[ad_1]

Greenback’s Retreat from Peaks

The DXY index dropped by 0.2% to 104.75 on Tuesday, retreating from a five-month excessive, reflecting the weakening of the US greenback.

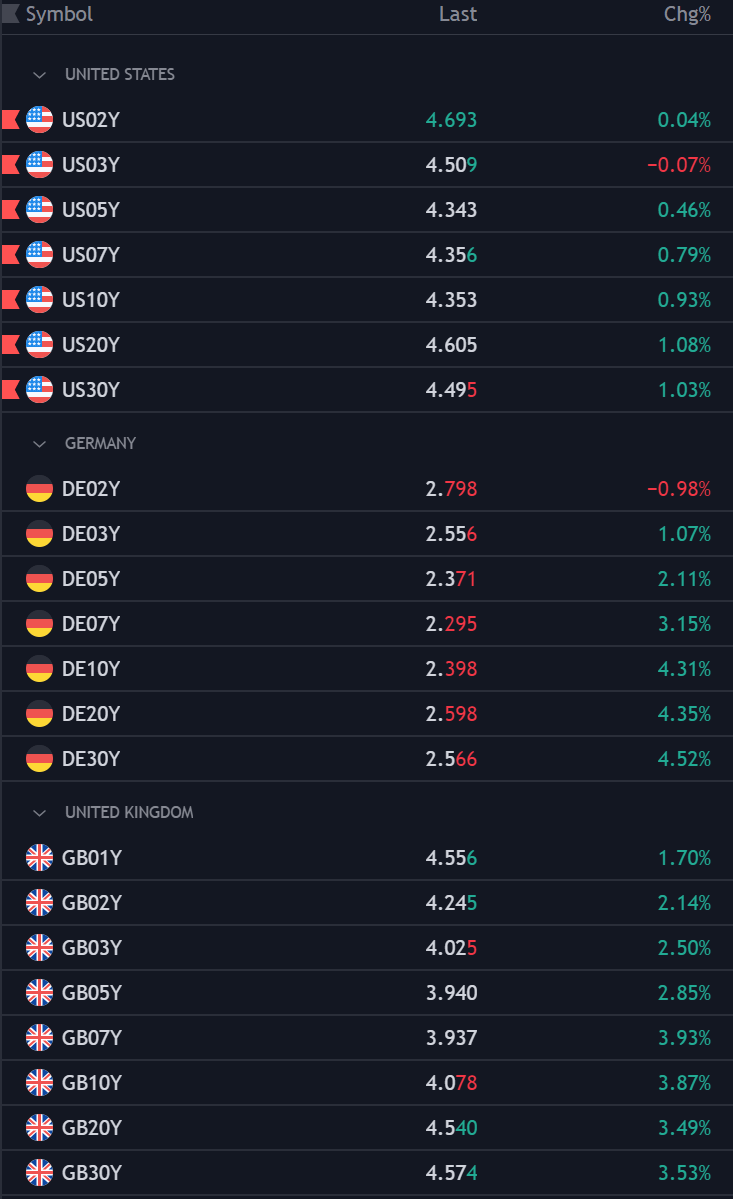

The greenback failed to profit from a rise in authorities charges regardless of a extra notable achieve in international yields, significantly these from Germany and the UK.

This motion highlights the aggressive nature of world monetary markets by catching as much as the present dynamics of the Treasury market.

