[ad_1]

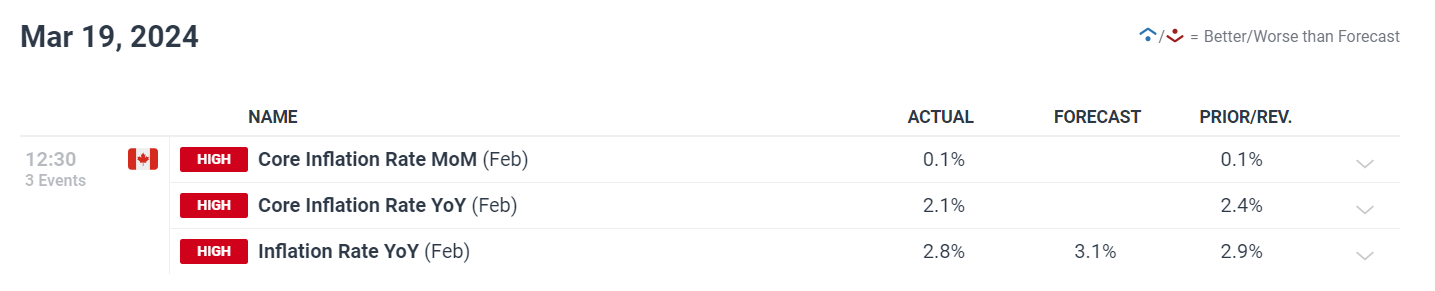

Canada’s February inflation, together with each core and headline measures, slowed greater than anticipated, with the CPI dropping nicely beneath the 3.1% estimate to 2.8%.

With this decline, core inflation has reached its lowest degree in additional than two years, growing stress on the Financial institution of Canada (BoC) to ponder easing monetary circumstances.

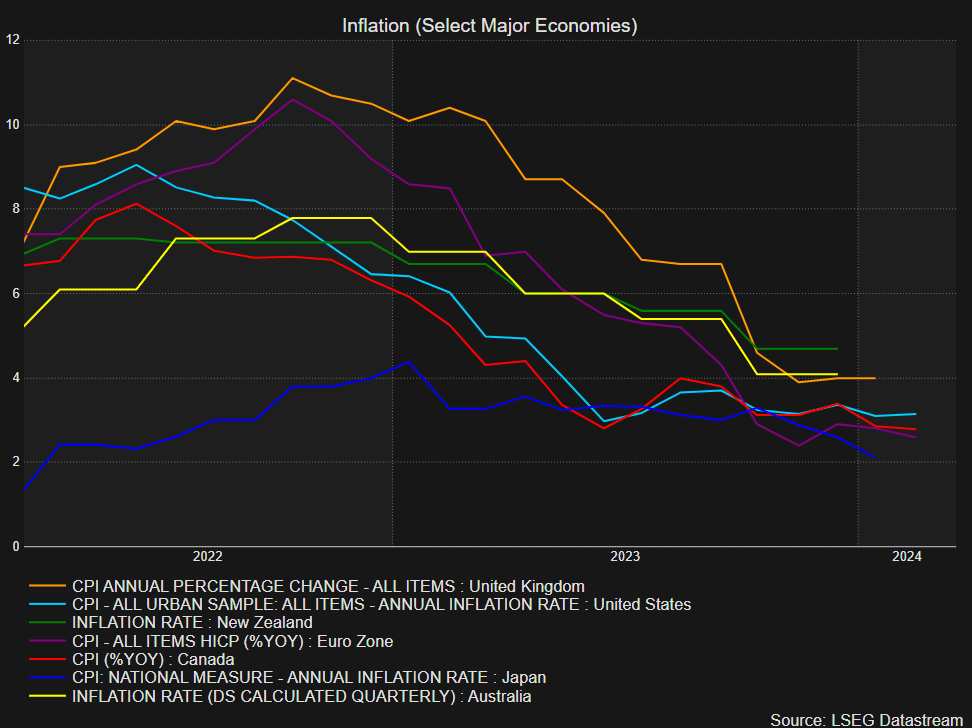

When in comparison with different nations with inflation charges of greater than 8%, Canada stands out on account of this growth, which is illustrated within the graph beneath.

