish breakout above final week’s excessive, factors to further will increase. Nevertheless, warning is suggested as resistance and assist ranges come into play inside the present bullish pattern.

The current enhance in silver costs, adopted by a return to assist close to the 38.2% Fibonacci retracement and the 20-day transferring common, highlights the market’s volatility.

Regardless of Monday’s surge initiating a bullish weekly breakout, resistance was met round $25.39 earlier than a retracement. The worth exercise signifies a impartial stance, with silver anticipated to complete considerably weak for the day.

Key Value Ranges and Targets

Silver’s 15.7% rally over the past 16 days suggests recent market curiosity, albeit with resistance close to the $25.78 peak.

Surpassing the main resistance stage at $26.14 would affirm the growing uptrend and pave the door for larger targets starting at $26.95. An ascending ABCD sample factors to a longer-term goal of $27.15, indicating potential additional beneficial properties.

Warning Amidst Bullish Sentiment

Regardless of the bullish outlook, silver needs to be approached with warning till it crosses the swing excessive of $25.78.

Decrease Fibonacci retracement ranges and essential transferring averages might assist a retracement. Monitoring worth exercise beneath the $24.33 swing low will present details about the market’s trajectory.

US Financial Resilience and Impression on Silver

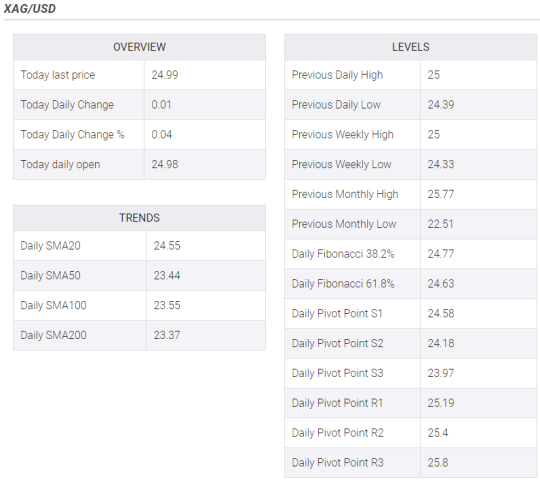

The XAG/USD pair’s impartial buying and selling close to $24.98 highlights market concern following sturdy US financial knowledge.

Constructive indicators from the Institute for Provide Administration (ISM) report and the Manufacturing Buying Managers’ Index (PMI) level to financial power, which reduces the potential of the Federal Reserve easing.

This sentiment has fueled hawkish bets and prompted a rise in US Treasury yields, impacting silver costs.

Anticipated Labor Market Knowledge

Upcoming US labor market statistics, reminiscent of Nonfarm Payrolls and Common Hourly Earnings, are extensively monitored for clues about financial well being and coverage course.

These knowledge items will affect market expectations and investor sentiment within the following days.

Technical Evaluation

On the each day chart, the XAG/USD’s Relative Power Index (RSI) exhibits purchaser dominance, indicating that upward momentum will proceed.

Nevertheless, the Shifting Common Convergence Divergence (MACD) signifies some modest bearish stress. The pair maintains above main Easy Shifting Averages (SMA), indicating sturdy rising momentum over longer intervals.

The submit Silver Value Evaluation: Weekly Breakout Amidst Impartial Stance appeared first on Dumb Little Man.

[ad_2]