[ad_1]

Financial Indicators: A Quiet Week with Potential Implications

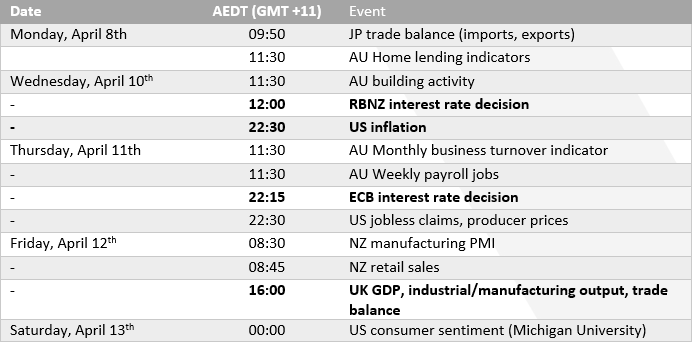

This week will not be filled with vital Australian financial updates, but indicators like dwelling lending and enterprise exercise may stir curiosity amongst traders. Any indicators of weak spot right here may gasoline hypothesis amongst AUD skeptics, probably influencing bets in direction of a fee reduce. Nevertheless, barring such developments, these datasets are anticipated to stay secondary in focus.

World Dynamics: Center Japanese Tensions and Market Impacts

Latest escalations within the Center East have heightened worries about wider battle implications, influencing US markets to retreat from their peaks. This growth, highlighted by a bearish engulfing sample within the S&P 500’s efficiency, underscores the significance of contemplating headline dangers and their potential to dampen sentiment—an element that might negatively have an effect on the AUD/USD pair, given its risk-sensitive nature.

Central Financial institution Views: RBA’s Stance Amid World Easing Alerts

The Reserve Financial institution of Australia (RBA)‘s current minutes acknowledged slower development and inflation however maintained that inflation was “too excessive”. This language suggests a fee reduce will not be imminent.

However, the sudden fee reduce by the Swiss Nationwide Financial institution (SNB) and anticipated changes by the Financial institution of England (BOE) trace at a attainable shift in direction of easing by central banks, though the RBA’s path is difficult by the Federal Reserve’s stance towards fast fee cuts.

Consideration can also be directed in direction of the Reserve Financial institution of New Zealand (RBNZ), which, regardless of signaling a protracted restrictive fee coverage, may lean in direction of easing as a consequence of financial contractions, including one other layer to the central banking panorama.

Market Outlook for AUD/USD: Influences from Overseas

Key worldwide occasions like US inflation information, producer costs, and the European Central Financial institution (ECB) assembly are set to dominate the scene. Softening US CPI figures may bolster expectations for a Fed fee reduce in June, probably easing pressures on the RBA.

Equally, a decline in US producer costs may weaken the US greenback, favoring an AUD/USD uptick.

Whereas the ECB’s upcoming stance stays mounted, its response to current comfortable inflation figures is keenly awaited. This international central banking ambiance may not directly form the RBA’s decision-making, presumably hastening a coverage easing timeline.

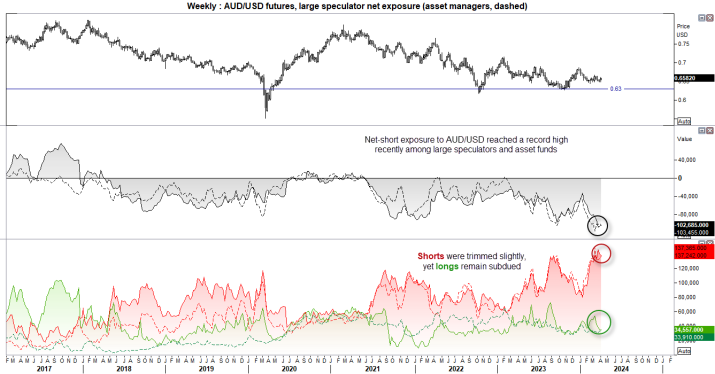

AUD/USD Futures – Market Sentiment from the COT Report:

Latest tendencies present a file net-short publicity in AUD/USD futures, signaling excessive bearish sentiment. Regardless of a slight discount briefly positions by giant speculators, a rise by asset managers was famous.

The subdued lengthy positions trace at restricted upside potential, though the present bearish extremity warrants warning towards forecasting extended declines with out vital disruptive occasions.

A bullish outdoors week on the AUD/USD weekly chart suggests a possible for a three-week bullish reversal, presumably influenced by softer US inflation numbers, aligning with seasonal tendencies favoring AUD/USD.

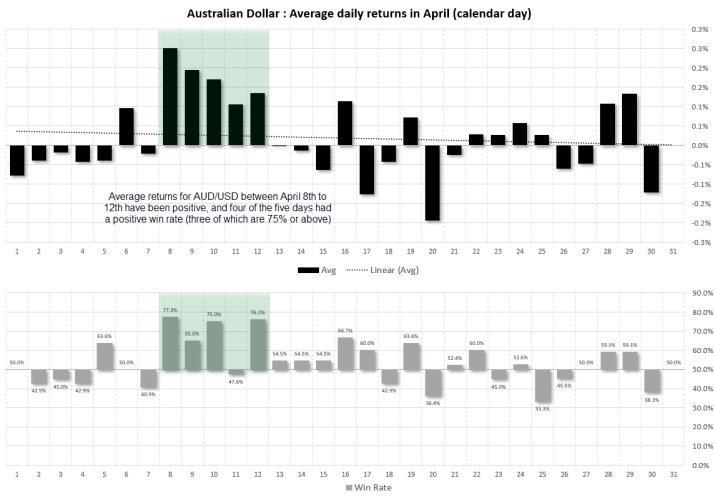

AUD/USD Seasonality in April:

Historic evaluation since 1976 reveals April as a usually constructive month for AUD/USD, with a mean return of 0.48%, a median of 0.82%, and a 55.8% win fee.

Particularly, the interval from April eighth to twelfth showcases persistently constructive each day returns, aligning with a historically weaker efficiency in US markets throughout the identical timeframe.

Whereas seasonality just isn’t a assured predictor, favorable situations may result in a bullish week for AUD/USD, supporting its seasonal pattern.

AUD/USD Technical Evaluation:

The Australian greenback has lately demonstrated resilience, bouncing again from a false break beneath 75c. Regardless of a momentary pause indicated by Friday’s hanging man candle, the foreign money’s place above its 200-day EMA suggests restricted draw back danger.

This positioning, mixed with seasonal tendencies favoring an uptick, positions AUD/USD as a candidate for bullish consideration, particularly on dips, within the week forward.

[ad_2]