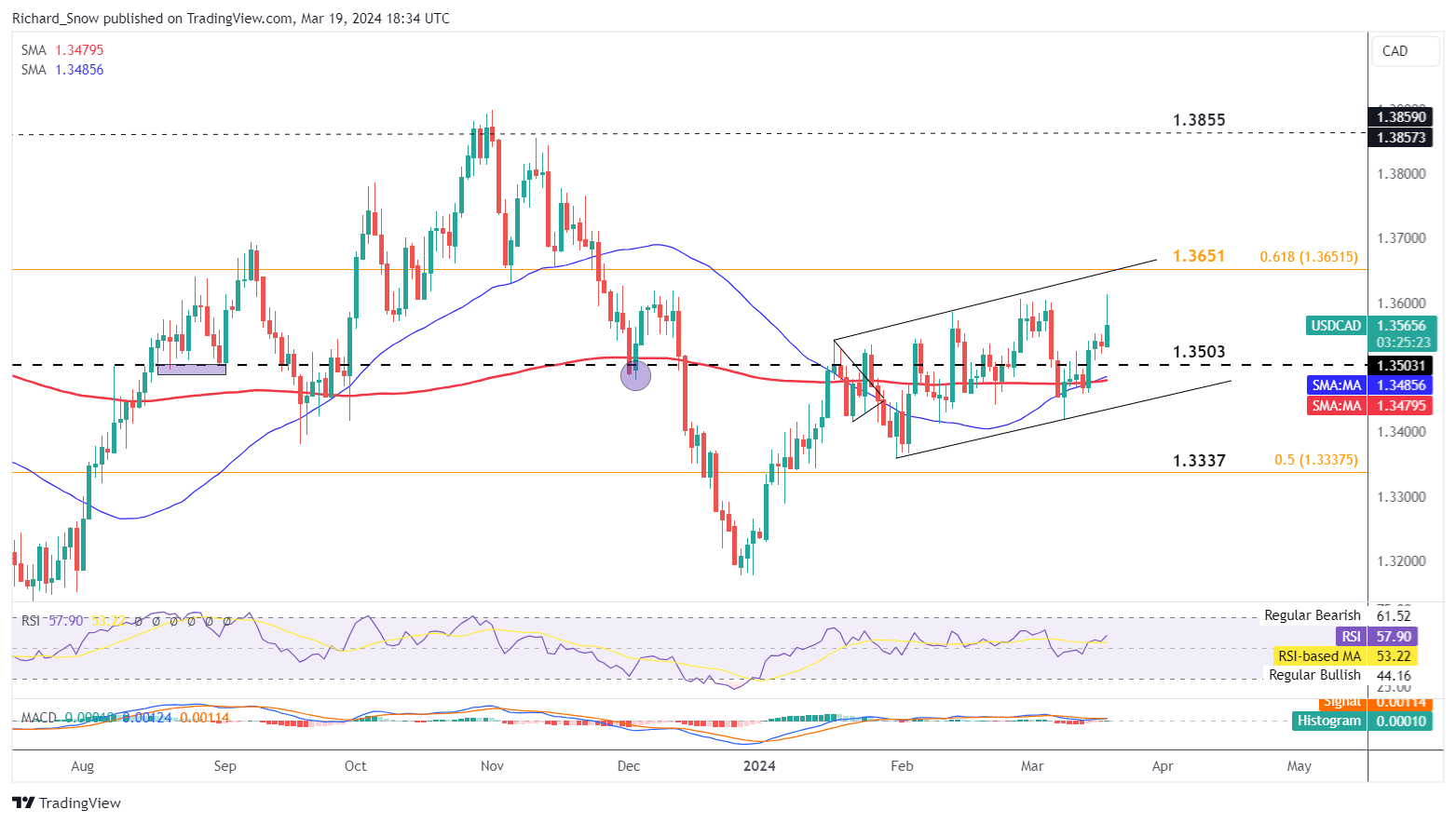

USD/CAD’s Blended Response Amid Inflation Knowledge

The USD/CAD pair rose sharply after the discharge of the softer inflation knowledge, but it surely misplaced momentum because the New York session went on. The pair’s bullish trajectory targets channel resistance, bouncing off a help bounce at 1.3420 and breaking above the 200-day SMA at 1.3500.

