[ad_1]

In the course of the first quarter of 2024, there was a noticeable enchancment in company sentiment, suggesting that corporations are feeling extra constructive in regards to the future in comparison with the earlier 12 months.

This shift in the direction of positivity is demonstrated by important will increase in share repurchases and dividend payouts, that are essential ways for delivering worth to shareholders.

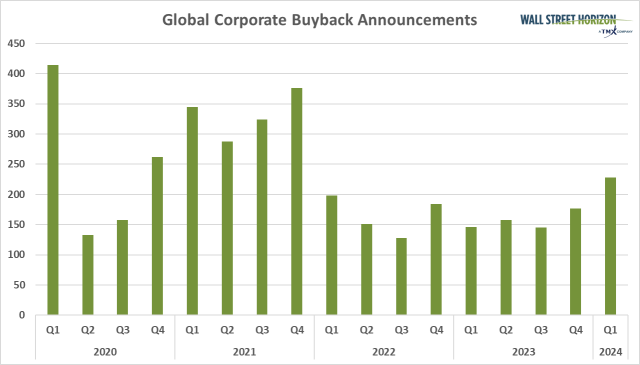

Buyback Bulletins Surge

Throughout this era, there was a major improve in buyback bulletins, reaching the highest ranges since This fall 2021, with 228 corporations asserting repurchase packages.

This signifies a important turning level, indicating a excessive degree of assurance within the potential for future enlargement and monetary stability. Buybacks are a useful gizmo that may point out each a rise in shareholder worth and sturdy money movement positions inside firms.

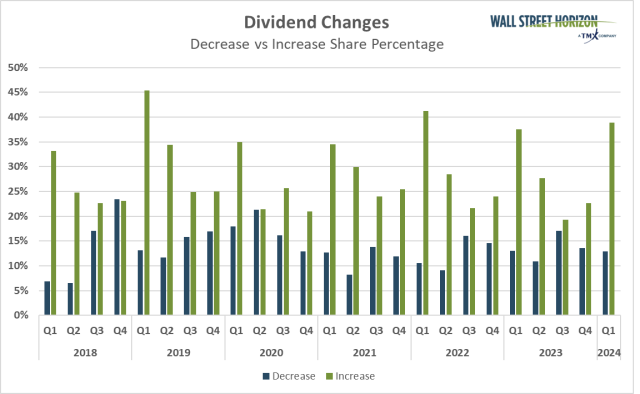

Dividend Will increase Attain New Heights

In Q1 2024, dividend actions surged to ranges not seen since earlier than 2018, as a staggering 1,639 corporations selected to enhance their dividends.

This motion highlights the constructive outlook and monetary energy of the company sector. Dividends are generally seen as an indicator of an organization’s monetary well being and potential for future earnings.

Market Outlook: A Cautiously Optimistic Perspective

The broader market outlook stays cautiously optimistic regardless of the observable uplift in company actions.

Given the present financial uncertainties and considerations about rates of interest, it could be clever to undertake a cautious strategy on the subject of rising dividends within the coming months.

Nonetheless, it’s anticipated that the bigger corporations within the S&P 500 will have the ability to deal with these challenges effectively, suggesting that their skill to bounce again might not be the identical for all sectors of the market.

S&P 500 Dividend Dynamics

Analyzing S&P 500 dividends supplies a extra detailed perspective. Though there was a slight decline in dividends per share in Q1 2024 in comparison with the earlier quarter, the general development continues to be constructive.

This era was marked by main gamers initiating important dividends, indicating a strategic shift in the direction of rewarding shareholders in response to altering market situations.

Conclusion: Navigating By way of Alternatives and Dangers

With the primary quarter of 2024 underway, there are constructive indicators for the 12 months forward. Company sentiment is sturdy and there are strategic company monetary actions that recommend a constructive outlook.

However, the mix of potential good points and potential losses ensuing from present financial uncertainties highlights the necessity for cautious monitoring and considerate preparation.

Firms’ proactive measures relating to buybacks and dividends reveal a cautious but forward-thinking technique in maneuvering by way of the advanced market panorama.

The submit Q1 2024 Dividend Funds Surge $16B, Reflecting Optimistic Company Outlook appeared first on Dumb Little Man.

[ad_2]