[ad_1]

|

|

AximTrade Assessment

Foreign exchange brokers play an important function within the international monetary markets, appearing as intermediaries that enable merchants and buyers to purchase and promote currencies. AximTrade stands out as a notable participant on this subject, distinguished by its regulatory compliance and distinctive choices. Duly regulated by the ASIC and SVGFSA, AximTrade has cemented its status on the worldwide stage by delivering unparalleled companies, cutting-edge options, and extremely aggressive buying and selling situations.

Our overview dives deep into AximTrade, spotlighting its standout options and areas which will want enchancment. We goal to furnish a complete analysis, specializing in the dealer’s distinctive promoting propositions. This evaluation is geared in direction of offering readers with important details about AximTrade’s numerous account choices, deposit and withdrawal processes, fee buildings, and extra, mixing professional evaluation with actual dealer suggestions.

The purpose of this overview is to supply a balanced view of AximTrade, empowering you with the insights wanted to determine if it aligns along with your buying and selling necessities. By inspecting each the benefits and potential drawbacks, our goal is to help you in making an knowledgeable choice concerning selecting AximTrade as your go-to brokerage service supplier.

What’s AximTrade?

AximTrade is acknowledged as a outstanding foreign exchange dealer within the monetary markets, catering to a variety of buying and selling wants. The dealer is acclaimed for its use of the MT4 foreign currency trading platform, which is taken into account the business commonplace for foreign exchange and CFD buying and selling. Providing a various portfolio, AximTrade.com offers entry to over 30 foreign exchange foreign money pairs, fairness, gold, and silver, presenting a wide range of choices for private funding and buying and selling.

Working beneath stringent regulatory frameworks, AximTrade is totally regulated in Australia and New Zealand, jurisdictions identified for his or her sturdy monetary rules and reliable authorities businesses. These present a security internet for merchants in case of disputes with the dealer. Furthermore, AximTrade maintains an offshore entity in Saint Vincent and the Grenadines, famous for its extra lenient regulatory setting for foreign exchange brokers.

The regulatory setting considerably impacts buying and selling situations equivalent to leverage. AximTrade affords completely different leverage caps relying on the entity a dealer is registered with. As an illustration, Australian rules limit leverage to a most of 1:30, whereas its entities in New Zealand and Saint Vincent and the Grenadines provide a lot increased leverage, as much as an astonishing 1:3,000. Distinctive to AximTrade is the “Infinite Leverage Account,” enabling merchants to primarily borrow an infinite quantity of buying and selling capital, highlighting the dealer’s dedication to offering versatile buying and selling situations.

Security and Safety of AximTrade

The security and safety of AximTrade have been totally vetted, with insights gathered from in depth analysis by Dumb Little Man. As a multifaceted foreign exchange dealer, AximTrade Group encompasses numerous entities, every regulated in several jurisdictions to make sure dealer security. AximTrade Pty Restricted falls beneath the oversight of the Australian Securities and Investments Fee (ASIC), establishing a robust regulatory basis. Moreover, Huntington Providers Restricted, a New Zealand-based IBC, is permitted as a Monetary Service Supplier (FSP), whereas AximTrade LLC is regulated by the Monetary Providers Authority of Saint Vincent and the Grenadines and the Nationwide Futures Affiliation.

To additional safeguard shopper funds, AximTrade implements essential monetary safety measures. Every shopper’s funds are segregated, transferred to separate financial institution accounts, guaranteeing safety from unexpected firm dangers. The dealer additionally affords unfavorable stability safety, a important characteristic that stops purchasers from shedding more cash than they’ve deposited. This mechanism is pivotal in sustaining the monetary well-being of merchants.

Furthermore, the dealer’s mum or dad firm, Thara Heights Proprietor’s Company, has a longstanding operational historical past since 2010, reinforcing its stability and reliability within the monetary sector. AximTrade additionally accommodates fashionable monetary practices by accepting digital wallets and cryptocurrency for fund deposits and withdrawals, catering to the varied preferences of its international clientele. These measures collectively underscore AximTrade’s dedication to offering a safe and dependable buying and selling setting.

