[ad_1]

Bitcoin and Ethereum Costs Surge on ETF Approval Speculations

Bitcoin and Ethereum are rising in early European buying and selling, with experiences claiming that the Hong Kong Securities and Change Fee (SEC) has authorised numerous spot BTC and ETH exchange-traded funds (ETFs).

Though no formal affirmation has been issued, China Asset Administration (HK) Ltd hinted at permission in an announcement on its web site.

Bitcoin Halving Occasion and Market Sentiment

Whereas the market is buzzing with pleasure concerning the supposed ETF approvals, merchants are additionally maintaining a cautious eye on the upcoming Bitcoin halving occasion on Saturday, April twentieth.

With solely 683 blocks left to mine earlier than the occasion, pleasure, and hypothesis are sturdy.

Weekend Turmoil Spurs Crypto Promote-off

The Bitcoin market skilled great volatility over the weekend on account of Iran’s retaliatory strikes on Israeli targets. The ensuing uncertainty sparked a sell-off, with Bitcoin falling to $60.6k and Ethereum reaching a low of $2,845.

Costs have been rebounding, though recovering from weekend losses could take a while.

Technical Outlook for Bitcoin and Ethereum

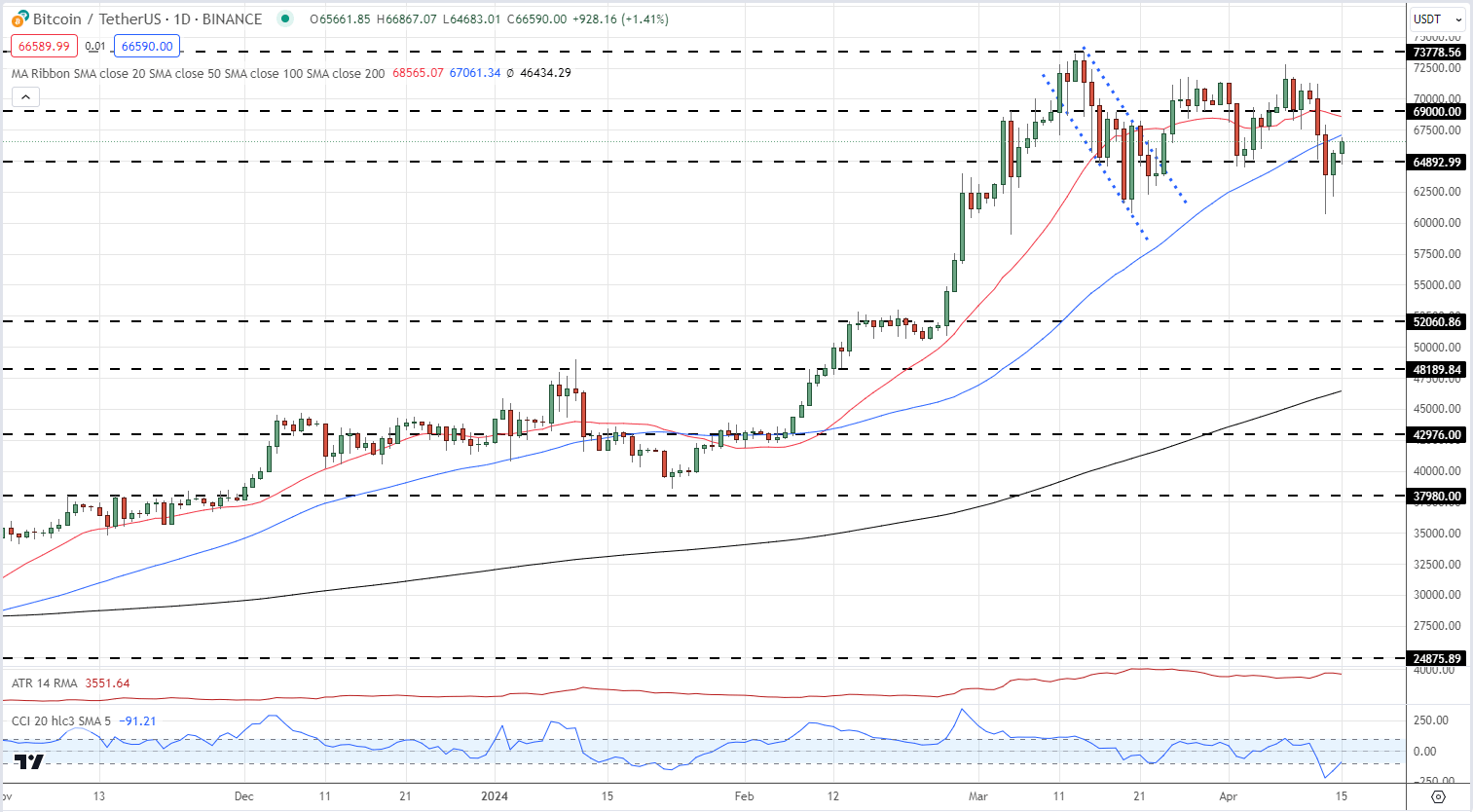

Bitcoin’s latest drop under important transferring averages for the primary time since January highlights the necessity for a powerful restoration above them, in addition to reclaiming the $69k help degree, to clear the best way for a brand new try on the mid-March all-time excessive.

