[ad_1]

Market Outlook and Sentiment Evaluation

Within the dynamic realm of forex buying and selling, adopting contrarian methods can unveil hidden potentialities by deviating from standard considering.

IG shopper sentiment supplies worthwhile insights into the market’s sentiment, particularly when analyzing the Euro FX pairs comparable to EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

When mixed with technical and elementary evaluation, these insights provide merchants an intensive understanding of the market.

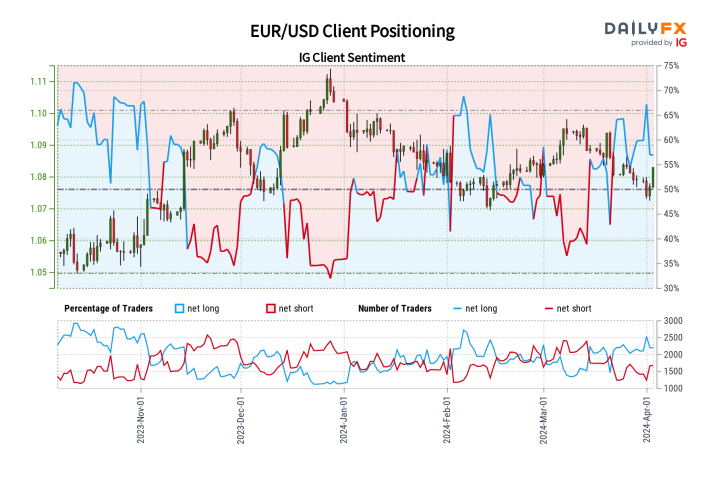

EUR/USD: A Blended Sentiment Panorama

The sentiment surrounding the EUR/USD pair is sort of nuanced, as most retail merchants appear to have a barely bullish leaning.

However, a notable improve in bearish sentiment signifies the potential for a optimistic shift. Merchants ought to train warning and think about each sentiment and broader market analyses.

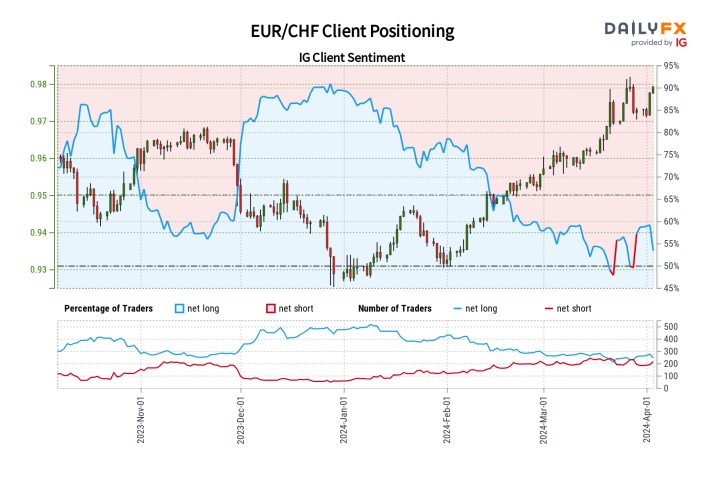

EUR/CHF: Bullish however Waning

Merchants are at the moment expressing a optimistic outlook for EUR/CHF, though there are indications of a potential decline. There are conflicting indicators and a decline in optimistic positions that counsel the potential for downward corrections.

The future actions of this pair require a cautious method, highlighting the importance of a complete evaluation technique.

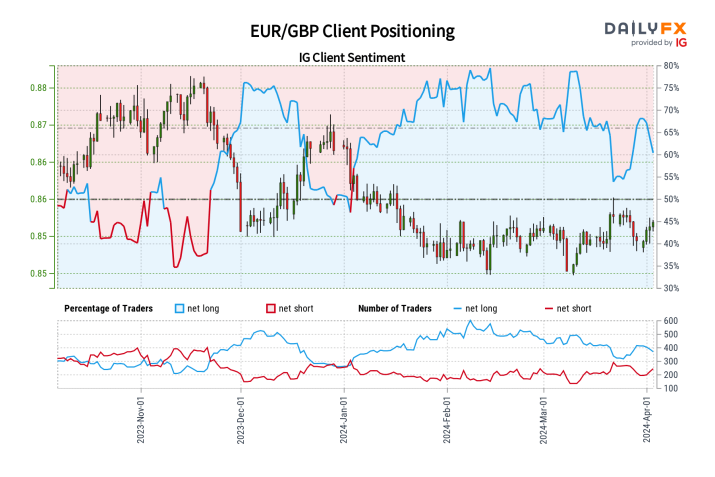

EUR/GBP: Optimism Faces Resistance

The EUR/GBP pair is at the moment experiencing a sturdy bullish sentiment, though latest adjustments point out a extra balanced market dynamic.

Contemplating the present market situations, you will need to stay cautious and make use of a balanced method that mixes each sentiment and technical evaluation.

Though there are some predictions of a potential decline from contrarian views, the general long-term development stays unsure, emphasizing the necessity for cautious commentary and evaluation.

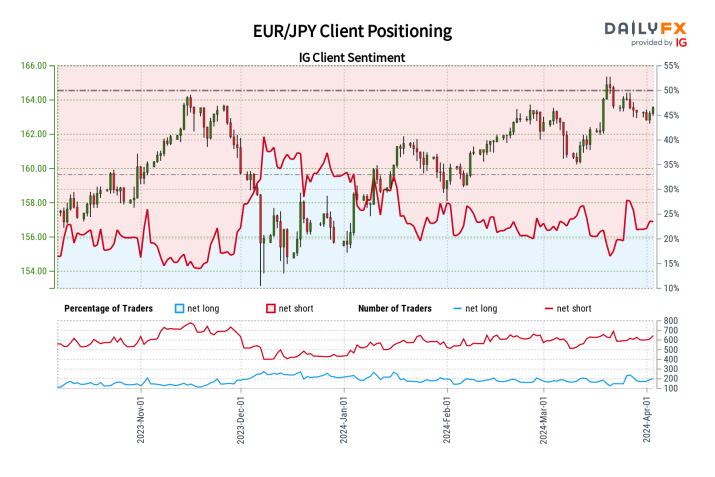

EUR/JPY: Bearish Bias with a Silver Lining

The EUR/JPY panorama is at the moment dominated by a sturdy bearish sentiment. Nonetheless, the rise in lengthy positions mixed with a bearish weakening suggests the potential for upward corrections.

You will need to carefully observe adjustments in sentiment and correlate them with technical indicators.

Technical Insights: EUR/USD and EUR/CHF

The EUR/USD is nearing necessary assist ranges, suggesting attainable adjustments in value shortly. Merchants ought to carefully monitor any reactions occurring across the 1.0704/12 space. A potential breakdown on this area might point out the potential for extra declines.

There’s a degree of resistance close to the 52-week transferring common, and whether it is damaged, it might point out a attainable upward development.

The EUR/CHF pair continues to point out energy because it stays inside an upward channel, even within the face of occasional bearish corrections.

Key financial indicators, such because the EU unemployment fee and inflation knowledge, provide worthwhile insights into the forex pair, shedding gentle on the uncertainties at play.

Conclusion

The present state of the Euro FX market is characterised by a multitude of things that affect each investor sentiment and technical indicators.

Merchants are suggested to undertake a market analyst mindset, incorporating contrarian views and counting on thorough technical and elementary analyses to make knowledgeable selections.

Staying adaptable and well-informed would be the key to navigating the ever-changing market in these unsure instances.

[ad_2]