Professionals and Cons of AximTrade

Professionals

- Globally acknowledged and controlled

- $1 minimal for cent/commonplace accounts

- ECNs begin at $50

- Aggressive spreads and commissions

- Leverage as much as 1:Infinite

- Cryptocurrency and digital funds

- Social buying and selling for additional revenue

- Free entry to MT4

Cons

- No entry for US, UK, Canada merchants

- Lacks internet terminal

Signal-Up Bonus of AximTrade

Within the ever-competitive world of foreign currency trading, brokers usually provide incentives to draw new purchasers. Nevertheless, as of the most recent replace, AximTrade doesn’t provide a sign-up bonus. This choice displays the dealer’s deal with different points of their service, equivalent to aggressive buying and selling situations and entry to superior buying and selling platforms.

Minimal Deposit of AximTrade

When buying and selling, the minimal deposit is a vital issue for a lot of buyers, particularly these new to the market or with restricted capital. AximTrade stands out by providing a extremely accessible entry level. For cent and commonplace accounts, the minimal deposit begins at simply $1, making it a pretty possibility for rookies or these wishing to check the dealer’s companies with minimal monetary dedication.

For merchants considering extra specialised buying and selling situations, equivalent to tighter spreads and extra direct market entry, AximTrade affords ECN accounts with a minimal deposit ranging from $50. This tier is tailor-made for extra skilled merchants or these seeking to have interaction with bigger volumes. This stratification in deposit necessities ensures that AximTrade caters to a large spectrum of merchants, from novices to seasoned buyers, by offering versatile monetary entry factors.

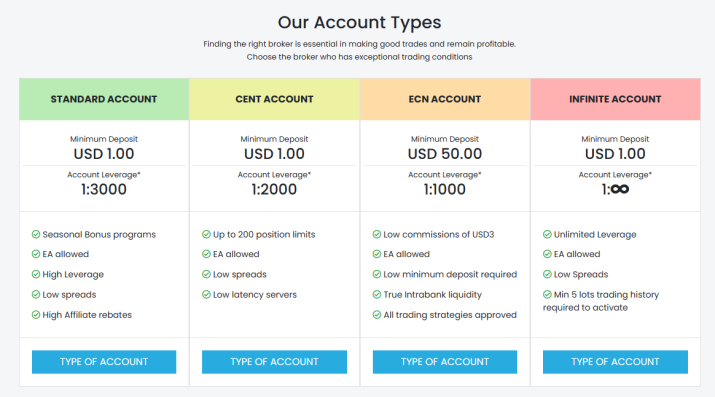

AximTrade Account Varieties

After thorough analysis and testing by our group of consultants at Dumb Little Man, we’ve compiled an in depth overview of AximTrade‘s account sorts, designed to cater to each Foreign exchange rookies {and professional} merchants. All accounts characteristic assist for foreign money pair trades, unfavorable stability safety, and place hedging. Margin calls and Cease out ranges are set at 60%/30%, respectively.

Cent

- Micro account with a $1 minimal deposit.

- Contract dimension of 1,000 items.

- Leverage as much as 1:2,000.

- Spreads begin at 1 pip for main foreign money pairs.

- Indices and cryptocurrencies buying and selling unavailable.

Commonplace

- Fundamental account with floating spreads from 1 pip for main pairs.

- $1 minimal deposit.

- Trades currencies, cryptocurrencies, CFDs on indices, metals, and power with as much as 1:3,000 leverage.

ECN

- Skilled account with the tightest spreads from 0.0 pips on main foreign money pairs.

- $3 fee per lot every manner.

- Leverage as much as 1:100.

- $50 minimal deposit.

- Buying and selling property choice much like the usual account.

INFINITE

- Fundamental account with spreads as little as 3 Pip.

- Limitless leverage.

- $1 minimal deposit.

- Margin name/Cease out degree: 60% / 0%.

PRO

- Skilled account with spreads as little as 5 pips.

- Excessive minimal deposit of $300.

- Leverage as much as 1:1,000.

