[ad_1]

Gold hits a report excessive because the Federal Reserve confirms rate of interest cuts

Gold costs have climbed to historic highs following the Federal Reserve’s most latest financial coverage announcement. Regardless of adjustments in inflation and financial forecasts, the central financial institution’s choice to stay to its plan of three rate of interest cuts this 12 months has lifted gold considerably.

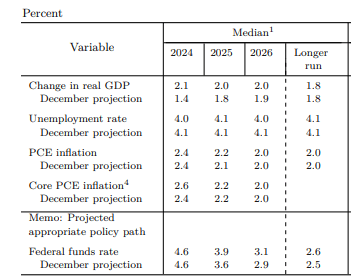

The Federal Reserve’s Abstract of Financial Projections for March 2024 highlighted numerous modifications, together with a minimal improve within the long-term federal funds price from 2.5% to 2.6%. This alteration proposes revisiting the ‘impartial price,’ which balances financial progress with out being overly stimulative or restrictive.

Fed Abstract of Financial Projections, March 2024

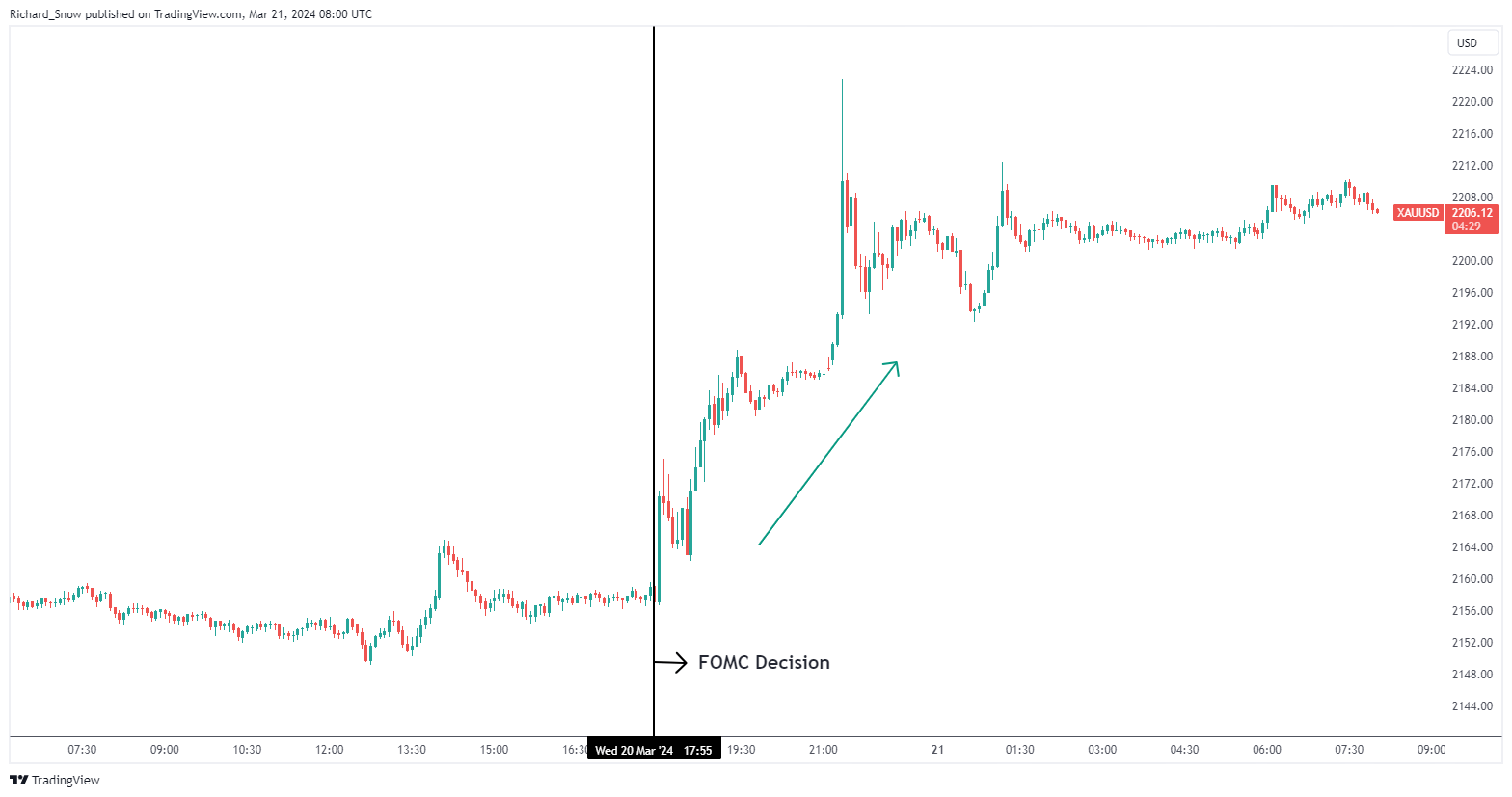

Previous to the Fed’s assertion, the dialogue centered on whether or not the central financial institution would revise its rate-cutting forecast in gentle of latest sturdy financial statistics and better inflation figures. Nonetheless, the Fed’s affirmation of its December predictions triggered a dovish market response, weakening the foreign money and decreasing short-term yields just like the 2-year Treasury yield. This market dynamic supplied excellent circumstances for gold to realize a brand new all-time excessive.

