[ad_1]

Samsung Outperforms Apple in World Smartphone Market

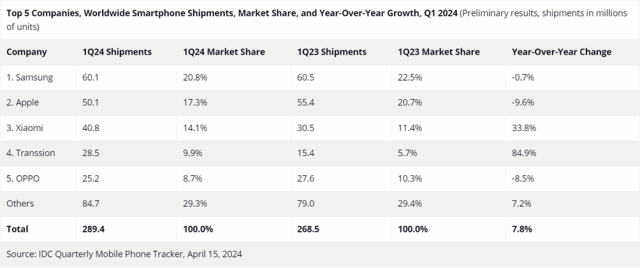

In Q1 2024, Samsung Electronics (KS:005930) took the lead over Apple (NASDAQ:AAPL) to change into the world’s high smartphone vendor, as reported by IDC. Apple’s iPhone shipments declined almost 10% year-on-year.

Regardless of a 7.8% development in international smartphone shipments, totaling 289.4 million models, Samsung surged forward with 60.1 million models bought, capturing a 20.8% market share. In distinction, Apple bought 50.1 million iPhones, holding a 17.3% market share.

Chinese language manufacturers like Xiaomi and Huawei additionally noticed will increase, with Xiaomi securing the third spot with a 14.1% market share.

Samsung Beneficial properties from U.S. Chips Act

The U.S. Division of Commerce just lately introduced that below the Biden administration’s Chips and Science Act of 2022, Samsung would obtain as much as $6.4 billion to increase its semiconductor manufacturing in Texas. This initiative goals to bolster U.S. chip manufacturing and cut back dependence on Asian suppliers.

Samsung is anticipated to speculate about $45 billion in its Texas amenities by 2030, which ought to improve job creation and financial development within the U.S., whereas additionally boosting Samsung’s semiconductor section.

In early April, Samsung projected a major improve in its first-quarter working revenue for 2024, anticipating an increase of 931.3% to 6.6 trillion received ($4.77 billion), pushed by excessive demand and rising chip costs.

Samsung’s Inventory Efficiency Signifies Market Confidence

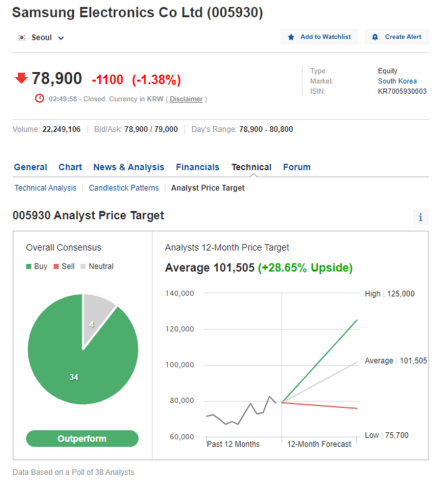

Samsung’s inventory has proven exceptional resilience, with a notable 11% improve from its January low, in distinction to Apple’s 15% fall since December. Over the past 12 months, Samsung’s market worth on the Korean Inventory Alternate has grown by 21.44%, reaching about $385 billion.

Analysts are optimistic, predicting a 28.65% rise in Samsung’s inventory value over the following 12 months, with a median goal value of 101,505 Korean received per share ($73.40).

Upcoming Monetary Report back to Shed Gentle on Samsung’s Prospects

On April 30, Samsung will disclose its Q1 2024 monetary outcomes. Traders are eager to see if Samsung can maintain its inventory market momentum following its management in smartphone gross sales and whether or not the chip sector’s development will additional propel its inventory worth.

[ad_2]