AximTrade Buyer Opinions

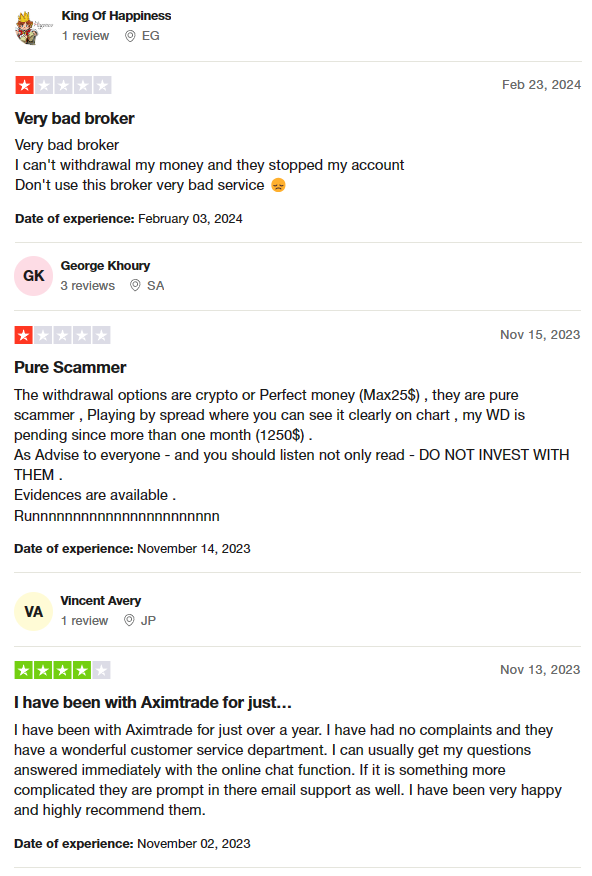

Buyer opinions of AximTrade reveal a blended reception amongst its customers. Some clients have expressed vital dissatisfaction, highlighting points with withdrawals and account administration. Complaints embody difficulties in withdrawing funds, with choices restricted to cryptocurrency or Good Cash, and cases of accounts being unexpectedly frozen.

Accusations of the dealer being a “rip-off” as a consequence of problematic unfold practices and extended pending withdrawals have been voiced, urging potential purchasers to keep away from investing. Contrarily, one other phase of customers experiences a optimistic expertise, praising the dealer’s customer support.

These clients spotlight an environment friendly on-line chat perform for fast question decision and commend the immediate e mail assist for extra advanced points. This group of customers has beneficial AximTrade, glad with over a 12 months of service. This divergence in suggestions means that whereas AximTrade could provide commendable buyer assist to some, it faces severe allegations of service inconsistencies and operational points from others, reflecting a broad spectrum of dealer experiences.

AximTrade Charges, Spreads, and Commissions

When navigating the monetary panorama of AximTrade, understanding its charges, spreads, and commissions is crucial for merchants. Notably, AximTrade doesn’t impose commissions on deposits and withdrawals, though fees from sure cost methods could apply. As an illustration, Skrill and Neteller deduct a 4% payment from the transaction quantity for withdrawals. Moreover, the dealer ensures that account upkeep comes with none price.

When it comes to buying and selling prices, AximTrade adopts a floating unfold mannequin. Spreads begin from 1 pip for each cent and commonplace accounts, providing aggressive charges for merchants. For these using ECN accounts, spreads could be as little as 0.0 pips, accompanied by an extra fee of USD 3 per lot for the opening and shutting of positions. One other payment to think about is the swap payment, which is a fee charged for transferring a place to the subsequent buying and selling day.

These monetary buildings underscore AximTrade’s dedication to transparency and cost-efficiency in buying and selling operations. By offering a transparent breakdown of relevant charges and the situations beneath which they’re charged, AximTrade caters to a variety of merchants, from these searching for minimal preliminary investments to skilled merchants in search of superior buying and selling situations.

Deposit and Withdrawal

The deposit and withdrawal processes at AximTrade have been carefully examined and examined by a buying and selling skilled at Dumb Little Man, guaranteeing a radical analysis. The findings reveal that AximTrade processes all withdrawal requests inside 24 working hours, contingent upon the dealer’s verification standing. It’s noteworthy that funds are immediately credited by all obtainable channels as soon as deposited.

For withdrawals, AximTrade helps a wide range of strategies tailor-made to its worldwide clientele. Neteller, Skrill, and USDT (ERC20) are universally obtainable, whereas FasaPay is unique to Indonesian merchants. Financial institution transfers cater to purchasers from Malaysia, Indonesia, Thailand, Vietnam, China, and India. AximTrade can be within the strategy of increasing its withdrawal choices to incorporate Bitcoin, MomoPay, Zalopay, Visa, and Mastercard, enhancing accessibility for its customers.