This resistance is predicted to align with the principle 2020–2022 motion’s 61.8% Fibonacci retracement. Nonetheless, the large higher wick formation means that bulls could must regroup.

Market Reactions and Fee Lower Projections

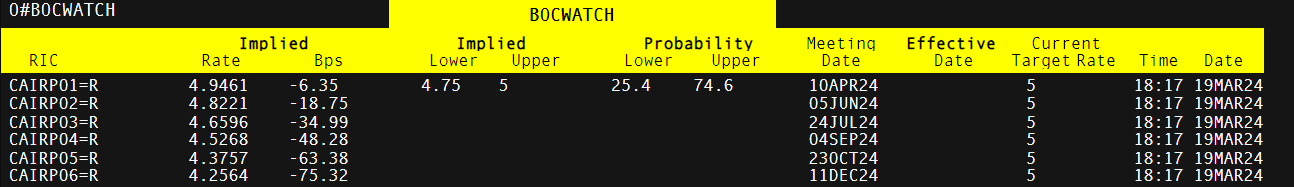

Buyers at the moment are extra closely betting on a BoC charge lower in June, with market possibilities supporting a reduce at roughly 62%, on account of the surprising slowdown in Canada’s inflation. To reduce financial stress, the rationale for easing financial coverage is strengthened by the continued decreased inflation.

Then again, expectations for the Federal Reserve to chop rates of interest have shifted from June to July, doubtlessly sustaining a favorable rate of interest differential for the USD towards G7 currencies.Core inflation metrics in Canada additionally fell to ranges not seen in additional than two years, though headline inflation dipped at a charge that was the slowest since final June.

Such knowledge has ramped up investor bets for a June charge reduce, with cash market predictions for a 25 foundation level discount exceeding 75%. Fee cuts starting in June at the moment are anticipated to be set in movement by the BoC’s extra dovish outlook in April.

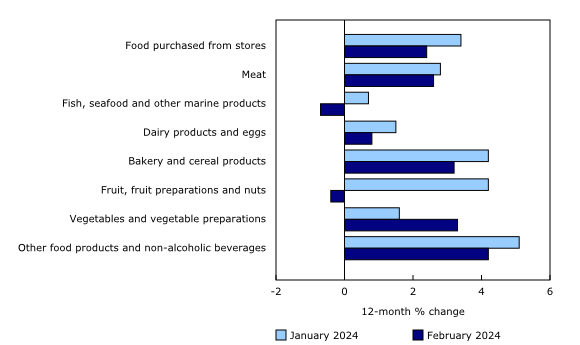

The Canadian foreign money fell to a three-month low versus the US greenback on account of the inflation deceleration, and the yield on the nation’s 10-year bond considerably decreased. Decrease meals costs in addition to cheaper web and cell service contributed to the general slowdown in inflation for Canadians.

Last Ideas

Analysts argue that the present inflation knowledge justifies a June charge reduce. They warn that any additional delays may damage the financial system. With the BoC sustaining charges to fight inflation, the newest figures recommend a potential shift in coverage might be imminent.

Nonetheless, the financial institution has indicated it seeks sustained proof of underlying inflation slowing earlier than contemplating charge reductions. Because the BoC prepares to replace its forecasts, the main focus stays on attaining a cautious steadiness between stimulating financial progress and sustaining worth stability.

The submit Canada’s February Inflation Slowdown Fuels June Fee Lower Expectations Amidst Fed’s Delayed Cuts appeared first on Dumb Little Man.

[ad_2]