[ad_1]

Market psychology is vital in monetary buying and selling as a result of it steers retail merchants towards frequent patterns. Nevertheless, seasoned merchants acknowledge the advantages of contrarian strategies, which capitalize on market temper adjustments.

Utilizing metrics akin to IG buyer sentiment, they determine extreme bullishness or bearishness as potential turning factors after which mix these insights with technical and elementary research to make better-informed buying and selling selections.

Market Outlook: Gold, AUD/USD, and NZD/USD

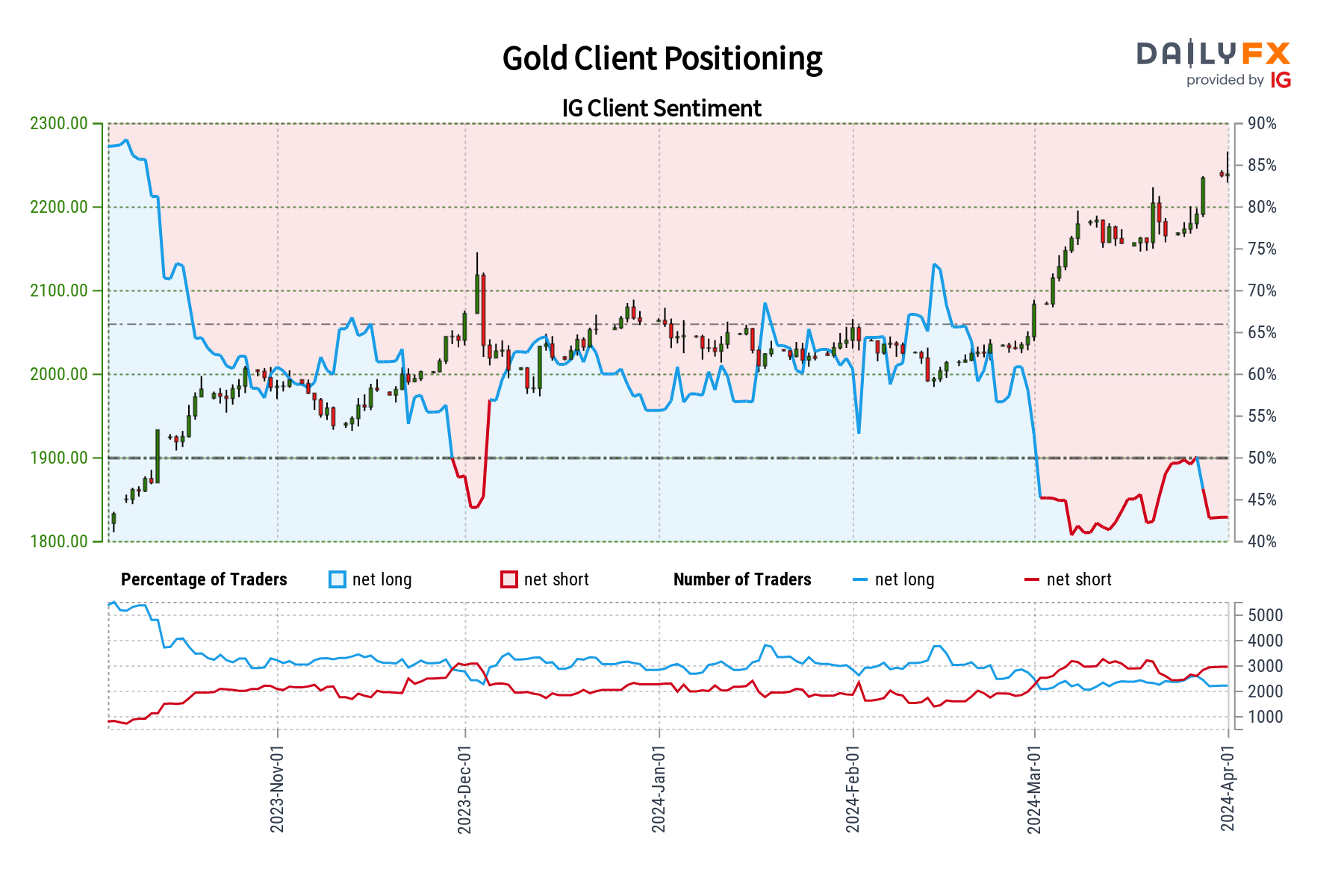

Regardless of the present retail perspective, gold’s value prediction anticipates extra upward motion.

In line with IG buyer statistics, 55.46% of merchants are net-short, implying a contrarian indicator of gold’s continued run, doubtlessly reaching new highs past the present all-time excessive earlier than any drop.