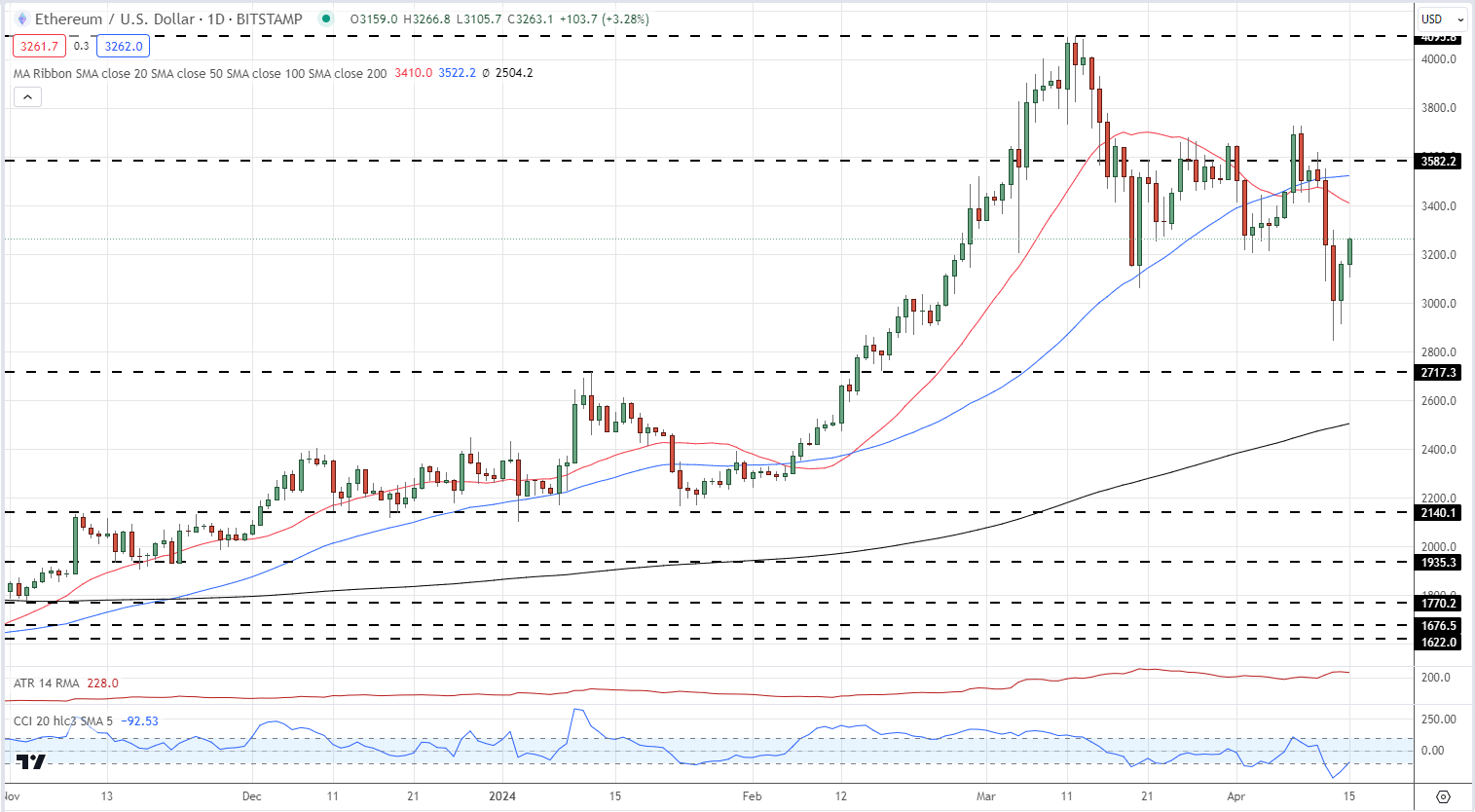

In the meantime, Ethereum is aiming to surpass its earlier low and attain $3,582, with additional resistance at $3,728.

Hong Kong Leads in Approving Bitcoin and Ethereum ETFs

Hong Kong has emerged as a forerunner in allowing buying and selling of Bitcoin and Ethereum money ETFs, outperforming the US SEC’s regulatory processes.

Main monetary establishments similar to China Asset Administration and Bosera Capital have acquired approval to introduce these revolutionary merchandise, which can enable buyers to purchase cryptocurrency shares immediately with money.

Mainland China’s Regulatory Panorama

Regardless of Hong Kong’s accomplishments, mainland China’s strict crypto guidelines make it troublesome for Chinese language buyers to entry these ETFs.

Regulatory constraints now preclude mainland funds from investing in cryptocurrency-linked items, highlighting the hole in crypto guidelines between Hong Kong and the mainland.

Hong Kong Financial Authority’s Digital Foreign money Initiatives

Since July of final yr, the Hong Kong Financial Authority (HKMA) has actively advocated for the institution of digital currencies as a mainstream medium of change.

Mainstream banks similar to HSBC and Commonplace Chartered are serving to regulated cryptocurrency regulators acquire entry to banking providers, highlighting Hong Kong’s dedication to digital innovation.

Remaining Ideas

Unconfirmed experiences of spot BTC and ETH ETF approvals in Hong Kong have sparked a big improve in cryptocurrency values, with Bitcoin and Ethereum main the best way.

Whereas regulatory boundaries exist, Hong Kong’s proactive method to digital property creates a persuasive precedent for international markets, implying a wider acceptance of cryptocurrencies in mainstream finance.

The put up Hong Kong Spot ETF Approval Rumors Spark Bitcoin and Ethereum Rally appeared first on Dumb Little Man.

[ad_2]