[ad_1]

Market Dynamics and Financial Knowledge

Amidst a backdrop of USD weak spot and conflicting Federal Reserve bulletins, the Pound Sterling has gained momentum towards the US Greenback, rising to 1.264, or a 0.56% advance.

Alternatively, the GBP/CHF trade price is shifting cautiously as Franc’s place is unsure as a result of sudden 25 foundation level price drop by the Swiss Nationwide Financial institution.

US and UK Financial Indicators

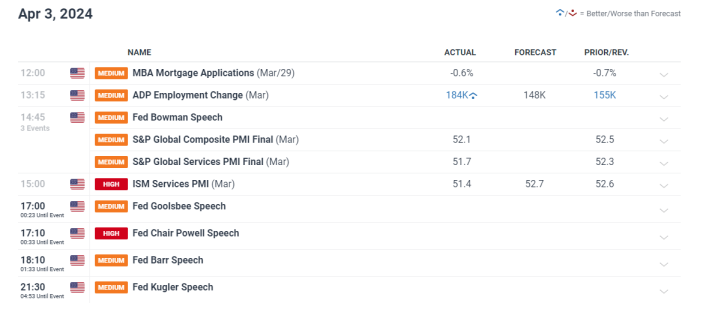

This week’s information schedule for the UK appears sparse, whereas the US has printed many vital financial stories. Remarkably, the US companies PMI fell from 52.6 in March to 51.4, indicating drops in each “costs” and “new orders”.

The lower and the robust ADP employment report, which revealed 184K new positions vs an anticipated 148K, additional complicate the dynamics of the forex market.

GBP/USD Dynamics

The GBP/USD trade price has proven tenacity, establishing help at 1.2585, which corresponds to the 200-day SMA. Resistance ranges are seen round 1.2736 and 1.2800 on the upside.

From a seven-week low of 1.2539, this forex pair confirmed a robust restoration, exhibiting a vast buying and selling vary that had beforehand positioned it among the many prime performers towards the G10 currencies in Q1.

GBP/CHF Evaluation

Following the 25 foundation level price drop by the Swiss Nationwide Financial institution (SNB), the GBP/CHF pair has struggled to interrupt above the 1.1460 resistance degree.

On condition that help is seen at 1.1345, there appears to be room for a potential retracement, which means that merchants on this forex pair ought to proceed cautiously.

Central Financial institution Expectations and Charge Cuts

Financial institution of England (BoE)

With a 66% chance of a price drop by the BoE of 25 foundation factors in June, market gamers are more and more leaning in that course.

This expectation is a results of the altering financial panorama and the central financial institution’s response to development prospects and inflationary pressures.

Federal Reserve (Fed)

Rate of interest cuts by 25 foundation factors by July 31 are actually absolutely factored into expectations for the Fed.

With differing views amongst Fed members relating to the course of financial coverage, the market consensus is that there will likely be two to a few price cuts this 12 months. This adjustment displays that settlement.

Closing Ideas

The GBP/USD pair, supported by central financial institution insurance policies and financial indicators, demonstrates resilience amidst volatility within the US greenback as merchants negotiate the complexity of the forex market.

In the mean time, given the market weak spot and price cuts by SNB, the GBP/CHF pair is shifting cautiously. To find out the longer term course, merchants will likely be attentively observing forthcoming financial information and central financial institution statements.

These forex pairings’ actions will likely be influenced by the interplay of central financial institution expectations, market sentiment, and financial indicators, which is able to current merchants with each prospects and challenges.

The submit GBP/USD Good points Amid USD Weak point; GBP/CHF Strikes Cautiously appeared first on Dumb Little Man.

[ad_2]