Gold Soars to New All-Time Excessive

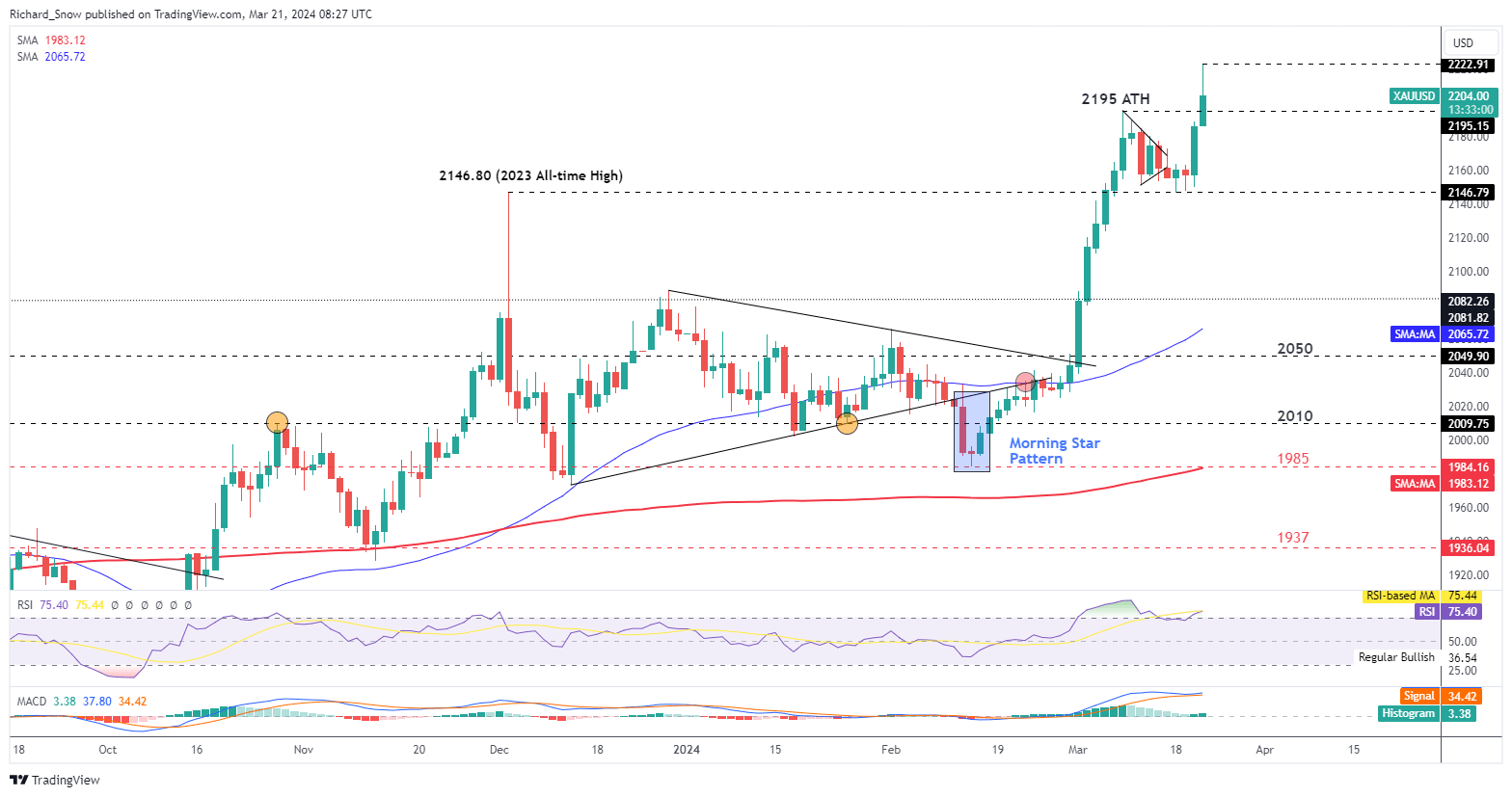

Gold’s rally continues following the FOMC assembly. Following Wednesday’s Federal Open Market Committee (FOMC) assembly, gold costs have continued to rise, establishing a brand new excessive. The dear metallic’s worth consolidated above the earlier all-time excessive of $2146.80, reaching over $2222. This rise was anticipated if gold costs held above the earlier excessive, indicating sturdy momentum within the gold market.

Every day Gold (XAU/USD) Chart

The rise in gold costs can also be aided by rising central financial institution purchases, notably from China. Regardless of the prospect of a brief decline attributable to latest giant motion and a possible greenback restoration, gold’s assist stays stable close to $2146. This growth demonstrates the dear metallic’s enduring enchantment as a safe-haven asset in an unsure financial atmosphere.

Remaining Ideas

Buyers and sellers should repeatedly monitor these developments, notably the impression of Federal Reserve coverage on gold costs. The mixture of dovish Federal Reserve estimates and sturdy demand for gold factors to a continued bullish development for the dear metallic, making a profitable alternative for buyers.

The submit Gold Surged to a New All-time Excessive After The Fed Reaffirmed Its Fee Minimize View appeared first on Dumb Little Man.

[ad_2]