Anticipation Builds Round Nonfarm Payrolls

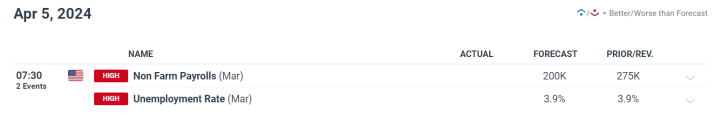

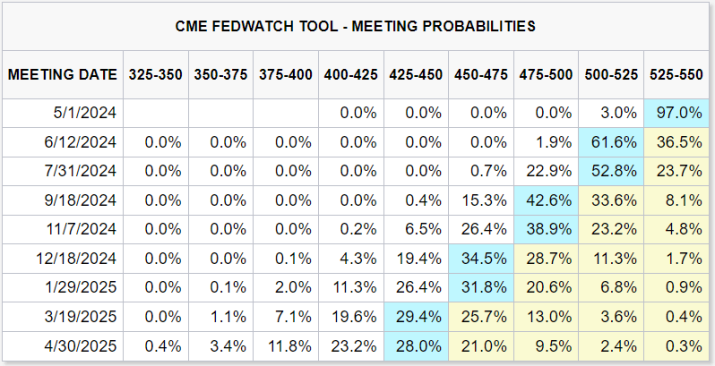

All eyes at the moment are on the U.S. financial occasions which can be arising, most notably the nonfarm payrolls for March, that are anticipated this Friday. The Federal Reserve’s financial coverage could also be influenced by this essential report.

200,000 new jobs have been added final month, in line with analysts, holding the unemployment price at 3.9%. The market is alert for potential surprises that may have an effect on the Fed’s coverage on rates of interest in 2024, given the present patterns of job development exceeding forecasts.

EUR/USD Evaluation

Key transferring averages converge at 1.0800 and 1.0835, which might present resistance for EUR/USD after restoration from the key help stage at 1.0725.

In a bullish state of affairs, the pair would purpose for these ranges, however in a bearish market, it would drop under 1.0700 and 1.0640. This fluctuation follows the Euro Space Manufacturing PMI, which beat forecasts by a small margin and demonstrated resilience.

USD/JPY Evaluation

Because the USD/JPY trades near the 152.00 resistance, it’s nonetheless being monitored intently. If this stage is damaged, the Japanese authorities may step in, which could spark a swift correction.

In distinction, ought to this hurdle not be overcome, the pair could retreat within the course of the 50-day easy transferring common, which is positioned round 149.75. BoJ interventions have market contributors on edge, which makes buying and selling this pair require much more warning.

USD/CAD Evaluation

Bullish indicators are current within the USD/CAD pair, which remains to be above key transferring averages and a December trendline that gives help. 1.3695 is the goal for further beneficial properties, with resistance positioned at 1.3600.

Help for the draw back is positioned between 1.3510 and 1.3480, which is important to maintain the market optimistic. The technical place of USD/CAD signifies attainable upward momentum, regardless of flat efficiency within the face of robust commodity markets.

GBP/USD Evaluation

The GBP/USD pair has remained resilient, boosted by robust UK Manufacturing PMI information, which rose to 50.3 in March from 47.5 in February, exceeding analyst expectations.

This upward momentum means that the pair could attempt greater ranges, with an rapid focus on breaking the 1.2600 barrier. A profitable breach right here might pave the way in which for resistance testing between 1.2650 and 1.2685.

The pound’s energy towards the greenback will most probably rely on sustained financial indicators surpassing forecasts, in addition to market sentiment towards financial coverage tweaks by each the Financial institution of England and the Federal Reserve.

Financial Indicators and Market Reactions

Whereas manufacturing facility orders elevated by 1.4% in February, according to predictions, the JOLTs Job Openings information for a similar month confirmed no change at 8.75 million.

Based mostly on this information, it seems that merchants are being cautious and could also be taking beneficial properties near latest highs. The Manufacturing PMI for the Euro Space carried out higher than anticipated in March, falling considerably to 46.1 from a predicted decline of 45.7.

Comparably, the Manufacturing PMI for the UK confirmed development, hitting 50.3 in March. These information, which present manufacturing sectors’ resilience within the face of wider financial worries, point out a small restoration within the EUR/USD and GBP/USD alternate charges.

Remaining Ideas

The trajectory of the US greenback remains to be strongly influenced by central financial institution indicators and upcoming financial reviews as merchants maneuver round these occasions.

An essential occasion that might help or contradict the present financial coverage view is the approaching nonfarm payroll report.

As a result of the worldwide foreign money market is responding to those refined indicators, merchants and traders have to be on the lookout and base their selections on technical-level evaluation and financial fundamentals.

For market gamers, the approaching days might be vital because the relative threat and alternative in foreign money pairs akin to EUR/USD, GBP/USD, USD/CAD, and USD/JPY will rely on these altering financial narratives.

[ad_2]