[ad_1]

Gold Value Efficiency Overview

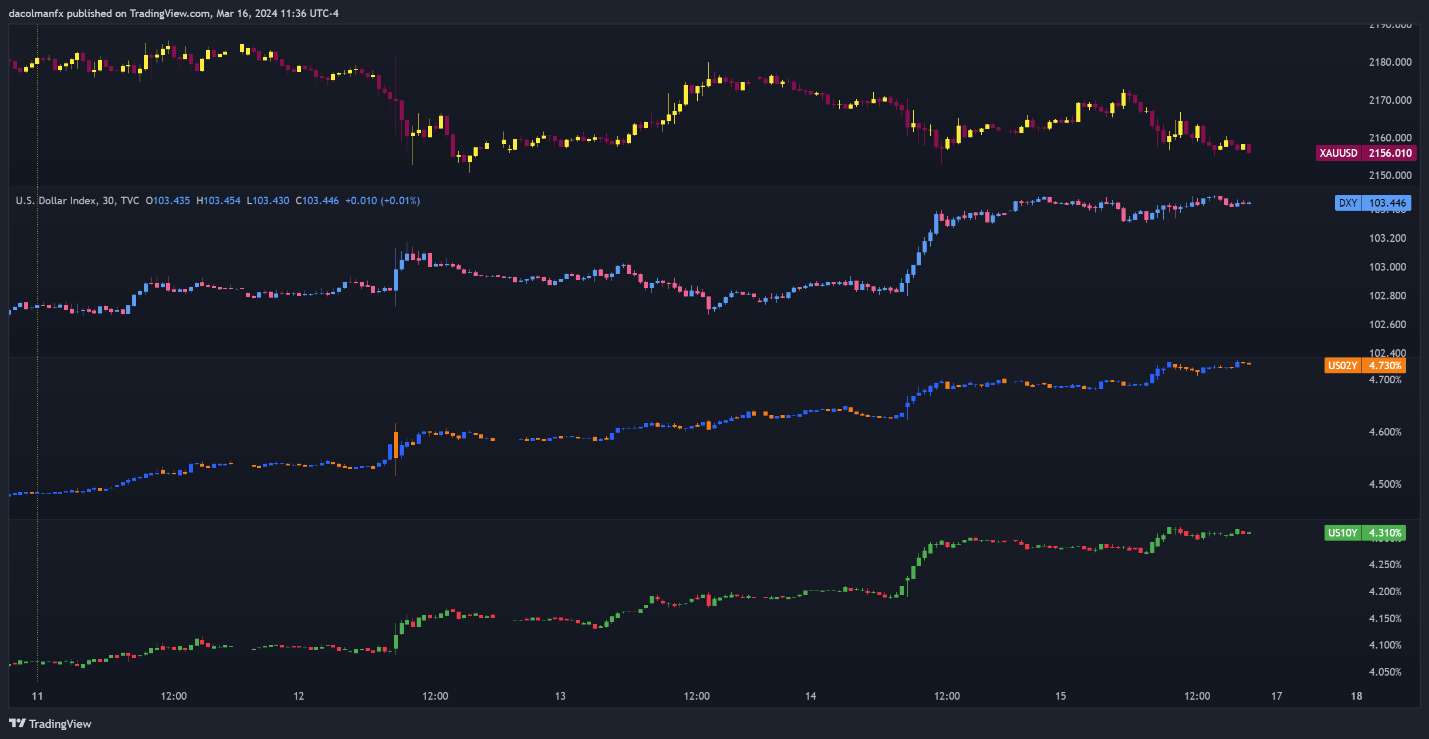

This week noticed a slight retreat within the worth of gold (XAU/USD), down roughly 1.05% to $2,155. Rebounding U.S. Treasury yields and a rising US greenback are attributed to the decline.

