[ad_1]

This week will probably be one of many busiest of the yr, crammed with earnings studies, a Federal Reserve assembly, substantial financial information, and a Treasury Quarterly Refunding announcement.

Though there are combined opinions in regards to the affect of the Quarterly Refunding Announcement, it’s prone to find yourself as a non-event. Particulars will begin to floor on Monday afternoon, with the official bulletins set for Wednesday morning.

There’s some hypothesis on social media that the Treasury Basic Account (TGA) will probably be considerably lowered, doubtlessly releasing a wave of liquidity into the markets.

Whereas a discount from the present $900 billion to about $750 billion is feasible, it’s inconceivable that it’s going to lower to $100 billion.

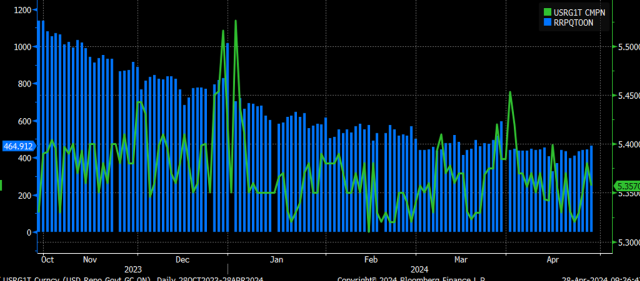

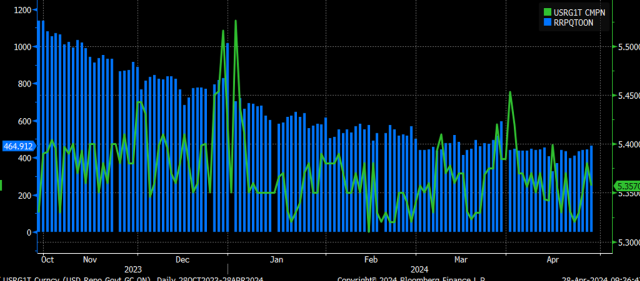

If the Treasury reduces invoice issuance, a few of the funds which have moved out of the reverse repo facility in latest months may begin to circulate again. If there’s an extra of money within the in a single day funding markets, in a single day charges may drop to the reverse repo charge of 5.3%.

If charges fall too low, the cash will probably discover its approach again into the Reverse Repo Program (RRP), which may assist drain liquidity from the system, particularly if the reverse repo facility will increase sooner than the TGA decreases.

Because the finish of March, the in a single day charge has usually been trending decrease, and the money within the repo facility has been usually trending greater. So, the small print we get within the subsequent few days might be essential, particularly if invoice issuance is web unfavorable.

This week’s Federal Reserve assembly might be extra necessary for credit score spreads than anything. Monetary circumstances eased considerably when the Fed pivoted and indicated potential charge cuts in December.

That course of started in November when Powell steered that charge hikes have been practically over. Will this assembly function the catalyst to begin tightening these circumstances once more if Powell means that the variety of charge cuts anticipated in March is perhaps lowered, with the June assembly probably taking all of them away? It’s a risk.

To this point, the bottom level for spreads was proper across the March FOMC assembly.

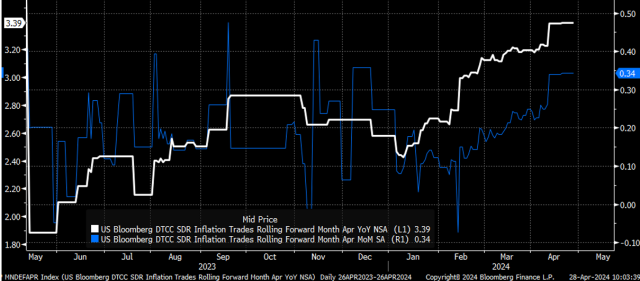

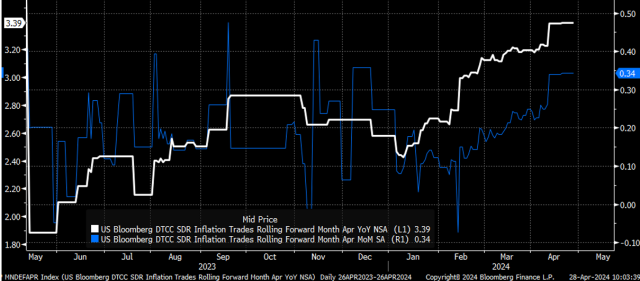

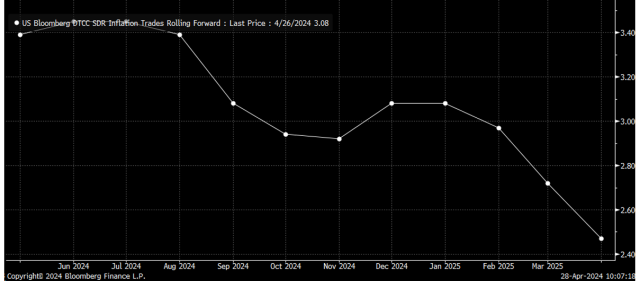

One cause the Fed might remove all charge cuts by June is that the April CPI swaps are anticipated to indicate a rise of 0.34% month-over-month and by 3.4% year-over-year. Let’s face it: 0.34% is simply 0.01% away from 0.35%, which then rounds as much as 0.4%. If the CPI studies one other 0.4% in April for the third consecutive month, it won’t bode nicely for the speed lower outlook.

Based mostly on the present CPI pricing, will probably be difficult to see charges under 3.0% till February 2025. So, if the Fed is hoping for a collection of favorable studies earlier than beginning to lower charges, they could have to attend till Could 2025—a minimum of if the present pattern continues and swap pricing is correct.

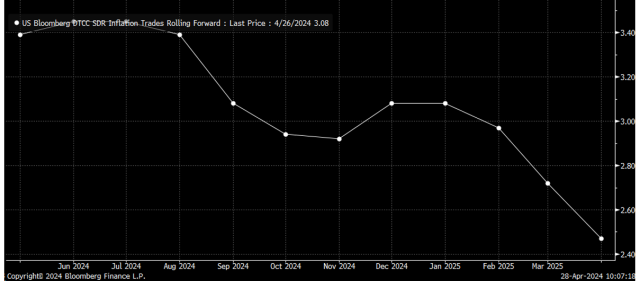

This means that the 2-year Treasury charges will proceed to rise and push by the bull flag.

US 2-12 months Yield-Day by day Chart

The 10-year can be prone to climb greater and attain round 5% after breaking above resistance at 4.65% on the finish of final week.

That is most likely why the greenback must also proceed to strengthen, push greater, and get away of its bull flag.

In the meantime, the S&P 500 rose this week to achieve the 20-day transferring common, may be very near the 50-day transferring common, and is approaching the downtrend line. So, this week will probably be pivotal in figuring out whether or not the downtrend within the SPX ought to persist.

[ad_2]