Remarkably, AximTrade doesn’t impose a withdrawal payment, though cost methods equivalent to Skrill and Neteller levy a 4% cost on the transaction quantity. For different methods, the payment is 0%. The minimal withdrawal quantities range by foreign money and methodology, guaranteeing flexibility for merchants throughout completely different areas. This complete strategy to managing monetary transactions underscores AximTrade’s dedication to offering a seamless and environment friendly banking expertise for its customers.

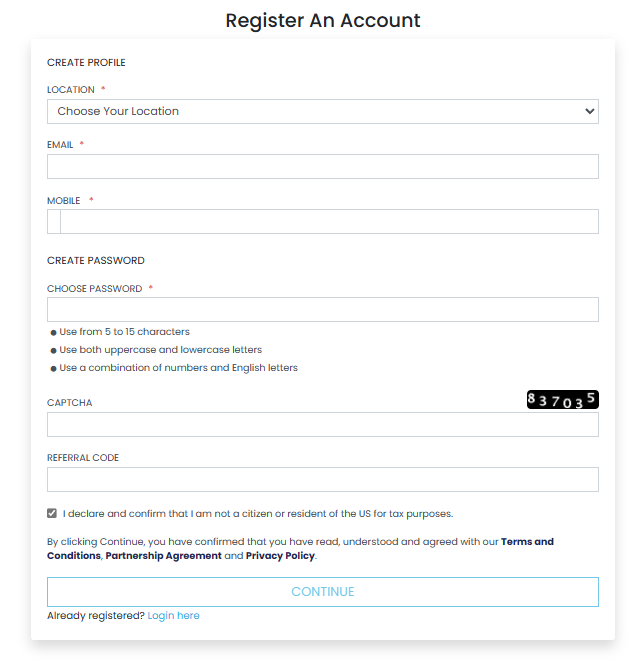

The best way to Open an AximTrade Account

- Go to AximTrade’s web site and choose New Account on the suitable facet.

- Enter your nation of residence, e mail handle, and telephone quantity.

- Create a password to your account and enter a referral code if obtainable.

- Verify you’re not a US tax resident and submit the shape.

- Search for a registration affirmation in your display.

- Examine your cellular for an OTP code from AximTrade and enter it.

- Confirm your account by the affirmation hyperlink despatched to your e mail.

- Navigate again to the fundamental web page of the AximTrade web site.

- Click on Member Login and enter your e mail, password, and CAPTCHA code.

AximTrade Affiliate Program

The AximTrade Affiliate Program caters to each personal merchants and corporations, providing profitable alternatives to earn extra revenue. Members can get pleasure from a most reward of as much as $20 per lot traded by their direct referrals, plus as much as 10% earnings from second-level referrals. This tiered system enhances the incomes potential for associates, making this system significantly enticing.

Moreover, this system features a Loyalty Program, which rewards lively associates with the prospect to win beneficial prizes equivalent to smartphones, watches, automobiles, and luxurious holidays. Eligibility for these attracts requires associates to realize a complete referral buying and selling quantity of 3,000 heaps inside a three-month interval, incentivizing each recruitment and buying and selling exercise amongst referred purchasers.

AximTrade helps its associates with every day remuneration, guaranteeing constant and well timed rewards for his or her efforts. Moreover, this system boasts around-the-clock assist and assigns a private supervisor to every affiliate, addressing any queries or issues which will come up. Importantly, there are no restrictions on withdrawals, permitting associates to entry their earnings freely and every time they select, highlighting AximTrade’s dedication to a clear and rewarding affiliate partnership.

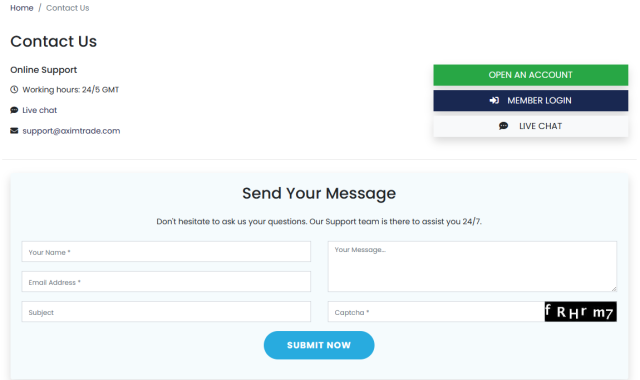

AximTrade Buyer Assist

Based mostly on the experiences of Dumb Little Man with AximTrade‘s Buyer Assist, it’s evident that the dealer prioritizes accessible and versatile communication channels for its purchasers. AximTrade affords a number of methods for merchants to succeed in out, together with dwell chat, a devoted kind for queries, e mail at [email protected], and thru social media platforms like Instagram, Fb, Twitter, and LinkedIn. This multi-channel strategy ensures that purchasers can select essentially the most handy methodology for them, enhancing the general assist expertise.