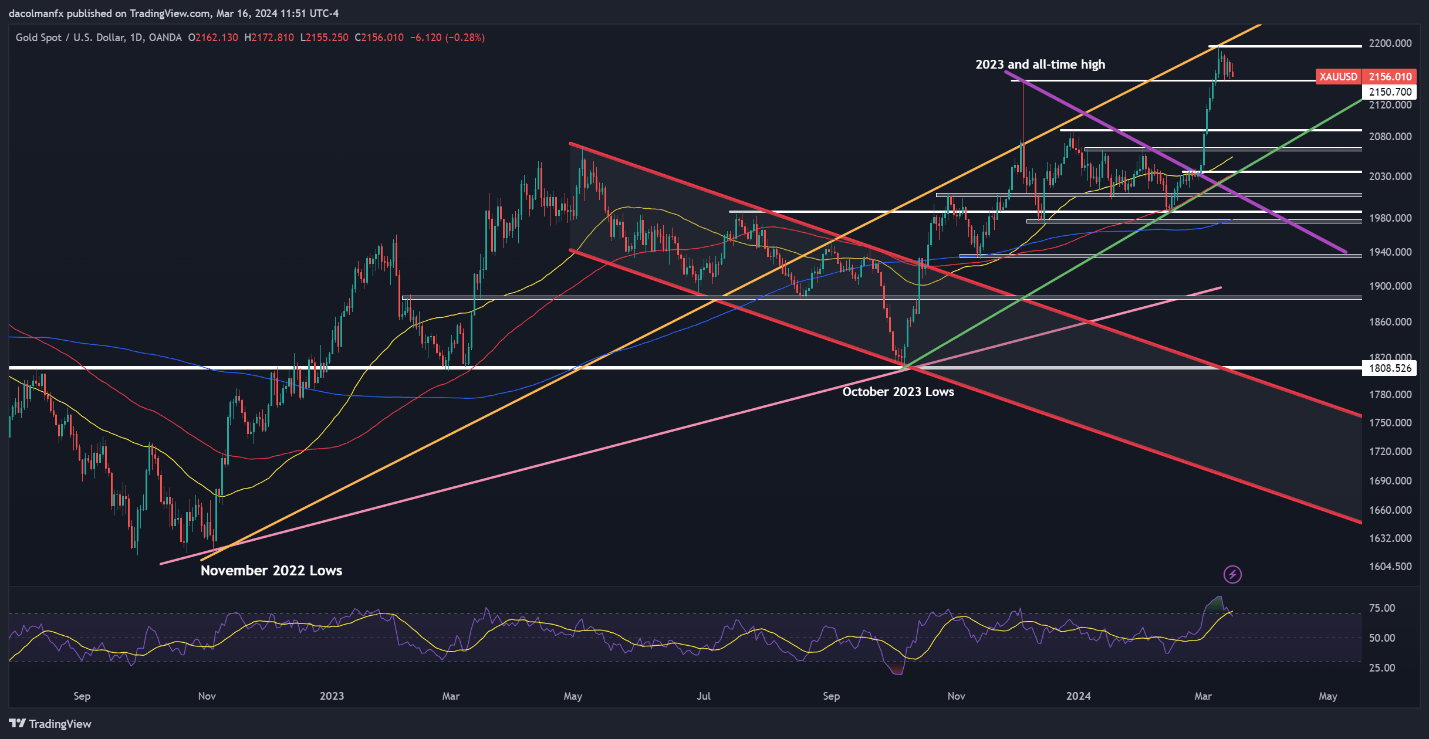

Regardless of this, there may be nonetheless a robust bullish pattern in gold, as evidenced by the 5.5% rise in March that despatched it to new all-time highs.

Expectations of a charge lower by the Federal Reserve drove this rise, which intensified when Fed Chair Jerome Powell’s feedback to Congress hinted at a potential shift towards a much less restrictive stance.

