[ad_1]

Monday noticed gold costs edge increased as buyers remained cautious forward of serious occasions, most notably the Federal Open Market Committee (FOMC) announcement on Wednesday. In early afternoon New York buying and selling, XAU/USD elevated by about 0.2%, discovering help at $2,150.

Fed Assembly Anticipation and Potential Coverage Shift

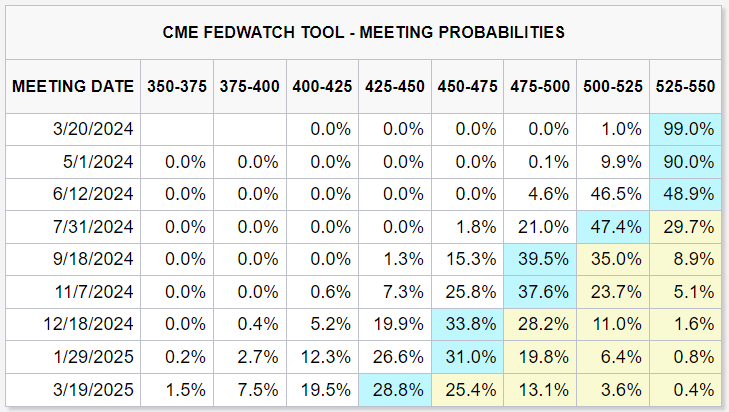

The Federal Reserve will maintain its March assembly this week. The central financial institution is predicted to maintain its current coverage settings in place, however given the worrying developments in inflation, it’s anticipated that it could modify its ahead steerage and financial projections.

Sudden spikes in latest inflation figures level to a attainable pause or reversal within the development of disinflation. Because of this, the Fed could take a extra cautious method, suspending charge reductions and slicing again on different easing measures.

Market Affect Situations

The Fed’s place could trigger the greenback and U.S. Treasury yields to rise, which could stifle the present treasured metals increase. However, gold could achieve traction if the Fed sticks to its dovish outlook, regardless of latest inflation information suggesting in any other case.

Technical Evaluation

Gold costs steadied on Monday, rebounding from help at $2,150. Help ranges are $2,150 and $2,085, and resistance is at $2,175 and $2,195.

Gold costs held steady on Tuesday as merchants targeted on central financial institution choices from the Reserve Financial institution of Australia (RBA) and the Financial institution of Japan (BoJ).

Central Financial institution Choices Affect

The BoJ’s potential withdrawal from the unfavorable rate of interest coverage (NIRP) may set off volatility, which might impression the worth of gold in addition to the USD/JPY pair. With little impact available on the market, the RBA is anticipated to maintain its rate of interest the place it’s.

Upcoming Fed Determination

With the essential Fed choice on Wednesday approaching, merchants are prepared. The short-term technical image for gold suggests a attainable bullish continuation if it breaks by way of resistance ranges at $2,164 and $2,190.

Last Ideas

Because the world’s markets anxiously await the FOMC assertion, gold costs are nonetheless inclined to modifications in Fed coverage and the state of the world economic system. It’s endorsed that merchants maintain a watchful eye on essential ranges of help and resistance if there may be any future market volatility.

The submit Gold Value Outlook: Fed Might Shake Up Markets, Sparking Pullback or Rally in Retailer appeared first on Dumb Little Man.

[ad_2]