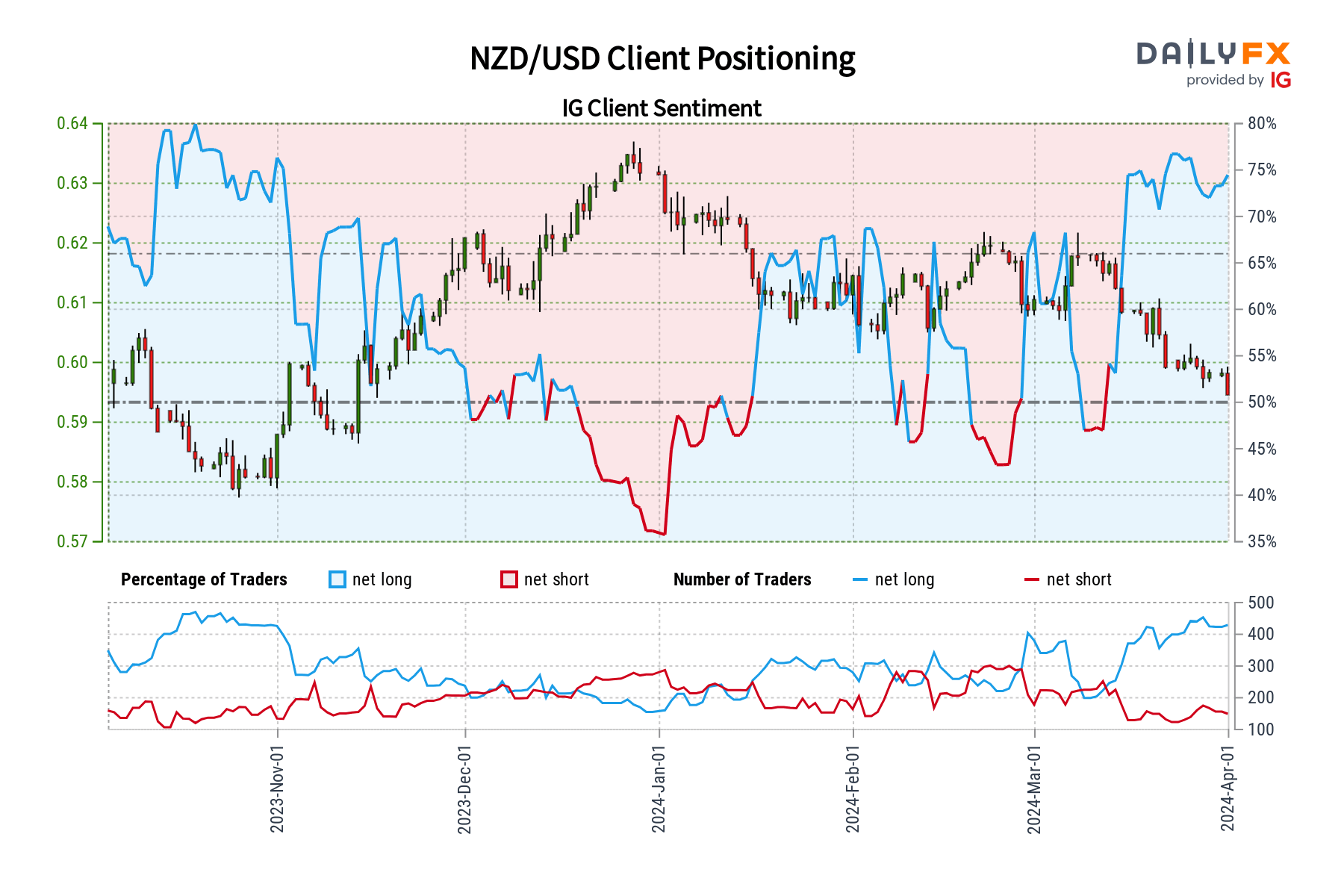

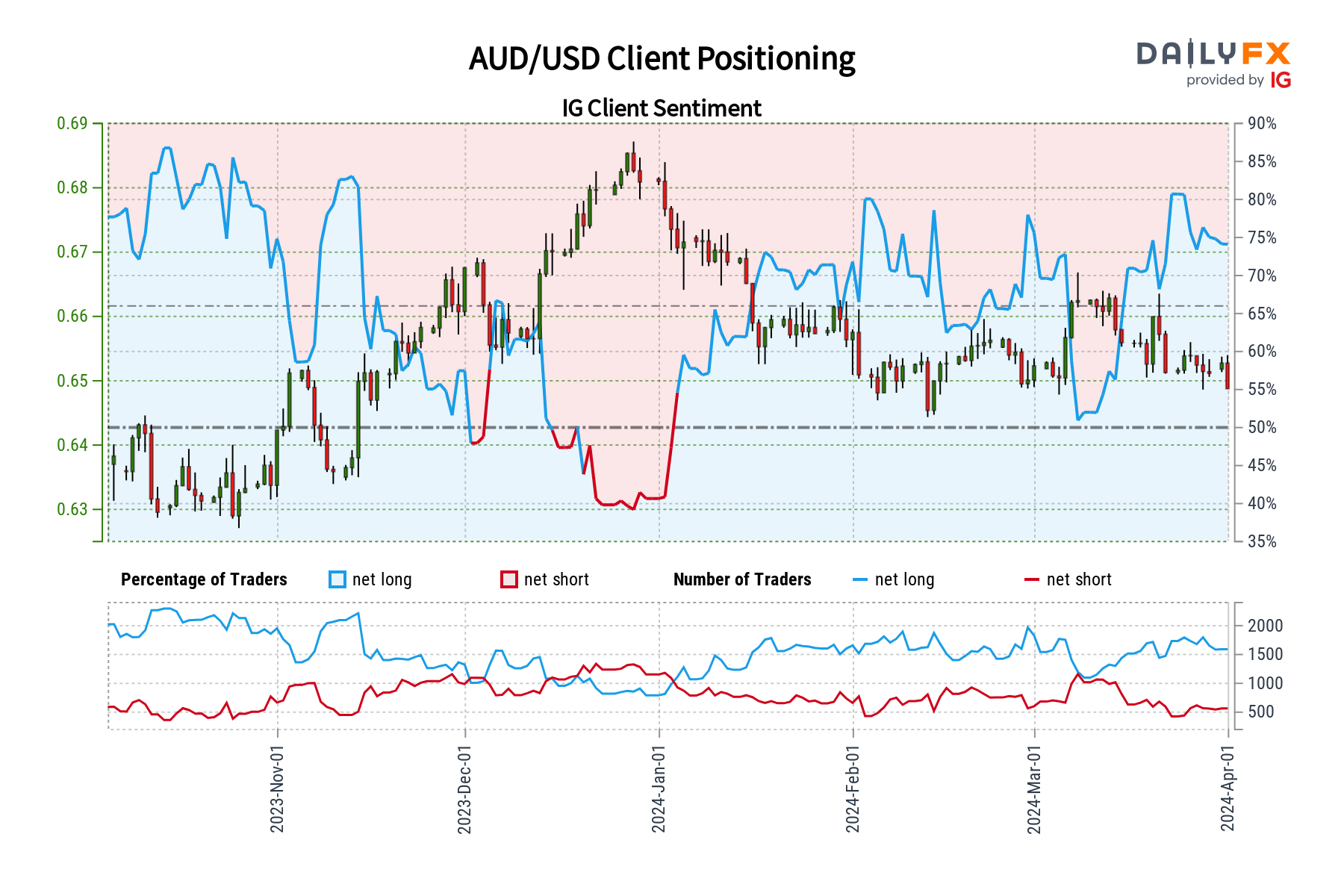

In distinction, the AUD/USD and NZD/USD pairings present a majority of bullish sentiment amongst merchants, with 75.92% and 72.74% holding net-long positions, respectively.

This one-sided euphoria, together with an improve in net-long positions, alerts the potential of extra declines, which is in step with our contrarian view that these currencies will fall.

Every day Digest & Technical Evaluation

Gold’s efficiency stays robust, with costs growing however nonetheless just under the report prime of $2,265. XAU/USD at the moment trades round $2,240, up 0.30%.

This motion comes in opposition to the backdrop of a stronger US greenback and larger Treasury bond yields, fueled by good US financial indicators such because the ISM Manufacturing PMI’s growth and S&P International’s Manufacturing PMI experiences displaying progress.

Regardless of current will increase, technical evaluation means that gold’s rally has been overextended, with a adverse divergence within the Relative Power Index (RSI) indicating warning.

Nevertheless, the route for gold stays optimistic, with possible retreat ranges indicated at $2,200, which can result in extra help ranges.

For merchants, the juxtaposition of bullish sentiment in forex pairs in opposition to a backdrop of fine US financial efficiency offers a advanced atmosphere.

With the Federal Reserve’s cautious stance on rates of interest, as indicated in Chair Jerome Powell’s current remarks, merchants ought to mix contrarian indications with in depth market analyses.

Key Takeaways and Closing Ideas

Buying and selling, notably with gold’s continued run and the various dynamics of AUD/USD and NZD/USD, demonstrates the significance of reconciling market sentiment with financial fundamentals.

The present market circumstances function a clear reminder to merchants of the significance of implementing a complete technique that mixes sentiment evaluation, technical insights, and a good understanding of market fundamentals.

This complete method is vital, particularly in circumstances when retail sentiment is considerably biased in one route, displaying the potential advantages of taking a contrarian method to uncover commerce alternatives that go counter to fashionable opinion.

Wanting forward, the significance of being attentive to financial information and financial coverage strikes can’t be overstated, since these elements could cause main market volatility.

[ad_2]