The supply of the on-line chat characteristic is especially noteworthy, because it extends past the web site to incorporate the consumer’s private account space. This ensures that help is available at each stage of the shopper’s journey with AximTrade, from common inquiries on the web site to particular questions throughout the buying and selling setting. This degree of assist accessibility underscores AximTrade’s dedication to offering a supportive and responsive service to its purchasers, thereby enhancing dealer satisfaction and confidence within the platform.

Benefits and Disadvantages of AximTrade Buyer Assist

AximTrade vs Different Brokers

#1. AximTrade vs AvaTrade

AximTrade, identified for its low entry threshold and excessive leverage choices, caters particularly properly to merchants searching for flexibility in buying and selling situations. Its capacity to supply infinite leverage and a $1 minimal deposit for sure account sorts stands in distinction to AvaTrade‘s strategy, which emphasizes a broad vary of monetary devices and a robust regulatory framework throughout a number of jurisdictions. With over 300,000 registered clients and a deal with offering a full on-line buying and selling expertise, AvaTrade appeals to merchants in search of a diversified portfolio and stringent regulatory safety.

Verdict: AvaTrade is perhaps higher for merchants valuing a big selection of monetary devices and regulatory safety. In distinction, AximTrade is extra fitted to these prioritizing versatile buying and selling situations and excessive leverage.

#2. AximTrade vs RoboForex

RoboForex affords a formidable array of over 12,000 buying and selling choices throughout eight asset courses, supported by a wide range of buying and selling platforms like MetaTrader, cTrader, and RTrader. Its robust emphasis on cutting-edge know-how and tailor-made buying and selling situations makes it a robust competitor. AximTrade, with its deal with excessive leverage and low minimal deposits, offers an easy entry level for brand new and skilled merchants alike however may lack the breadth of buying and selling choices and platform selection that RoboForex boasts.

Verdict: RoboForex edges out for merchants who worth variety in buying and selling platforms and a big selection of buying and selling devices. Nevertheless, for these in search of simplicity and excessive leverage, AximTrade stays a compelling alternative.

#3. AximTrade vs FXChoice

FXChoice, with its dedication to serving each lively and passive merchants since 2010, emphasizes high quality brokerage companies and a collection of buying and selling devices and companies for automated buying and selling. The main target right here is on skilled merchants, given the absence of cent accounts, zero spreads, and the restricted validity of demo accounts. In distinction, AximTrade appeals to a broader viewers with its low minimal deposits and excessive leverage choices, providing a extra accessible entry level for newcomers and adaptability for seasoned merchants.

Verdict: For knowledgeable merchants targeted on automated buying and selling {and professional} ECN accounts, FXChoice could be the preferable possibility, given its tailor-made companies and strict regulatory setting. AximTrade, nevertheless, affords broader attraction to these new to foreign currency trading or these searching for excessive leverage and low entry limitations.

Select Asia Foreign exchange Mentor for Your Foreign exchange Buying and selling Success

For people obsessed with forging a profitable profession in foreign currency trading and aiming for vital monetary success, Asia Foreign exchange Mentor is the prime vacation spot for top-notch foreign exchange, inventory, and crypto buying and selling training. The founder, Ezekiel Chew, a celebrated determine amongst buying and selling establishments and banks, is the cornerstone of Asia Foreign exchange Mentor. Notably, Ezekiel’s common seven-figure trades set him a minimize above different educators, showcasing his distinctive prowess within the subject. The explanations for our endorsement are compelling:

Complete Curriculum: Asia Foreign exchange Mentor delivers a radical academic package deal spanning inventory, crypto, and foreign currency trading. The curriculum is meticulously designed to arm budding merchants with the requisite expertise and data to thrive in these diversified markets.

Confirmed Observe Report: The status of Asia Foreign exchange Mentor is solidified by its observe document of persistently grooming worthwhile merchants in several market segments. This success underscores the efficacy of their academic methods and mentorship.

