[ad_1]

Financial Information Underwhelms

A mix of weaker-than-expected financial information and dovish feedback from Federal Reserve Chair Jerome Powell brought on the U.S. greenback to decline.

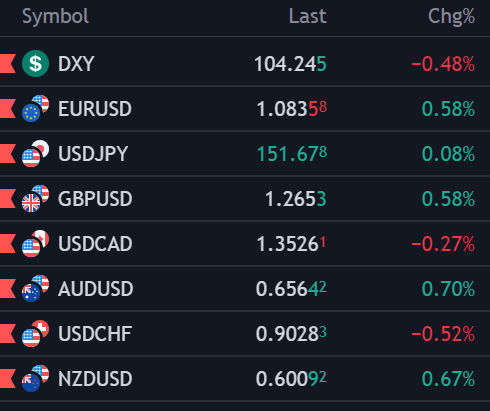

With a 0.48% decline, the DXY index—which gauges the power of the greenback relative to a basket of currencies—moved away from its current multi-month highs.

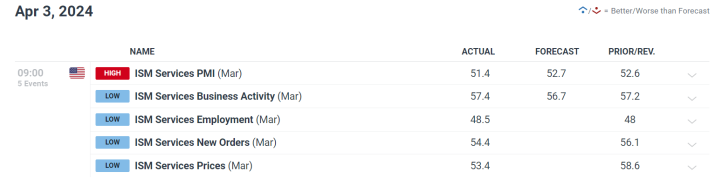

The weak March ISM Providers PMI, which signaled a slowdown within the companies sector—a significant a part of the US GDP—was a main contributing issue to this fall.

Powell’s Cautious Strategy

Regardless of market expectations for easing in 2024, Jerome Powell emphasised the Federal Reserve’s continued cautious strategy to fee cuts in an tackle on the Stanford Enterprise, Authorities, and Society Discussion board.

Powell underlined that earlier than contemplating fee modifications, there have to be extra convincing proof that inflation is headed towards the Fed’s 2% goal.

His remarks show his unwavering dedication to placing a steadiness between the risks of untimely fee cuts and people of an overly restrictive financial coverage.

Give attention to Labor Market Information

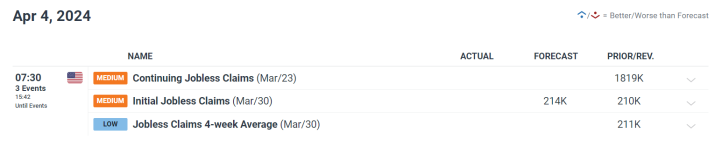

The following nonfarm payrolls report and the U.S. unemployment claims information will now be the main focus of consideration as they’re broadly watched for clues in regards to the state of the labor market in america.

Preliminary jobless claims are anticipated to indicate a minor improve for the week ending March 30.

These numbers are essential since they supply direct details about the state of the labor market and, consequently, about any modifications to the Federal Reserve’s financial coverage.

Technical and Market Views

If the present losses within the U.S. greenback index persist, assist could also be discovered on the 104.00 stage, which is indicated by the intersection of the 50% Fibonacci retracement and a short-term ascending trendline.

Alternatively, a bullish market reversal would come from the psychological 105.00 stage.

Market individuals proceed to pay shut consideration to those technical ranges, adjusting their plans in response to statements about coverage and attainable modifications in market sentiment.

Fed Officers Echo Powell’s Sentiment

Powell’s cautious stance was repeated by different Federal Reserve officers, equivalent to Raphael Bostic, President of the Atlanta Fed, who stated that any fee cuts would most likely wait till the fourth quarter of 2024.

All Fed members agree that data-driven policymaking is essential, with inflation and labor market dynamics taking part in a significant position in influencing future selections.

Ultimate Ideas

Merchants should comprehend the difficult relationships between labor market information, inflation, and Federal Reserve coverage selections as they navigate the present financial panorama.

Latest statements by Jerome Powell and miserable financial information spotlight the cautious steadiness that the Fed goals to maintain.

To successfully react to market swings, merchants have to be alert as new information turns into accessible and incorporate technical evaluation and macroeconomic elements into their ways.

Within the upcoming months, the trajectory of the US greenback and market expectations will probably be tremendously influenced by the Fed’s remarks and the altering financial indicators.

The buying and selling neighborhood will probably be intently observing these developments to evaluate the attainable influence on foreign money markets and wider monetary landscapes, as vital labor and inflation information are about to be launched.

[ad_2]