Inflation and Federal Reserve’s Stance

Disappointing shopper pricing knowledge in latest periods has brought on a story change, suggesting that the disinflation progress could also be stagnating or maybe reversing.

Given the growing inflation dangers proven by latest PPI and CPI knowledge, merchants could anticipate the Fed to undertake a extra hawkish stance, indicating a delay in easing coverage and fewer charge decreases than initially anticipated.

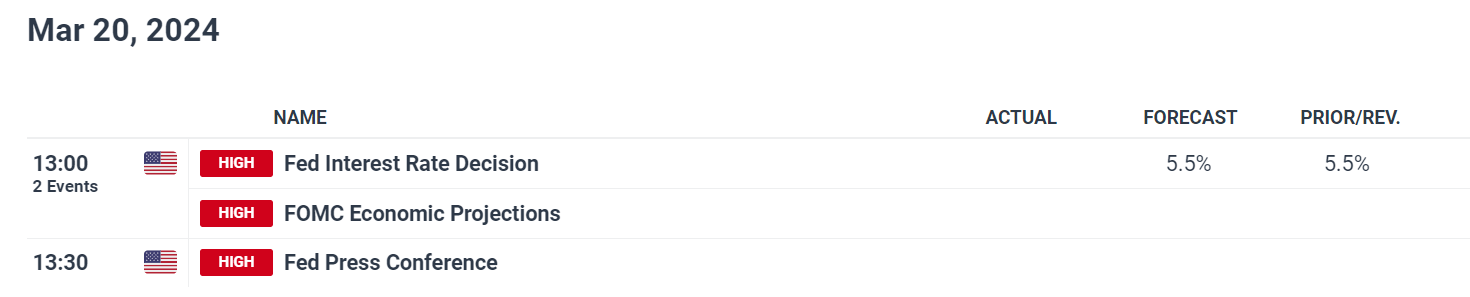

New pointers and forecasts are additionally eagerly awaited for the Fed’s March determination, which is scheduled on Wednesday. The Fed’s forecast of 75 foundation factors of easing this 12 months is per present market pricing.

Nevertheless, any indications of fewer reductions may elevate bond charges and the US foreign money, which might negatively have an effect on the value of gold.

Technical Evaluation and Future Motion

Gold costs remained above the $2,150 assist stage all through the week. To stop further promoting strain, the bulls want to guard this space.

If there are any pullbacks, they need to be focused round $2,085, whereas preserving an in depth eye on the vital stage of $2,065. Alternatively, if the market experiences a bullish resurgence, it might face a problem in surpassing the latest peak of $2,195. There might be further resistance close to the $2,205 mark.

Affect of US and Chinese language Financial Indicators

U.S. inflation knowledge has helped keep expectations for Fed charge cuts, as market members carefully monitor upcoming FOMC choices. If inflation stays excessive, the Fed could select to carry off on easing till there may be stronger proof of inflation discount.

Moreover, weak shopper sentiment and regular inflation expectations, coupled with modest enhancements in industrial manufacturing, are contributing elements. China’s give attention to proactive fiscal coverage and potential financial easing measures, comparable to diminished financial institution reserves, could have a optimistic affect on gold costs.

Given China’s standing as a main gold shopper, the nation’s financial restoration and stimulus measures play an necessary function. Anticipated Chinese language Retail Gross sales and Industrial Manufacturing knowledge, coupled with the Fed’s rate of interest determination, will play a vital function in shaping the trajectory of gold’s worth.

Closing Ideas

Within the face of Chinese language financial knowledge, gold merchants stay on edge as they navigate the complexities of U.S. inflation knowledge and the Federal Reserve’s impending decisions.

The course of gold’s worth within the coming days will certainly be formed by the fragile stability that exists between expectations for rates of interest, inflation, and international financial coverage.

Gold’s volatility is highlighted by its attraction as a safe-haven asset and its vulnerability to rate of interest fluctuations because the market awaits these important occasions.

[ad_2]