Skilled Mentor: Learners at Asia Foreign exchange Mentor profit from the experience of a mentor with a confirmed observe document in inventory, crypto, and foreign currency trading. Ezekiel affords personalised help, guiding college students by the complexities of every market confidently.

Supportive Group: Enrolling in Asia Foreign exchange Mentor grants entry to a welcoming group of formidable merchants targeted on success within the inventory, crypto, and foreign exchange arenas. This setting encourages mutual assist, alternate of concepts, and collaborative studying, enriching the academic journey.

Emphasis on Self-discipline and Psychology: Mastery in buying and selling requires a disciplined mindset and psychological resilience. Asia Foreign exchange Mentor emphasizes psychological coaching to help merchants in managing feelings, dealing with stress, and making knowledgeable choices throughout buying and selling actions.

Fixed Updates and Sources: Given the ever-changing nature of monetary markets, Asia Foreign exchange Mentor ensures learners keep knowledgeable on the most recent developments, methods, and market insights. Ongoing entry to important assets positions merchants to remain aggressive.

Success Tales: Asia Foreign exchange Mentor is happy with its quite a few success tales, with many college students considerably remodeling their buying and selling endeavors and reaching monetary autonomy by its in depth training in foreign exchange, inventory, and crypto buying and selling.

Asia Foreign exchange Mentor stands out because the foremost possibility for these wanting the best foreign exchange, inventory, and crypto buying and selling training, aiming to domesticate a worthwhile profession and attain monetary progress. With its all-inclusive curriculum, expert mentors, sensible studying strategy, and supportive group, Asia Foreign exchange Mentor equips aspiring merchants with the instruments and mentorship essential to turn into profitable professionals in numerous monetary markets.

Conclusion: AximTrade Assessment

In conclusion, the group of buying and selling consultants at Dumb Little Man has supplied a complete overview of AximTrade, highlighting its strengths and areas of concern. AximTrade emerges as a formidable participant within the foreign exchange brokerage business, celebrated for its low entry limitations and excessive leverage choices. These options make it significantly interesting to new merchants and people seeking to maximize their buying and selling potential with minimal preliminary funding.

Nevertheless, it’s essential for potential customers to weigh the dealer’s benefits in opposition to its shortcomings. Whereas AximTrade affords aggressive spreads and a variety of account sorts to go well with numerous buying and selling kinds, issues concerning buyer assist limitations and regional restrictions shouldn’t be neglected. The absence of a sign-up bonus may also deter some merchants, accustomed to such incentives from different brokers.

>> Additionally Learn: NAGA Assessment 2024 with Rankings By Dumb Little Man

AximTrade Assessment FAQs

What minimal deposit is required to start out buying and selling with AximTrade?

To start buying and selling with AximTrade, the minimal deposit requirement varies relying on the account sort chosen. For cent and commonplace accounts, a minimal deposit of $1 is required, making it extremely accessible for rookies. For these considering ECN accounts, which supply tighter spreads and extra direct market entry, the minimal deposit begins from $50. This flexibility ensures that merchants of all ranges can discover an account that fits their monetary capability and buying and selling technique.

Does AximTrade provide a sign-up bonus for brand new merchants?

As of the most recent data obtainable, AximTrade doesn’t provide a sign-up bonus for brand new merchants. The main target of AximTrade is extra on offering aggressive buying and selling situations, equivalent to low entry necessities and excessive leverage, quite than upfront monetary incentives. Merchants in search of value-added options may discover the dealer’s aggressive spreads and leverage choices to be compelling causes to hitch, even within the absence of a sign-up bonus.

How does AximTrade guarantee the security and safety of dealer funds?

AximTrade prioritizes the security and safety of its merchants’ funds by a number of mechanisms. Firstly, it operates beneath the regulation of respected our bodies such because the ASIC and SVGFSA, guaranteeing compliance with strict monetary requirements. Moreover, AximTrade employs the apply of segregating shopper funds from firm funds, which implies that merchants’ cash is saved in separate financial institution accounts. This segregation helps defend purchasers’ funds within the unlikely occasion of monetary instability or insolvency of the dealer. Moreover, AximTrade offers unfavorable stability safety, safeguarding merchants from shedding greater than their account stability throughout unstable market situations.

[ad_2]